Question

The Steven-Sun Company Canada employs two hourly workers R. Louis and M. Hydeas well as a salaried researcher, Dr. Jekyll. Dr. Jekyll is paid every

The Steven-Sun Company Canada employs two hourly workers R. Louis and M. Hydeas well as a salaried researcher, Dr. Jekyll. Dr. Jekyll is paid every two weeks. Steven-Sun Co. uses the following tax rates for deductions at source:

Federal Income Taxes: 20% of gross wages

C.P.P.: 1.7% of gross wages

U.I.C.: 2.5% of gross wages The company pays time-and-a-half for any hours worked in excess of a 40 week.

R. Louis has a wage-rate of $19.50 per hour.M. Hyde has a wage-rate of $20.25 per hour.

? Dr. Jekyll is paid $3,250 every two weeks and is due for his full two weeks' pay. For the week ended Aug. 30th, Louis worked 43 hours and Hyde worked 47 hours.

Employer's contribution for C.P.P. = employee's contributionEmployer's contribution for U.I.C. = 1.4 times employee's contribution

Employer's contribution for Provincial Health Care = 1.8% Total Gross Pay

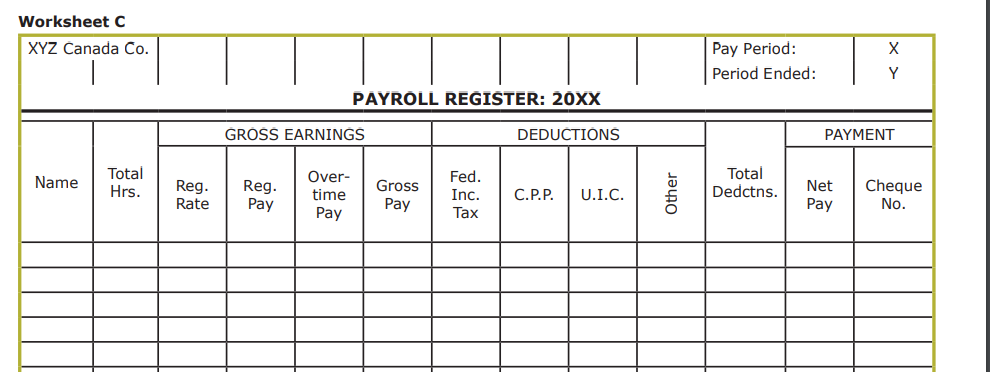

Worksheet C XYZ Canada Co. PAYROLL REGISTER: 20XX DEDUCTIONS Pay Period: Period Ended: GROSS EARNINGS Total Over- Fed. Name Reg. Hrs. Reg. Gross time Inc. C.P.P. U.I.C. Rate Pay Pay Pay Tax Other PAYMENT X Y Total Net Dedctns. Pay Cheque No.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started