Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The stock of Alpha Tool sells for $81.20 per share. Its current dividend rate, D 0 , is $3 per share. Analysts and investors expect

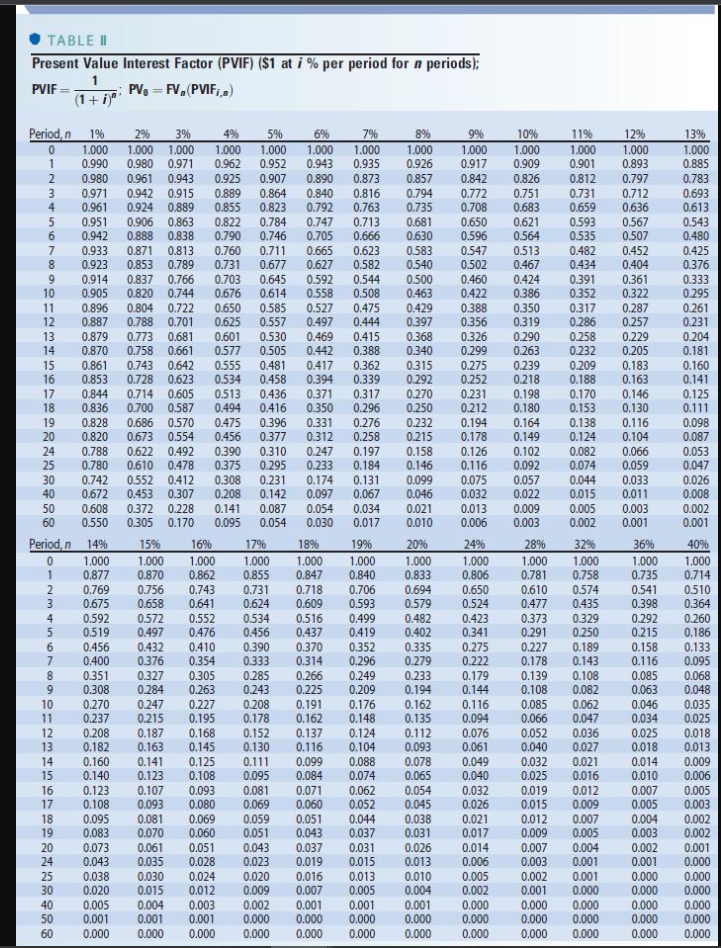

The stock of Alpha Tool sells for $81.20 per share. Its current dividend rate, D0, is $3 per share. Analysts and investors expect Alpha to increase its dividends at a 20 percent rate for each of the next 2 years. This annual dividend growth rate is expected to decline to 17 percent for years 3 and 4 and then to settle down to 13 percent per year forever. Calculate the cost of internal equity for Alpha Tool. Use Table II for your calculations.

TABLE II Present Value Interest Factor (PVIF) ($1 at i % per period for a periods); 1 PVIF PV = FV,(PVIF;,n) (1+i)" 1% 7% 8% 9% 10% 1.000 1.000 0.917 0.909 0.857 0.842 0.826 0.794 0.772 0.751 0.961 0.735 0.708 0.683 0.621 0.593 0.567 0.535 0.507 0.871 0.813 0.452 0.404 0.914 11 12 2% 3% 4% 5% 6% 1.000 1.000 1.000 1.000 1.000 1.000 1.000 1.000 0.990 0.980 0.971 0.962 0.952 0.943 0.935 0.926 0.980 0.961 0.943 0.925 0.907 0.890 0.873 0.971 0.942 0.915 0.889 0.864 0.840 0.816 0.924 0.889 0.855 0.823 0.792 0.763 0.906 0.863 0.822 0.784 0.747 0.713 0.681 0.650 0.888 0.838 0.790 0.746 0.705 0.666 0.630 0.596 0.564 0.760 0.711 0.665 0.623 0.583 0.547 0.513 0.482 0.731 0.677 0.627 0.582 0.540 0.502 0.467 0.434 0.703 0.645 0.592 0.544 0.500 0.460 0.424 0.676 0.614 0.558 0.508 0.463 0.422 0.386 0.650 0.585 0.527 0.475 0.429 0.388 0.350 0.625 0.557 0.497 0.444 0.397 0.356 0.319 0.601 0.530 0.469 0.415 0.368 0.326 0.290 0.577 0.505 0.442 0.388 0.340 0.299 0.263 0.555 0.481 0.417 0.362 0.315 0.275 0.239 0.534 0.458 0.394 0.339 0.292 0.252 0.218 0.513 0.436 0.371 0.317 0.198 0.494 0.416 0.350 0.296 0.250 0.212 0.180 0.475 0.396 0.331 0.276 0.232 0.194 0.164 0.456 0.377 0.312 0.258 0.215 0.178 0.149 0.390 0.310 0.247 0.197 0.158 0.126 0.102 0.082 0.066 0.375 0.295 0.233 0.184 0.146 0.116 0.092 0.074 0.308 0.231 0.174 0.131 0.208 0.142 0.097 0.067 0.141 0.087 0.054 0.034 0.095 0.054 0.030 0.017 15 0.853 0.789 0.837 0.766 0.905 0.820 0.744 0.896 0.804 0.722 0.887 0.788 0.701 13 0.879 0.773 0.681 14 0.870 0.758 0.661 0.861 0.743 0.642 0.853 0.728 0.623 17 0.844 0.714 0.605 0.836 0.700 0.587 0.828 0.686 0.570 0.820 0.673 0.554 0.788 0.622 0.492 0.780 0.610 0.478 0.742 0.552 0.412 40 0.672 0.453 0.307 0.608 0.372 0.228 0.550 0.305 0.170 16 0.270 0.231 0.138 0.124 0.104 0.059 0.044 0.099 0.075 0.057 0.046 0.032 0.022 0.015 0.009 0.005 0.003 0.002 0.001 Period, n 0 1 2 3 4 5 6 7 8 9 10 # 18 19 20 24 25 30 0 50 60 0 1 Period, n 14% 2 3 4 5 6 7 0.951 0.942 8 9 0.933 0.923 15% 16% 1.000 1.000 0.870 0.862 0.756 0.743 0.658 0.641 0.572 0.552 0.519 0.497 0.476 0.456 0.432 0.410 0.400 0.376 0.354 0.351 0.327 0.305 0.308 0.284 0.263 1.000 0.877 0.769 0.675 0.592 10 0.270 0.247 0.227 11 0.237 0.215 0.195 0.208 0.187 0.168 13 0.182 0.163 0.145 12 14 15 16 17 18 19 20 24 25 30 40 50 0.001 60 0.160 0.141 0.140 0.123 0.123 0.107 0.108 0.093 0.125 0.108 0.093 0.084 0.081 0.071 0.060 0.080 0.069 0.081 0.069 0.059 0.051 0.095 0.083 0.073 0.061 0.051 0.070 0.060 0.051 0.043 0.043 0.035 0.028 0.021 0.013 0.010 20% 1.000 1.000 1.000 18% 19% 17% 1.000 0.855 0.847 0.840 0.833 0.731 0.718 0.706 0.694 0.624 0.609 0.593 0.499 0.437 0.419 0.402 0.534 0.516 0.456 0.390 0.370 0.352 0.335 0.333 0.314 0.296 0.279 0.285 0.266 0.249 0.233 0.243 0.225 0.209 0.194 0.208 0.191 0.176 0.162 0.178 0.162 0.148 0.135 0.152 0.137 0.124 0.130 0.116 0.104 0.111 0.099 0.088 0.095 0.038 0.030 0.020 0.015 0.043 0.023 0.074 0.062 0.052 0.044 0.037 0.112 0.093 0.078 0.065 0.579 0.482 0.423 0.341 0.275 0.222 0.054 0.045 0.037 0.031 0.019 0.015 0.024 0.020 0.016 0.013 0.010 0.005 0.004 0.005 0.004 0.001 0.001 0.001 0.012 0.009 0.007 0.003 0.002 0.001 0.001 0.000 0.000 0.000 0.000 0.000 0.000 0.000 0.000 0.038 0.031 0.026 0.013 0.006 0.003 0.000 0.000 0.000 24% 1.000 0.806 0.650 0.524 0.179 0.144 0.116 0.094 0.076 0.061 0.049 0.040 0.021 0.017 0.014 0.006 0.005 0.002 0.000 0.000 0.000 11% 12% 1.000 1.000 0.901 0.893 0.797 0.712 0.636 0.812 0.731 0.659 0.391 0.352 0.317 0.286 28% 32% 1.000 1.000 0.781 0.758 0.610 0.574 0.477 0.435 0.258 0.229 0.232 0.205 0.209 0.183 0.188 0.163 0.373 0.291 0.227 0.189 0.178 0.143 0.139 0.108 0.108 0.082 0.000 0.000 0.000 0.170 0.146 0.153 0.130 0.116 0.329 0.250 0.085 0.062 0.066 0.047 0.052 0.036 0.040 0.027 0.046 0.034 0.025 0.018 0.032 0.021 0.014 0.025 0.016 0.010 0.032 0.019 0.012 0.007 0.026 0.015 0.009 0.005 0.012 0.007 0.009 0.005 0.007 0.004 0.003 0.001 0.361 0.322 0.002 0.001 0.001 0.000 0.287 0.257 0.000 0.000 0.000 0.033 0.011 36% 1.000 0.735 0.541 0.398 0.292 0.215 0.085 0.063 13% 1.000 0.885 0.004 0.003 0.783 0.693 0.613 0.543 0.480 0.425 0.376 0.333 0.295 0.261 0.231 0.204 0.181 0.160 0.141 0.125 0.111 0.098 0.087 0.053 0.047 0.026 0.008 0.002 0.001 0.158 0.133 0.116 0.095 40% 1.000 0.714 0.510 0.364 0.260 0.186 0.068 0.048 0.035 0.025 0.018 0.013 0.009 0.006 0.005 0.003 0.002 0.002 0.002 0.001 0.000 0.000 0.000 0.000 0.001 0.000 0.000 0.000 0.000 0.000 0.000 0.000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate the cost of internal equity for Alpha Tool we can use the Gordon Growth Model ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started