Question

The stock price is 80 the volatility of the stock is 20%. Assuming that the time to expiration is 3 months and the interest

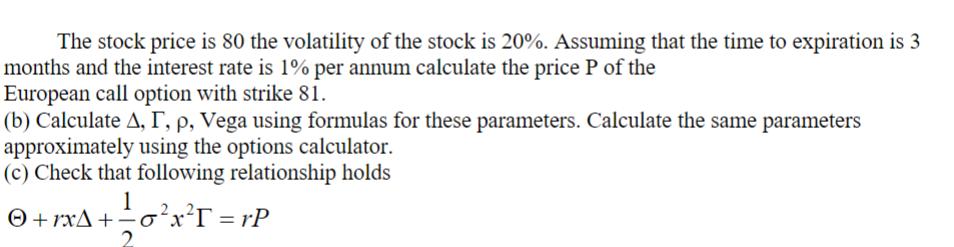

The stock price is 80 the volatility of the stock is 20%. Assuming that the time to expiration is 3 months and the interest rate is 1% per annum calculate the price P of the European call option with strike 81. (b) Calculate A, F, p, Vega using formulas for these parameters. Calculate the same parameters approximately using the options calculator. (c) Check that following relationship holds 1 +rxA+ 10xT = rP

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Fundamentals of Futures and Options Markets

Authors: John C. Hull

8th edition

978-1292155036, 1292155035, 132993341, 978-0132993340

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App