Answered step by step

Verified Expert Solution

Question

1 Approved Answer

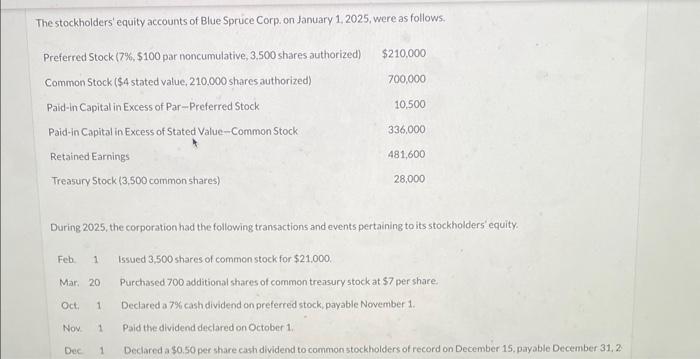

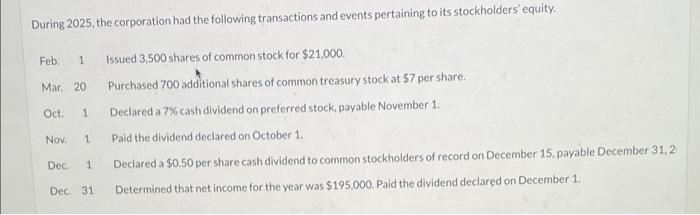

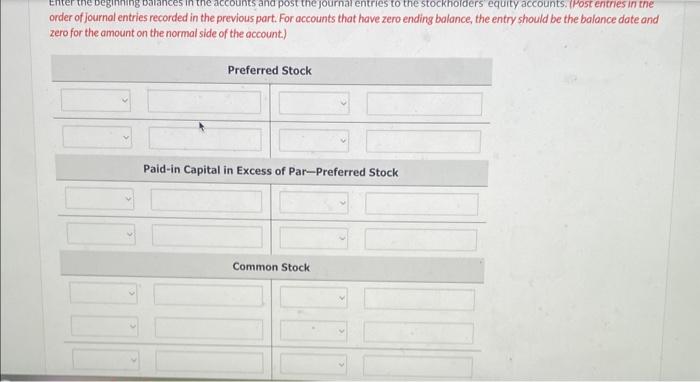

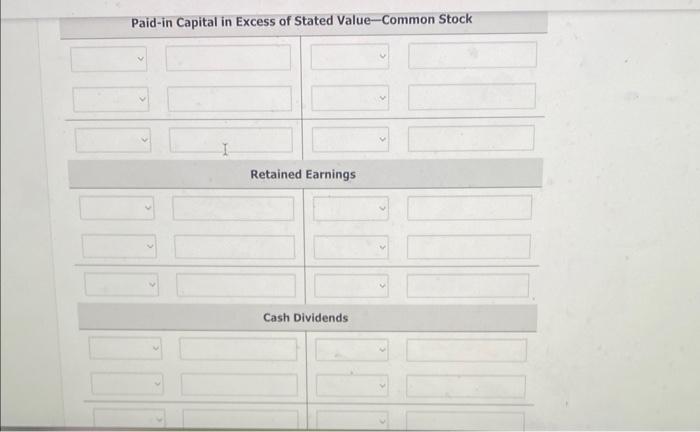

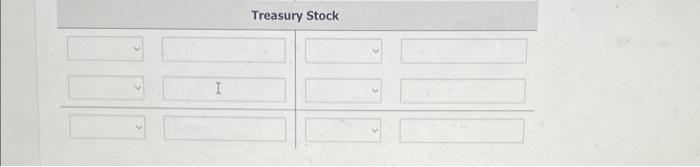

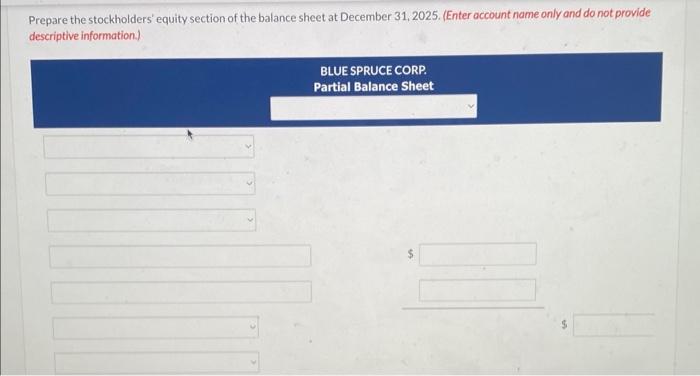

The stockholders' equity accounts of Blue Spruce Corp. on January 1, 2025, were as follows. During 2025, the corporation had the following transactions and events

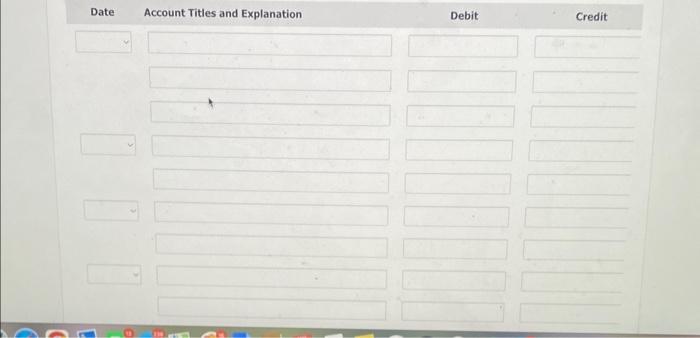

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

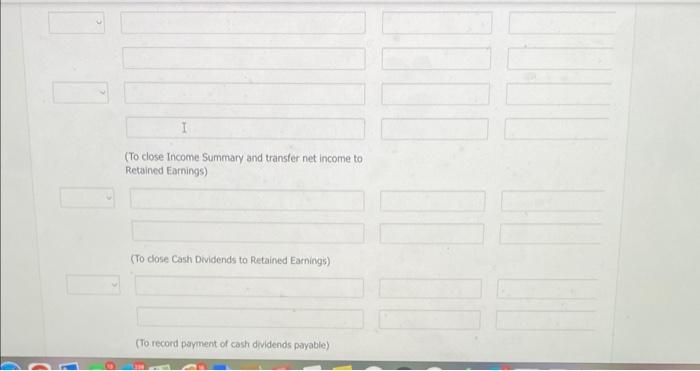

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started