Question

The stock is priced at $165.13/share (non-dividend). The expirations are August 21 and October 16 and the continuously compounded interest rates are 5.35% and

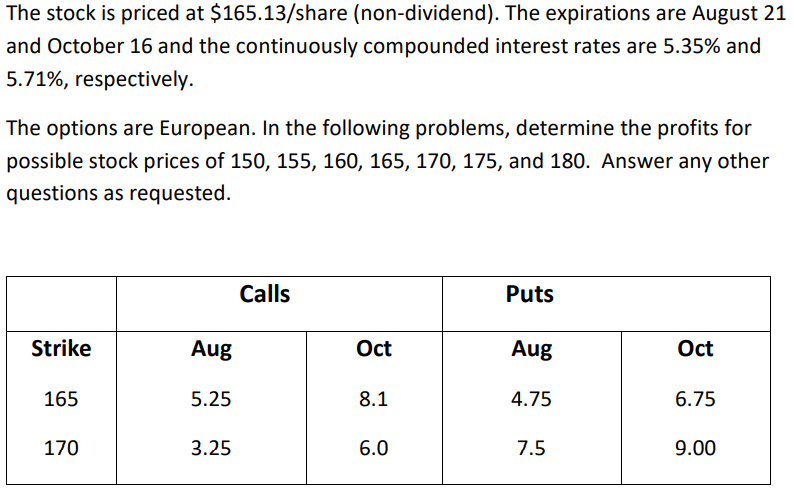

The stock is priced at $165.13/share (non-dividend). The expirations are August 21 and October 16 and the continuously compounded interest rates are 5.35% and 5.71%, respectively. The options are European. In the following problems, determine the profits for possible stock prices of 150, 155, 160, 165, 170, 175, and 180. Answer any other questions as requested. Calls Puts Strike Aug Oct Aug Oct 165 5.25 8.1 4.75 6.75 170 3.25 6.0 7.5 9.00

Step by Step Solution

3.49 Rating (172 Votes )

There are 3 Steps involved in it

Step: 1

To determine the profits for the given stock prices and option details we need to calculate the payoff from both call options and put options For call ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Introduction To Derivatives And Risk Management

Authors: Robert Brooks, Don M Chance, Roberts Brooks

8th Edition

0324601212, 9780324601213

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App