Answered step by step

Verified Expert Solution

Question

1 Approved Answer

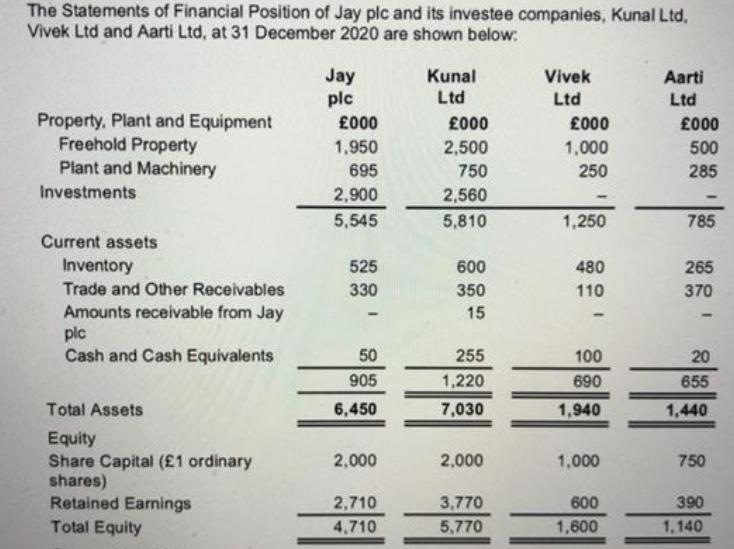

The Statements of Financial Position of Jay plc and its investee companies, Kunal Ltd, Vivek Ltd and Aarti Ltd, at 31 December 2020 are

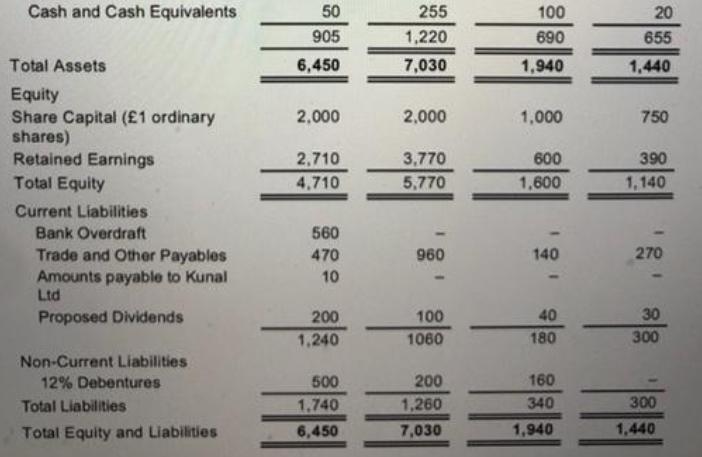

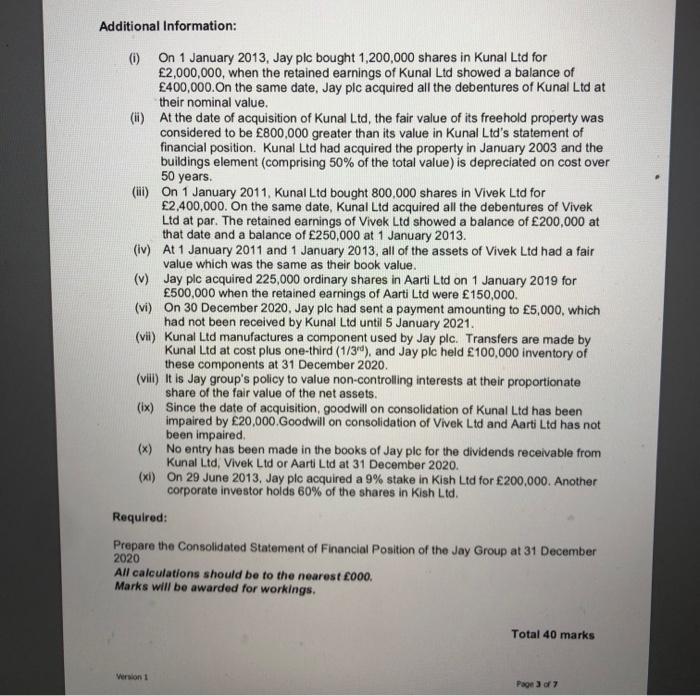

The Statements of Financial Position of Jay plc and its investee companies, Kunal Ltd, Vivek Ltd and Aarti Ltd, at 31 December 2020 are shown below: Property, Plant and Equipment Freehold Property Plant and Machinery Investments Current assets Inventory Trade and Other Receivables Amounts receivable from Jay pic Cash and Cash Equivalents Total Assets Equity Share Capital (1 ordinary shares) Retained Earnings Total Equity Jay plc 000 1,950 695 2,900 5,545 525 330 50 905 6,450 2,000 2,710 4,710 Kunal Ltd 000 2,500 750 2,560 5,810 600 350 15 255 1,220 7,030 2,000 3,770 5,770 Vivek Ltd 000 1,000 250 1,250 480 110 100 690 1,940 1,000 600 1,600 Aarti Ltd 000 500 285 785 265 370 20 655 1,440 750 390 1,140 Cash and Cash Equivalents Total Assets Equity Share Capital (1 ordinary shares) Retained Earnings Total Equity Current Liabilities Bank Overdraft Trade and Other Payables Amounts payable to Kunal Ltd Proposed Dividends Non-Current Liabilities 12% Debentures Total Liabilities Total Equity and Liabilities 50 905 6,450 2,000 2,710 4,710 560 470 10 200 1,240 500 1,740 6,450 255 1,220 7,030 2,000 3,770 5,770 960 100 1060 200 1,260 7,030 100 690 1,940 1,000 600 1,600 140 40 180 160 340 1,940 20 655 1,440 750 390 1,140 270 30 300 111 300 1,440 Additional Information: (1) On 1 January 2013, Jay plc bought 1,200,000 shares in Kunal Ltd for 2,000,000, when the retained earnings of Kunal Ltd showed a balance of 400,000. On the same date, Jay plc acquired all the debentures of Kunal Ltd at their nominal value. (ii) At the date of acquisition of Kunal Ltd, the fair value of its freehold property was considered to be 800,000 greater than its value in Kunal Ltd's statement of financial position. Kunal Ltd had acquired the property in January 2003 and the buildings element (comprising 50% of the total value) is depreciated on cost over 50 years. (iii) On 1 January 2011, Kunal Ltd bought 800,000 shares in Vivek Ltd for 2,400,000. On the same date, Kunal Ltd acquired all the debentures of Vivek Ltd at par. The retained earnings of Vivek Ltd showed a balance of 200,000 at that date and a balance of 250,000 at 1 January 2013. (iv) At 1 January 2011 and 1 January 2013, all of the assets of Vivek Ltd had a fair value which was the same as their book value. (v) (vi) (vii) Jay plc acquired 225,000 ordinary shares in Aarti Ltd on 1 January 2019 for 500,000 when the retained earnings of Aarti Ltd were 150,000. On 30 December 2020, Jay plc had sent a payment amounting to 5,000, which had not been received by Kunal Ltd until 5 January 2021. Kunal Ltd manufactures a component used by Jay plc. Transfers are made by Kunal Ltd at cost plus one-third (1/3rd), and Jay plc held 100,000 inventory of these components at 31 December 2020. (viii) It is Jay group's policy to value non-controlling interests at their proportionate share of the fair value of the net assets. (ix) Since the date of acquisition, goodwill on consolidation of Kunal Ltd has been impaired by 20,000.Goodwill on consolidation of Vivek Ltd and Aarti Ltd has not been impaired. (x) No entry has been made in the books of Jay pic for the dividends receivable from Kunal Ltd, Vivek Ltd or Aarti Ltd at 31 December 2020. (xi) On 29 June 2013, Jay plc acquired a 9% stake in Kish Ltd for 200,000. Another corporate investor holds 60% of the shares in Kish Ltd. Version 1 Required: Prepare the Consolidated Statement of Financial Position of the Jay Group at 31 December 2020 All calculations should be to the nearest 000. Marks will be awarded for workings. Total 40 marks Page 3 of 7

Step by Step Solution

★★★★★

3.44 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

Answer W1 Group structure Acquired two years ago 1 January 2013 Fair value of the net assets In the ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started