Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The stock of a New York based company AFF is trading at $53. The volatility of the stock is 38% and the risk-free rate is

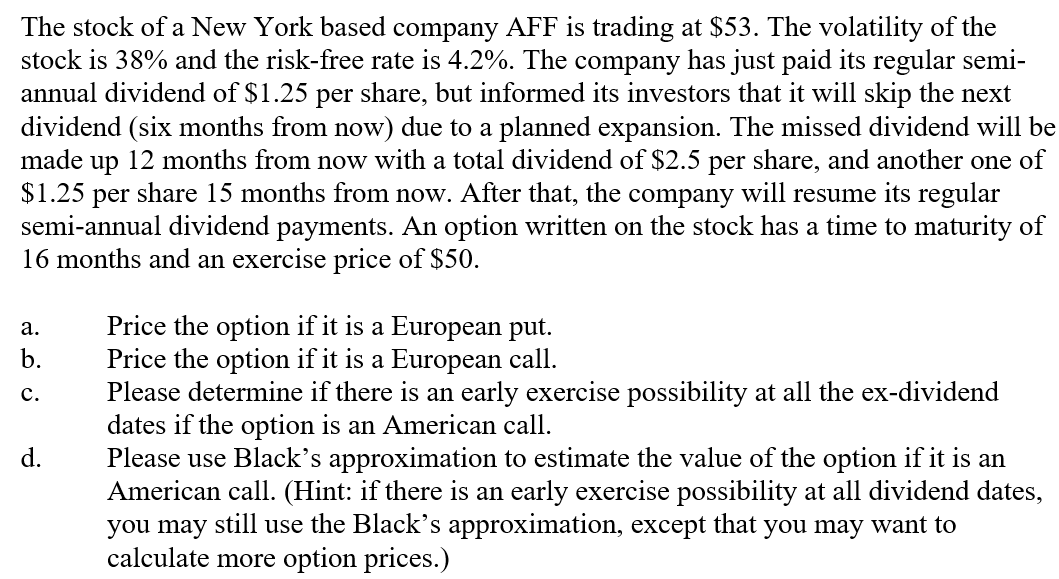

The stock of a New York based company AFF is trading at $53. The volatility of the stock is 38% and the risk-free rate is 4.2%. The company has just paid its regular semiannual dividend of $1.25 per share, but informed its investors that it will skip the next dividend (six months from now) due to a planned expansion. The missed dividend will be made up 12 months from now with a total dividend of $2.5 per share, and another one of $1.25 per share 15 months from now. After that, the company will resume its regular semi-annual dividend payments. An option written on the stock has a time to maturity of 16 months and an exercise price of $50. a. Price the option if it is a European put. b. Price the option if it is a European call. c. Please determine if there is an early exercise possibility at all the ex-dividend dates if the option is an American call. d. Please use Black's approximation to estimate the value of the option if it is an American call. (Hint: if there is an early exercise possibility at all dividend dates, you may still use the Black's approximation, except that you may want to calculate more option prices.)

The stock of a New York based company AFF is trading at $53. The volatility of the stock is 38% and the risk-free rate is 4.2%. The company has just paid its regular semiannual dividend of $1.25 per share, but informed its investors that it will skip the next dividend (six months from now) due to a planned expansion. The missed dividend will be made up 12 months from now with a total dividend of $2.5 per share, and another one of $1.25 per share 15 months from now. After that, the company will resume its regular semi-annual dividend payments. An option written on the stock has a time to maturity of 16 months and an exercise price of $50. a. Price the option if it is a European put. b. Price the option if it is a European call. c. Please determine if there is an early exercise possibility at all the ex-dividend dates if the option is an American call. d. Please use Black's approximation to estimate the value of the option if it is an American call. (Hint: if there is an early exercise possibility at all dividend dates, you may still use the Black's approximation, except that you may want to calculate more option prices.) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started