Answered step by step

Verified Expert Solution

Question

1 Approved Answer

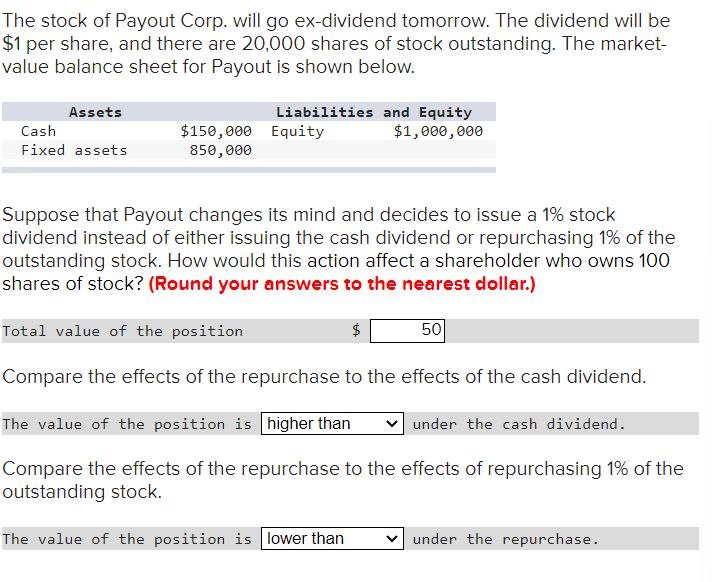

The stock of Payout Corp. will go ex - dividend tomorrow. The dividend will be $ 1 per share, and there are 2 0 ,

The stock of Payout Corp. will go exdividend tomorrow. The dividend will be

$ per share, and there are shares of stock outstanding. The market

value balance sheet for Payout is shown below.

Suppose that Payout changes its mind and decides to issue a stock

dividend instead of either issuing the cash dividend or repurchasing of the

outstanding stock. How would this action affect a shareholder who owns

shares of stock? Round your answers to the nearest dollar.

Total value of the position

Compare the effects of the repurchase to the effects of the cash dividend.

The value of the position is higher than under the cash dividend.

Compare the effects of the repurchase to the effects of repurchasing of the

outstanding stock.

The value of the position is lower than under the repurchase.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started