Answered step by step

Verified Expert Solution

Question

1 Approved Answer

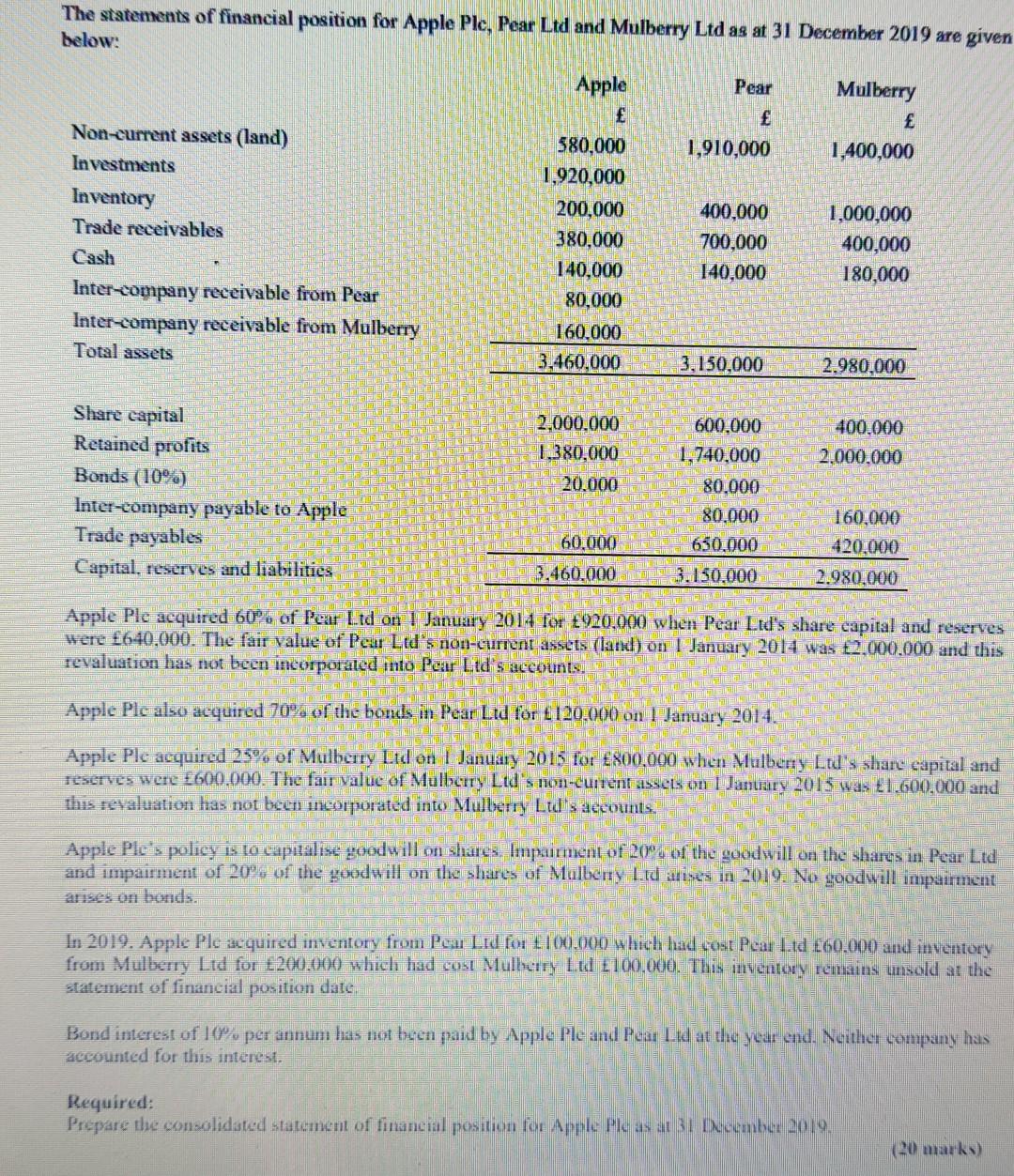

The statements of financial position for Apple Ple, Pear Ltd and Mulberry Ltd as at 31 December 2019 are given below: Apple Pear Mulberry Non-current

The statements of financial position for Apple Ple, Pear Ltd and Mulberry Ltd as at 31 December 2019 are given below: Apple Pear Mulberry Non-current assets (land) 580,000 1,910,000 1,400,000 Investments 1,920,000 Inventory 200,000 400,000 1,000,000 Trade receivables 380,000 700,000 400,000 Cash 140,000 140.000 180,000 Inter-company receivable from Pear 80,000 Intersompany receivable from Mulberry 160.000 Total assets 3,460,000 3,150,000 2.980,000 Share capital Retained profits Bends (10%) Inter-company payable to Apple Trade payables Capital, reserves and liabilities 2.000.000 1.380,000 20.000 400.000 2.000.000 600.000 1,740,000 80.000 80.000 650.000 3.150.000 60.000 3.460.000 160.000 420.000 2.980.000 Apple Ple acquired 60. of Pear Ltd on 1 January 2014 for 920,000 when Pear Ltd's share capital and reserves Were 640,000. The fair value of Peur Ltd's non-current assets (and) on 1 January 2014 was 2,000,000 and this revaluation has not been incorporated into Pear Ltd's accounts. Apple Plc also acquired 70% of the bonds in Pear Ltd for 120.000 on 1 January 2014. Apple Ple acquired 25% of Mulberry Ltd on January 2015 for 800,000 when Mulberry Lad's share capital and reserves were 600.000. The fair value of Mulberry Ltd's non-current assets on | January 2015 was 1,600,000 and this revaluation has not been incorporated into Mulberry Lid's accounts. Apple Ple's policy is to capitalise goodwill on shares. Impairment of 2009. of the goodwill on the shares in Pear Ltd and impairment of 2004 of the goodwill on the shares of Mulberry Ltd arise in 2019. No goodwill impairment arises on bonds. In 2019. Apple Plc acquired inventory from Pear Lid for 100.000 which had cost Pear Ltd 60,000 and inventory from Mulberry Ltd for 200,000 which had cost Mulhenry Ltd 100.000. This inventory remains unsold at the statement of financial position date, Bond interest of 10% per annum has not been paid by Apple Ple and Pear Lid at the year end. Neither company has accounted for this interest. Required: Prepare the consolidated statement of financial position for Apple Ple as at 31 December 2019. (20 marks) The statements of financial position for Apple Ple, Pear Ltd and Mulberry Ltd as at 31 December 2019 are given below: Apple Pear Mulberry Non-current assets (land) 580,000 1,910,000 1,400,000 Investments 1,920,000 Inventory 200,000 400,000 1,000,000 Trade receivables 380,000 700,000 400,000 Cash 140,000 140.000 180,000 Inter-company receivable from Pear 80,000 Intersompany receivable from Mulberry 160.000 Total assets 3,460,000 3,150,000 2.980,000 Share capital Retained profits Bends (10%) Inter-company payable to Apple Trade payables Capital, reserves and liabilities 2.000.000 1.380,000 20.000 400.000 2.000.000 600.000 1,740,000 80.000 80.000 650.000 3.150.000 60.000 3.460.000 160.000 420.000 2.980.000 Apple Ple acquired 60. of Pear Ltd on 1 January 2014 for 920,000 when Pear Ltd's share capital and reserves Were 640,000. The fair value of Peur Ltd's non-current assets (and) on 1 January 2014 was 2,000,000 and this revaluation has not been incorporated into Pear Ltd's accounts. Apple Plc also acquired 70% of the bonds in Pear Ltd for 120.000 on 1 January 2014. Apple Ple acquired 25% of Mulberry Ltd on January 2015 for 800,000 when Mulberry Lad's share capital and reserves were 600.000. The fair value of Mulberry Ltd's non-current assets on | January 2015 was 1,600,000 and this revaluation has not been incorporated into Mulberry Lid's accounts. Apple Ple's policy is to capitalise goodwill on shares. Impairment of 2009. of the goodwill on the shares in Pear Ltd and impairment of 2004 of the goodwill on the shares of Mulberry Ltd arise in 2019. No goodwill impairment arises on bonds. In 2019. Apple Plc acquired inventory from Pear Lid for 100.000 which had cost Pear Ltd 60,000 and inventory from Mulberry Ltd for 200,000 which had cost Mulhenry Ltd 100.000. This inventory remains unsold at the statement of financial position date, Bond interest of 10% per annum has not been paid by Apple Ple and Pear Lid at the year end. Neither company has accounted for this interest. Required: Prepare the consolidated statement of financial position for Apple Ple as at 31 December 2019. (20 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started