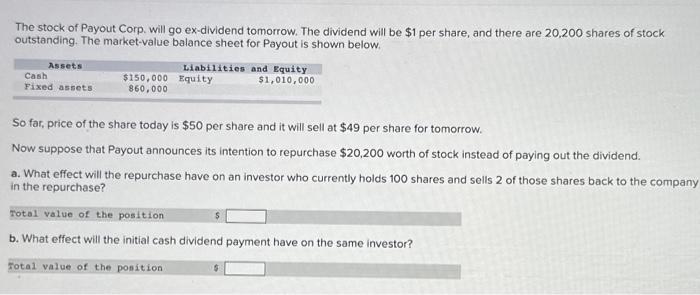

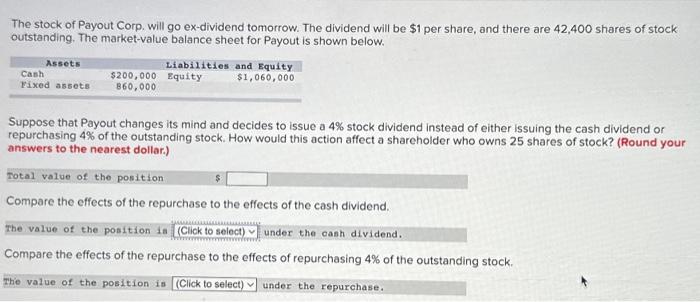

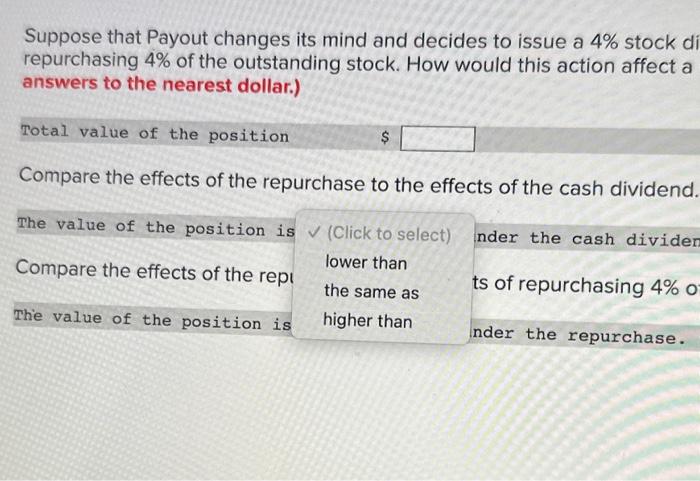

The stock of Payout Corp. will go ex-dividend tomorrow. The dividend will be \\( \\$ 1 \\) per share, and there are 20,200 shares of stock outstanding. The market-value balance sheet for Payout is shown below. So far, price of the share today is \\( \\$ 50 \\) per share and it will sell at \\( \\$ 49 \\) per share for tomorrow. Now suppose that Payout announces its intention to repurchase \\( \\$ 20,200 \\) worth of stock instead of paying out the dividend. a. What effect will the repurchase have on an investor who currently holds 100 shares and sells 2 of those shares back to the compa in the repurchase? Total value of the position b. What effect will the initial cash dividend payment have on the same investor? Suppose that Payout changes its mind and decides to issue a \4 stock di repurchasing \4 of the outstanding stock. How would this action affect a answers to the nearest dollar.) Total value of the position \\( \\$ \\) Compare the effects of the repurchase to the effects of the cash dividend. The value of the position is Compare the effects of the rep The value of the position is (Click to select) lower than the same as higher than nder the cash divider ts of repurchasing \4 o nder the repurchase. The stock of Payout Corp. will go ex-dividend tomorrow. The dividend will be \\( \\$ 1 \\) per share, and there are 42,400 shares of stock outstanding. The market-value balance sheet for Payout is shown below. Suppose that Payout changes its mind and decides to issue a \4 stock dividend instead of either issuing the cash dividend or repurchasing \4 of the outstanding stock. How would this action affect a shareholder who owns 25 shares of stock? (Round your answers to the nearest dollar.) Total value of the position Compare the effects of the repurchase to the effects of the cash dividend. The value of the position is under the cash dividend. Compare the effects of the repurchase to the effects of repurchasing \4 of the outstanding stock. The value of the position is under the repurchase. The stock of Payout Corp. will go ex-dividend tomorrow. The dividend will be \\( \\$ 1 \\) per share, and there are 20,200 shares of stock outstanding. The market-value balance sheet for Payout is shown below. So far, price of the share today is \\( \\$ 50 \\) per share and it will sell at \\( \\$ 49 \\) per share for tomorrow. Now suppose that Payout announces its intention to repurchase \\( \\$ 20,200 \\) worth of stock instead of paying out the dividend. a. What effect will the repurchase have on an investor who currently holds 100 shares and sells 2 of those shares back to the compa in the repurchase? Total value of the position b. What effect will the initial cash dividend payment have on the same investor? Suppose that Payout changes its mind and decides to issue a \4 stock di repurchasing \4 of the outstanding stock. How would this action affect a answers to the nearest dollar.) Total value of the position \\( \\$ \\) Compare the effects of the repurchase to the effects of the cash dividend. The value of the position is Compare the effects of the rep The value of the position is (Click to select) lower than the same as higher than nder the cash divider ts of repurchasing \4 o nder the repurchase. The stock of Payout Corp. will go ex-dividend tomorrow. The dividend will be \\( \\$ 1 \\) per share, and there are 42,400 shares of stock outstanding. The market-value balance sheet for Payout is shown below. Suppose that Payout changes its mind and decides to issue a \4 stock dividend instead of either issuing the cash dividend or repurchasing \4 of the outstanding stock. How would this action affect a shareholder who owns 25 shares of stock? (Round your answers to the nearest dollar.) Total value of the position Compare the effects of the repurchase to the effects of the cash dividend. The value of the position is under the cash dividend. Compare the effects of the repurchase to the effects of repurchasing \4 of the outstanding stock. The value of the position is under the repurchase