Answered step by step

Verified Expert Solution

Question

1 Approved Answer

TRUE FALSE 1. Common examples of sin taxes include the taxes imposed on airline tickets and gA sales tax is a common example of

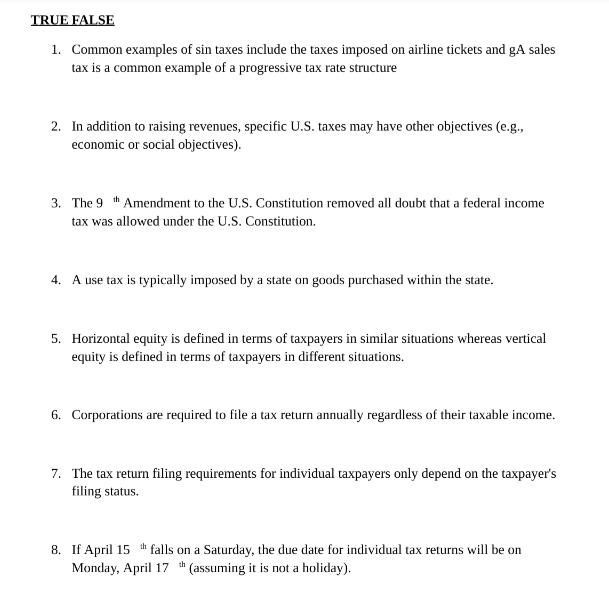

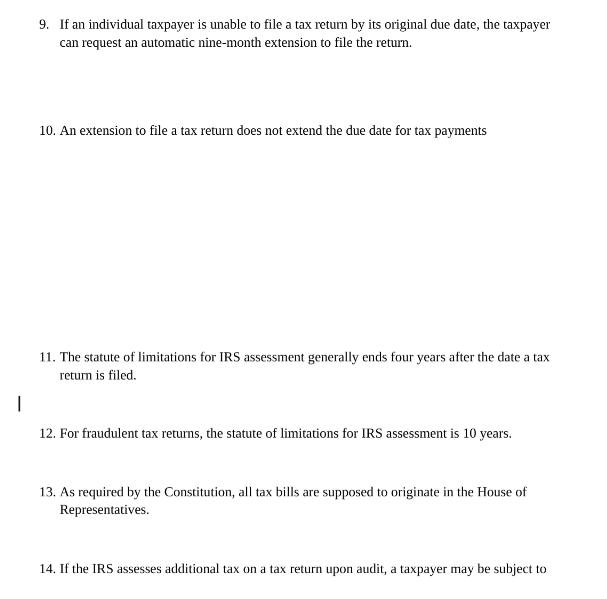

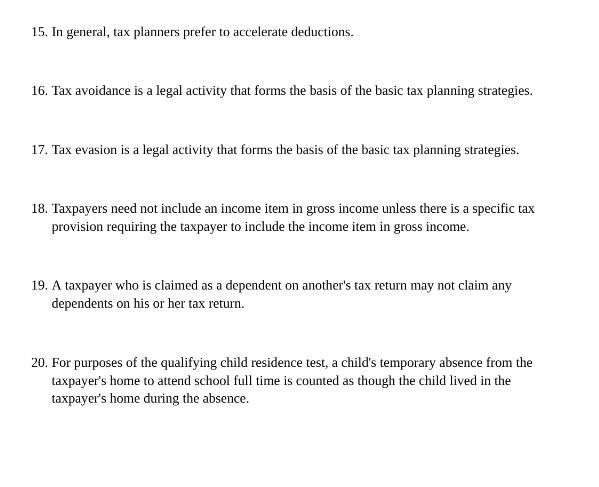

TRUE FALSE 1. Common examples of sin taxes include the taxes imposed on airline tickets and gA sales tax is a common example of a progressive tax rate structure 2. In addition to raising revenues, specific U.S. taxes may have other objectives (e.g., economic or social objectives). 3. The 9th Amendment to the U.S. Constitution removed all doubt that a federal income tax was allowed under the U.S. Constitution. 4. A use tax is typically imposed by a state on goods purchased within the state. 5. Horizontal equity is defined in terms of taxpayers in similar situations whereas vertical equity is defined in terms of taxpayers in different situations. 6. Corporations are required to file a tax return annually regardless of their taxable income. 7. The tax return filing requirements for individual taxpayers only depend on the taxpayer's filing status. 8. If April 15th falls on a Saturday, the due date for individual tax returns will be on Monday, April 17 th (assuming it is not a holiday). 9. If an individual taxpayer is unable to file a tax return by its original due date, the taxpayer can request an automatic nine-month extension to file the return. 10. An extension to file a tax return does not extend the due date for tax payments 11. The statute of limitations for IRS assessment generally ends four years after the date a tax return is filed. | 12. For fraudulent tax returns, the statute of limitations for IRS assessment is 10 years. 13. As required by the Constitution, all tax bills are supposed to originate in the House of Representatives. 14. If the IRS assesses additional tax on a tax return upon audit, a taxpayer may be subject to 15. In general, tax planners prefer to accelerate deductions. 16. Tax avoidance is a legal activity that forms the basis of the basic tax planning strategies. 17. Tax evasion is a legal activity that forms the basis of the basic tax planning strategies. 18. Taxpayers need not include an income item in gross income unless there is a specific tax provision requiring the taxpayer to include the income item in gross income. 19. A taxpayer who is claimed as a dependent on another's tax return may not claim any dependents on his or her tax return. 20. For purposes of the qualifying child residence test, a child's temporary absence from the taxpayer's home to attend school full time is counted as though the child lived in the taxpayer's home during the absence.

Step by Step Solution

★★★★★

3.42 Rating (146 Votes )

There are 3 Steps involved in it

Step: 1

Answer 1 False A sin tax is an excise tax imposed on items and services that are deemed harmful to ones health or alcohol cigarettes and gambling society such as Answer 2 True Tax policy may well as g...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started