The following option prices were observed for a stock for July 6 of a particular year. Use

Question:

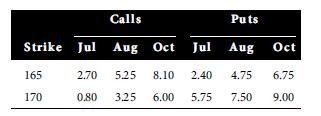

The following option prices were observed for a stock for July 6 of a particular year. Use this information in problems. Ignore dividends on the stock. The stock is priced at 165.13. The expirations are July 17, August 21, and October 16. The continuously compounded risk-free rates are 0.0503, 0.0535, and 0.0571, respectively. The standard deviation is 0.21. Assume that the options are European.

In problems, determine the profits for possible stock prices of 150, 155, 160, 165, 170, 175, and 180. Answer any other questions as requested. Note: Your Excel spreadsheet Stratlyz8e.xls will be useful here for obtaining graphs as requested, but it does not allow you to calculate the profits for several user-specified asset prices. It permits you to specify one asset price and a maximum and minimum. Use Stratlyz8e.xls to produce the graph for the range of prices from 150 to 180 but determine the profits for the prices of 150, 160,…, 180 by hand for positions held to expiration. For positions closed prior to expiration, use the spreadsheet BSMbin8e.xls to determine the option price when the position is closed; then calculate the profit by hand.

Repeat problem 8, but close the position on August 1. Use the spreadsheet to find the profits for the possible stock prices on August 1. Generate a graph and use it to identify the approximate breakeven stock price.

Data from in Problem 8

Buy one August 165 call contract. Hold it until the options expire. Determine the profits and graph the results. Then identify the breakeven stock price at expiration. What is the maximum possible loss on this transaction?

Step by Step Answer:

Introduction To Derivatives And Risk Management

ISBN: 9780324601213

8th Edition

Authors: Robert Brooks, Don M Chance, Roberts Brooks