Answered step by step

Verified Expert Solution

Question

1 Approved Answer

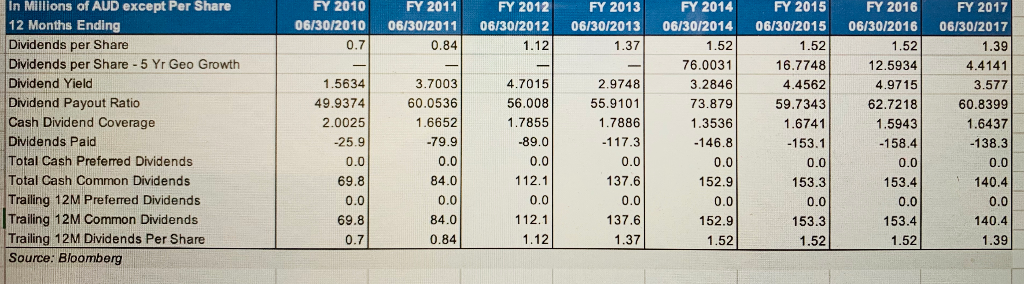

The stock price as at 30th June 2017 was $38.30 Now assume you bought this share two years ago a)If you bought share in the

The stock price as at 30th June 2017 was $38.30 Now assume you bought this share two years ago

a)If you bought share in the company on the 1st July 2015 at $34 and the share price exactly one year ago was $31, what is your capital gain per share today?

(b) Use the information in part (a), if you reinvested the dividends you received in more FLT shares, what is your wealth on 30th June 2017 on a per share basis? Assume that you have bought 1000 shares.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started