Answered step by step

Verified Expert Solution

Question

1 Approved Answer

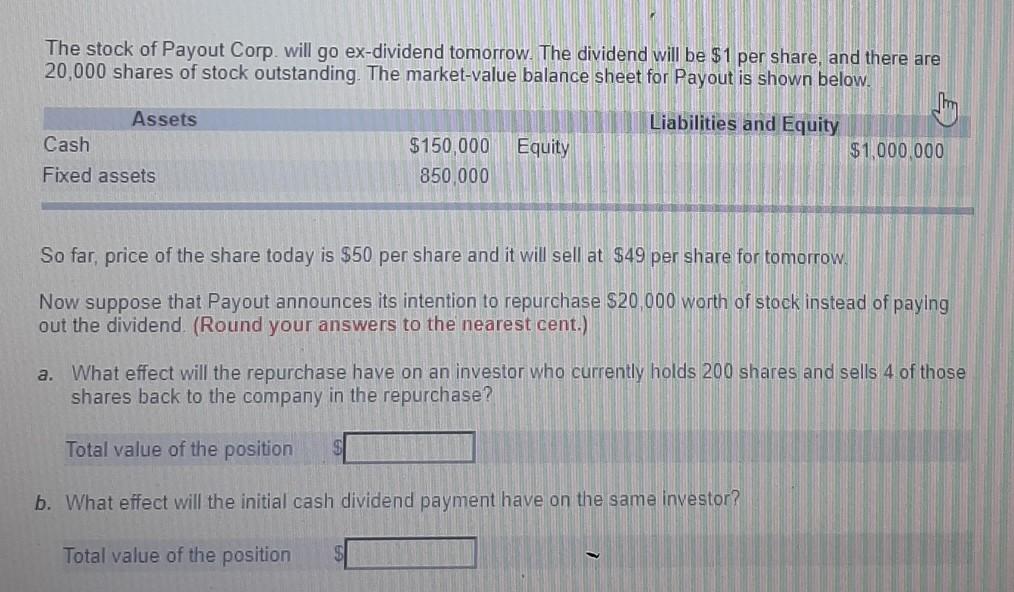

The stock of Payout Corp. will go ex-dividend tomorrow. The dividend will be $1 per share, and there are 20,000 shares of stock outstanding. The

The stock of Payout Corp. will go ex-dividend tomorrow. The dividend will be $1 per share, and there are 20,000 shares of stock outstanding. The market value balance sheet for Payout is shown below. Assets Cash Fixed assets Liabilities and Equity $1,000,000 $150,000 Equity 850,000 So far, price of the share today is $50 per share and it will sell at $49 per share for tomorrow. Now suppose that Payout announces its intention to repurchase $20,000 worth of stock instead of paying out the dividend (Round your answers to the nearest cent.) a. What effect will the repurchase have on an investor who currently holds 200 shares and sells 4 of those shares back to the company in the repurchase? Total value of the position b. What effect will the initial cash dividend payment have on the same investor? Total value of the position

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started