Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The stock market has a lot of ups and downs, which means that return on investment is risky (i.e., return is uncertain, as shown by

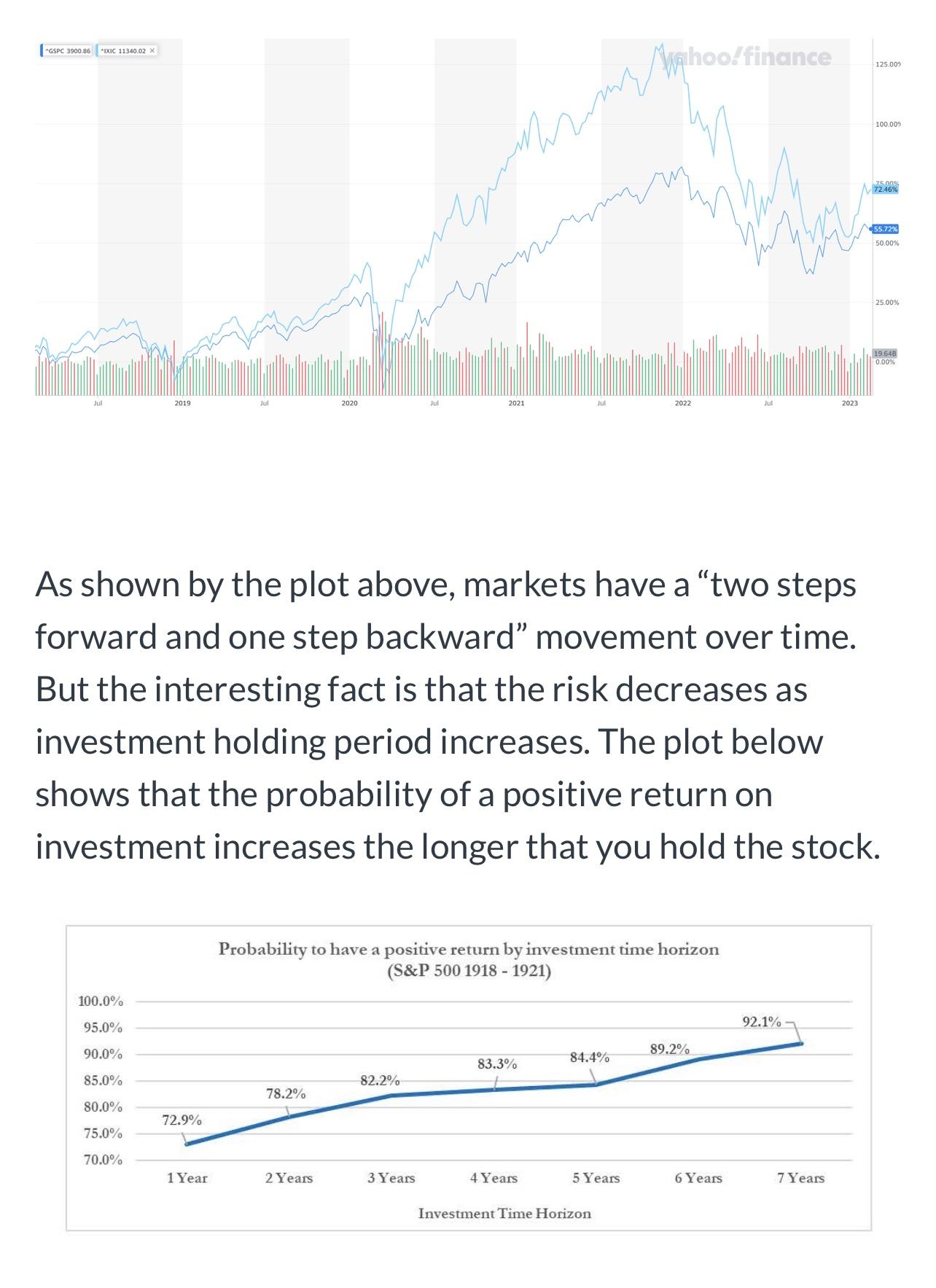

The stock market has a lot of ups and downs, which means that return on investment is risky (i.e., return is uncertain, as shown by the plot below for the S&P 500 and Nasdaq indexes.

*GSPC 3900.86 IXIC 11340.02 x Jul 2019 100.0% 95.0% 90.0% 85.0% 80.0% 75.0% 70.0% 72.9% Jul 1 Year 2020 78.2% 2 Years zomhooffin 82.2% mums 3 Years 2021 Probability to have a positive return by investment time horizon (S&P 500 1918-1921) 83.3% Jul As shown by the plot above, markets have a "two steps forward and one step backward" movement over time. But the interesting fact is that the risk decreases as investment holding period increases. The plot below shows that the probability of a positive return on investment increases the longer that you hold the stock. 4 Years 84.4% 2022 5 Years Investment Time Horizon 89.2% Jul 6 Years 92.1%- 2023 7 Years 125.00% 100.00% 75.00% 72.46% 55.72% 50.00% 25.00% 19.648 0.00%

Step by Step Solution

★★★★★

3.40 Rating (144 Votes )

There are 3 Steps involved in it

Step: 1

ANSWER Under certain market condition Putting resources into the financial exchange implies dangers and market slumps can be agitating for financial b...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started