Answered step by step

Verified Expert Solution

Question

1 Approved Answer

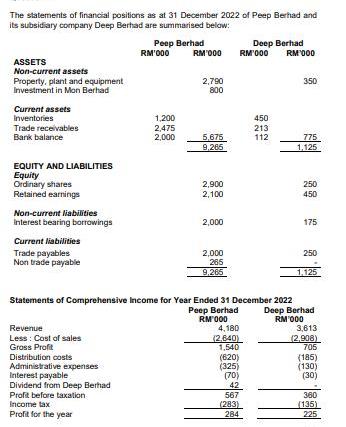

The statements of financial positions as at 31 December 2022 of Peep Berhad and its subsidiary company Deep Berhad are summarised below: ASSETS Non-current

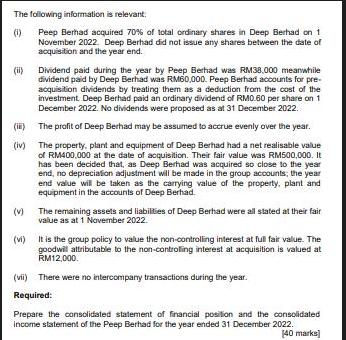

The statements of financial positions as at 31 December 2022 of Peep Berhad and its subsidiary company Deep Berhad are summarised below: ASSETS Non-current assets Property, plant and equipment Investment in Mon Berhad Current assets Inventories Trade receivables Bank balance EQUITY AND LIABILITIES Equity Ordinary shares Retained earnings Non-current liabilities Interest bearing borrowings Current liabilities Trade payables Non trade payable Revenue Less: Cost of sales Gross Profit Distribution costs Administrative expenses Peep Berhad Interest payable Dividend from Deep Berhad Profit before taxation Income tax Profit for the year RM'000 1,200 2,475 2,000 RM'000 2,790 800 5,675 9,265 2,900 2,100 2,000 2,000 265 9,265 Deep Berhad RM'000 RM 000 4,180 (2,640) 1,540 450 213 112 (620) (325) (70) 42 567 (283) 284 350 775 1,125 Statements of Comprehensive Income for Year Ended 31 December 2022 Peep Berhad Deep Berhad RM 000 RM'000 250 450 175 250 1,125 3,613 (2,908) 705 (185) (130) (30) 360 (135) 225 The following information is relevant. (1) Peep Berhad acquired 70% of total ordinary shares in Deep Berhad on 1 November 2022. Deep Berhad did not issue any shares between the date of acquisition and the year end. (ii) (i) (iv) (V) Dividend paid during the year by Peep Berhad was RM38.000 meanwhile dividend paid by Deep Berhad was RM60,000. Peep Berhad accounts for pre- acquisition dividends by treating them as a deduction from the cost of the investment Deep Berhad paid an ordinary dividend of RM0.60 per share on 1 December 2022. No dividends were proposed as at 31 December 2022. The profit of Deep Berhad may be assumed to accrue evenly over the year. The property, plant and equipment of Deep Berhad had a net realisable value of RM400.000 at the date of acquisition. Their fair value was RM500,000. It has been decided that, as Deep Berhad was acquired so close to the year end, no depreciation adjustment will be made in the group accounts; the year end value will be taken as the carrying value of the property, plant and equipment in the accounts of Deep Berhad. The remaining assets and liabilities of Deep Berhad were all stated at their fair value as at 1 November 2022. (vi) It is the group policy to value the non-controlling interest at full fair value. The goodwill attributable to the non-controlling interest at acquisition is valued at RM12,000. (vii) There were no intercompany transactions during the year. Required: Prepare the consolidated statement of financial position and the consolidated income statement of the Peep Berhad for the year ended 31 December 2022. [40 marks]

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started