Answered step by step

Verified Expert Solution

Question

1 Approved Answer

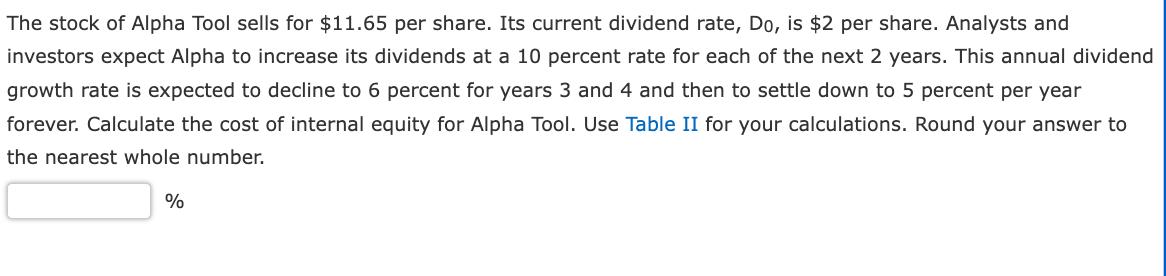

The stock of Alpha Tool sells for $11.65 per share. Its current dividend rate, Do, is $2 per share. Analysts and investors expect Alpha

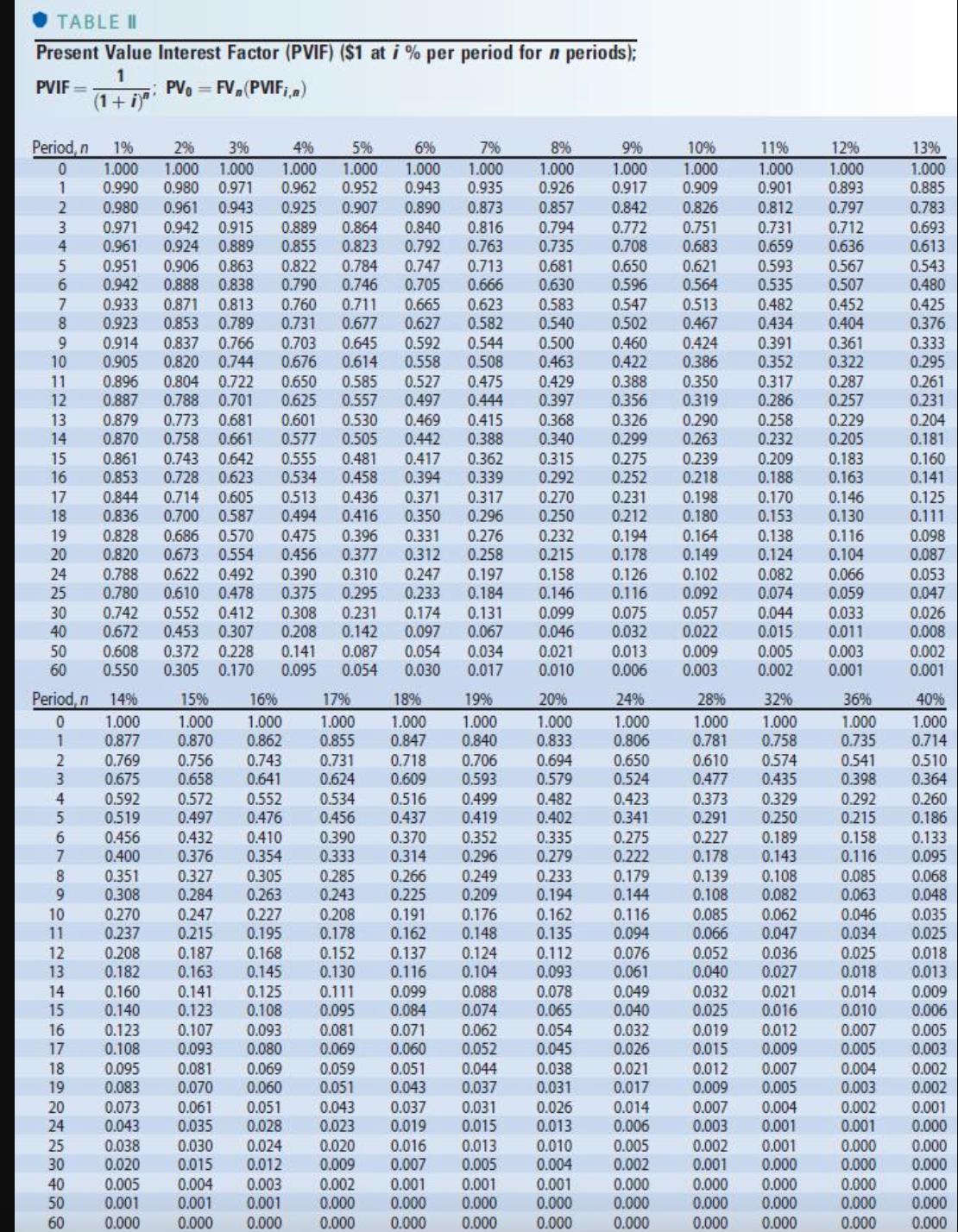

The stock of Alpha Tool sells for $11.65 per share. Its current dividend rate, Do, is $2 per share. Analysts and investors expect Alpha to increase its dividends at a 10 percent rate for each of the next 2 years. This annual dividend growth rate is expected to decline to 6 percent for years 3 and 4 and then to settle down to 5 percent per year forever. Calculate the cost of internal equity for Alpha Tool. Use Table II for your calculations. Round your answer to the nearest whole number. % TABLE II Present Value Interest Factor (PVIF) ($1 at i % per period for n periods); 1 PVIF= PV FV (PVIFi,n) (1+i)"' Period, n 1% 2% 3% 4% 5% 6% 7% 8% 9% 10% 11% 12% 13% 0 1.000 1.000 1.000 1.000 1.000 1.000 1.000 1.000 1.000 1.000 1.000 1.000 1.000 10 11 12 14 15 17 19 -234567890-2345678POLLUTUS 1 0.990 0.980 0.971 0.962 0.952 0.943 0.935 0.926 0.917 0.909 0.901 0.893 0.885 0.980 0.961 0.943 0.925 0.907 0.890 0.873 0.857 0.842 0.826 0.812 0.797 0.783 0.971 0.942 0.915 0.889 0.864 0.840 0.816 0.794 0.772 0.751 0.731 0.712 0.693 0.961 0.924 0.889 0.855 0.823 0.792 0.763 0.735 0.708 0.683 0.659 0.636 0.613 0.951 0.906 0.863 0.942 0.888 0.838 0.822 0.784 0.747 0.713 0.681 0.650 0.621 0.593 0.567 0.543 0.790 0.746 0.705 0.666 0.630 0.596 0.564 0.535 0.507 0.480 0.933 0.871 0.813 0.923 0.853 0.789 0.760 0.711 0.665 0.623 0.583 0.547 0.513 0.482 0.452 0.425 0.731 0.677 0.627 0.582 0.540 0.502 0.467 0.434 0.404 0.376 0.914 0.837 0.766 0.703 0.645 0.592 0.544 0.500 0.460 0.424 0.391 0.361 0.333 0.905 0.820 0.744 0.676 0.614 0.558 0.508 0.463 0.422 0.386 0.352 0.322 0.295 0.896 0.804 0.722 0.650 0.585 0.527 0.475 0.429 0.388 0.350 0.317 0.287 0.261 0.887 0.788 0.701 0.625 0.557 0.497 0.444 0.397 0.356 0.319 0.286 0.257 0.231 13 0.879 0.773 0.681 0.601 0.530 0.469 0.415 0.368 0.326 0.290 0.258 0.229 0.204 0.870 0.758 0.661 0.577 0.505 0.442 0.388 0.340 0.299 0.263 0.232 0.205 0.181 0.861 0.743 0.642 0.555 0.481 0.417 0.362 0.315 0.275 0.239 0.209 0.183 0.160 16 0.853 0.728 0.623 0.534 0.458 0.394 0.339 0.292 0.252 0.218 0.188 0.163 0.141 0.844 0.714 0.605 0.513 0.436 0.371 0.317 0.270 0.231 0.198 0.170 0.146 0.125 18 0.836 0.700 0.587 0.828 0.686 0.570 0.820 0.673 0.554 0.494 0.416 0.350 0.296 0.250 0.212 0.180 0.153 0.130 0.111 0.475 0.396 0.331 0.276 0.232 0.194 0.164 0.138 0.116 0.098 0.456 0.377 0.312 0.258 0.215 0.178 0.149 0.124 0.104 0.087 0.788 0.622 0.492 0.390 0.310 0.247 0.197 0.158 0.126 0.102 0.082 0.066 0.053 0.780 0.610 0.478 0.375 0.295 0.233 0.184 0.146 0.116 0.092 0.074 0.059 0.047 0.742 0.552 0.412 0.672 0.453 0.307 0.308 0.208 0.231 0.174 0.131 0.099 0.075 0.057 0.044 0.033 0.026 0.142 0.097 0.067 0.046 0.032 0.022 0.015 0.011 0.008 0.608 0.372 0.228 0.141 0.087 0.054 0.034 0.021 0.013 0.009 0.005 0.003 0.002 0.550 0.305 0.170 0.095 0.054 0.030 0.017 0.010 0.006 0.003 0.002 0.001 0.001 Period, n 14% 15% 16% 17% 18% 19% 20% 24% 28% 32% 36% 40% 0 1.000 1.000 1.000 1.000 1.000 1.000 1.000 1.000 1.000 1.000 1.000 1.000 1 0.877 0.870 0.862 0.855 0.847 0.840 0.833 0.806 0.781 0.758 0.735 0.714 2345 0.769 0.756 0.743 0.731 0.718 0.706 0.694 0.650 0.610 0.574 0.541 0.510 0.675 0.658 0.641 0.624 0.609 0.593 0.579 0.524 0.477 0.435 0.398 0.364 0.592 0.572 0.552 0.534 0.516 0.499 0.482 0.423 0.373 0.329 0.292 0.260 5 0.519 0.497 0.476 0.456 0.437 0.419 0.402 0.341 0.291 0.250 0.215 0.186 69 0.456 0.432 0.410 0.390 0.370 0.352 0.335 0.275 0.227 0.189 0.158 0.133 7 0.400 0.376 0.354 0.333 0.314 0.296 0.279 0.222 0.178 0.143 0.116 0.095 8 0.351 0.327 0.305 0.285 0.266 0.249 0.233 0.179 0.139 0.108 0.085 0.068 9 0.308 0.284 0.263 0.243 0.225 0.209 0.194 0.144 0.108 0.082 0.063 0.048 10 0.270 0.247 0.227 0.208 0.191 0.176 0.162 0.116 0.085 0.062 0.046 0.035 11 0.237 0.215 0.195 0.178 0.162 0.148 0.135 0.094 0.066 0.047 0.034 0.025 12 0.208 0.187 0.168 0.152 0.137 0.124 0.112 0.076 0.052 0.036 0.025 0.018 13 0.182 0.163 0.145 0.130 0.116 0.104 0.093 0.061 0.040 0.027 0.018 0.013 14 0.160 0.141 0.125 0.111 0.099 0.088 0.078 0.049 0.032 0.021 0.014 0.009 15 0.140 0.123 0.108 0.095 0.084 0.074 0.065 0.040 0.025 0.016 0.010 0.006 16 0.123 0.107 0.093 0.081 0.071 0.062 0.054 0.032 0.019 0.012 0.007 0.005 17 0.108 0.093 0.080 0.069 0.060 0.052 0.045 0.026 0.015 0.009 0.005 0.003 18 0.095 0.081 0.069 0.059 0.051 0.044 0.038 0.021 0.012 0.007 0.004 0.002 19 0.083 0.070 0.060 0.051 0.043 0.037 0.031 0.017 0.009 0.005 0.003 0.002 20 0.073 0.061 0.051 0.043 0.037 0.031 0.026 0.014 0.007 0.004 0.002 0.001 24 0.043 0.035 0.028 0.023 0.019 0.015 0.013 0.006 0.003 0.001 0.001 0.000 25 0.038 0.030 0.024 0.020 0.016 0.013 0.010 0.005 0.002 0.001 0.000 0.000 30 0.020 0.015 0.012 0.009 0.007 0.005 0.004 0.002 0.001 0.000 0.000 0.000 40 0.005 0.004 0.003 0.002 0.001 0.001 0.001 0.000 0.000 0.000 0.000 0.000 50 0.001 0.001 0.001 0.000 0.000 0.000 0.000 0.000 0.000 0.000 0.000 0.000 60 0.000 0.000 0.000 0.000 0.000 0.000 0.000 0.000 0.000 0.000 0.000 0.000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started