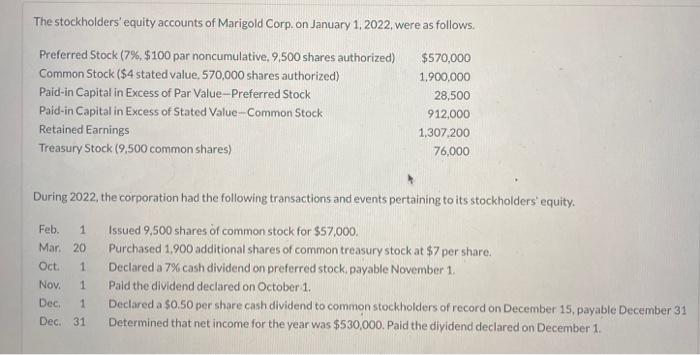

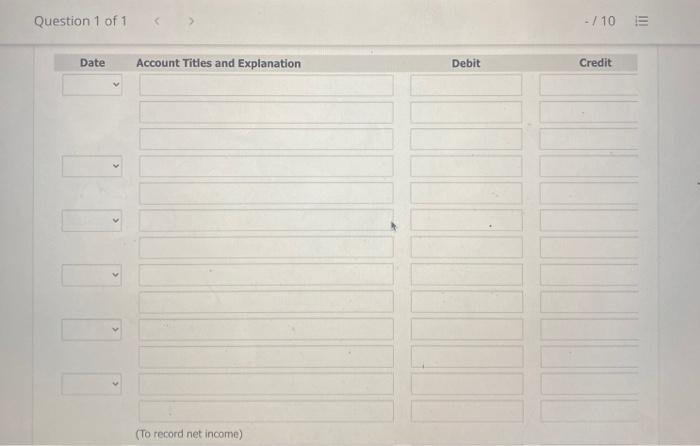

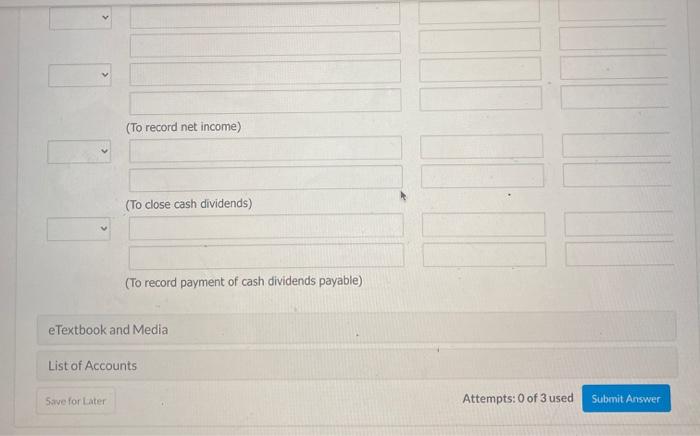

The stockholders' equity accounts of Marigold Corp. on January 1, 2022 were as follows. Preferred Stock (7%, $100 par noncumulative, 9,500 shares authorized) Common Stock ($4 stated value. 570,000 shares authorized) Paid-in Capital in Excess of Par Value-Preferred Stock Paid-in Capital in Excess of Stated Value --Common Stock Retained Earnings Treasury Stock (9,500 common shares) $570,000 1,900,000 28,500 912,000 1,307 200 76,000 During 2022, the corporation had the following transactions and events pertaining to its stockholders' equity. Feb. 1 Mar. 20 Oct 1 Nov. 1 Dec 1 Dec. 31 Issued 9,500 shares of common stock for $57,000. Purchased 1.900 additional shares of common treasury stock at $7 per share. Declared a 7% cash dividend on preferred stock payable November 1. Pald the dividend declared on October 1. Declared a $0.50 per share cash dividend to common stockholders of record on December 15, payable December 31 Determined that net income for the year was $530,000. Paid the dividend declared on December 1 Question 1 of 1 - / 10 E Date Account Tities and Explanation Debit Credit (To record net income) (To record net income) (To close cash dividends) (To record payment of cash dividends payable) e Textbook and Media List of Accounts Save for Later Attempts: 0 of 3 used Submit Answer The stockholders' equity accounts of Marigold Corp. on January 1, 2022 were as follows. Preferred Stock (7%, $100 par noncumulative, 9,500 shares authorized) Common Stock ($4 stated value. 570,000 shares authorized) Paid-in Capital in Excess of Par Value-Preferred Stock Paid-in Capital in Excess of Stated Value --Common Stock Retained Earnings Treasury Stock (9,500 common shares) $570,000 1,900,000 28,500 912,000 1,307 200 76,000 During 2022, the corporation had the following transactions and events pertaining to its stockholders' equity. Feb. 1 Mar. 20 Oct 1 Nov. 1 Dec 1 Dec. 31 Issued 9,500 shares of common stock for $57,000. Purchased 1.900 additional shares of common treasury stock at $7 per share. Declared a 7% cash dividend on preferred stock payable November 1. Pald the dividend declared on October 1. Declared a $0.50 per share cash dividend to common stockholders of record on December 15, payable December 31 Determined that net income for the year was $530,000. Paid the dividend declared on December 1 Question 1 of 1 - / 10 E Date Account Tities and Explanation Debit Credit (To record net income) (To record net income) (To close cash dividends) (To record payment of cash dividends payable) e Textbook and Media List of Accounts Save for Later Attempts: 0 of 3 used Submit