Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Investors estimate that Slender Burger's (SB) existing business generates $2.5 million in annual earnings every year for the foreseeable future (i.e., forever). SB has

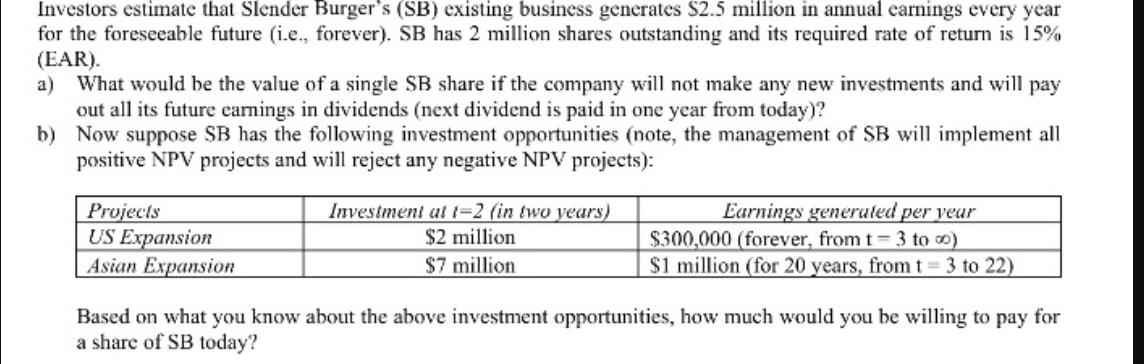

Investors estimate that Slender Burger's (SB) existing business generates $2.5 million in annual earnings every year for the foreseeable future (i.e., forever). SB has 2 million shares outstanding and its required rate of return is 15% (EAR). a) What would be the value of a single SB share if the company will not make any new investments and will pay out all its future earnings in dividends (next dividend is paid in one year from today)? b) Now suppose SB has the following investment opportunities (note, the management of SB will implement all positive NPV projects and will reject any negative NPV projects): Projects US Expansion Asian Expansion Investment at 1-2 (in two years) $2 million $7 million Earnings generated per year $300,000 (forever, from t=3 to ) $1 million (for 20 years, from t = 3 to 22) Based on what you know about the above investment opportunities, how much would you be willing to pay for a share of SB today?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a Value of SB the Companyno new investments PV of the perpetuity of dividends ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started