Question

The stock of Payout Corp. will go ex-dividend tomorrow. The dividend will be $2 per share, and there are 20,000 shares of stock outstanding. The

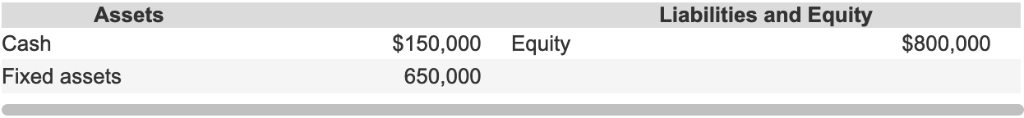

The stock of Payout Corp. will go ex-dividend tomorrow. The dividend will be $2 per share, and there are 20,000 shares of stock outstanding. The market-value balance sheet for Payout is shown below.

Suppose that Payout changes its mind and decides to issue a 5% stock dividend instead of either issuing the cash dividend or repurchasing 5% of the outstanding stock. How would this action affect a shareholder who owns 80 shares of stock? (Round your answers to the nearest dollar.)

Total Value of the Position: ___________

Compare the effects of the repurchase to the effects of the cash dividend.

The Value of the Position is (higher than / lower than / the same) under the cash dividend.

Compare the effects of the repurchase to the effects of repurchasing 5% of the outstanding stock.

The Value of the Position is (higher than / lower than / the same) under the repurchase.

Assets Liabilities and Equity $150,000 Equity Cash Fixed assets $800,000 650,000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started