Answered step by step

Verified Expert Solution

Question

1 Approved Answer

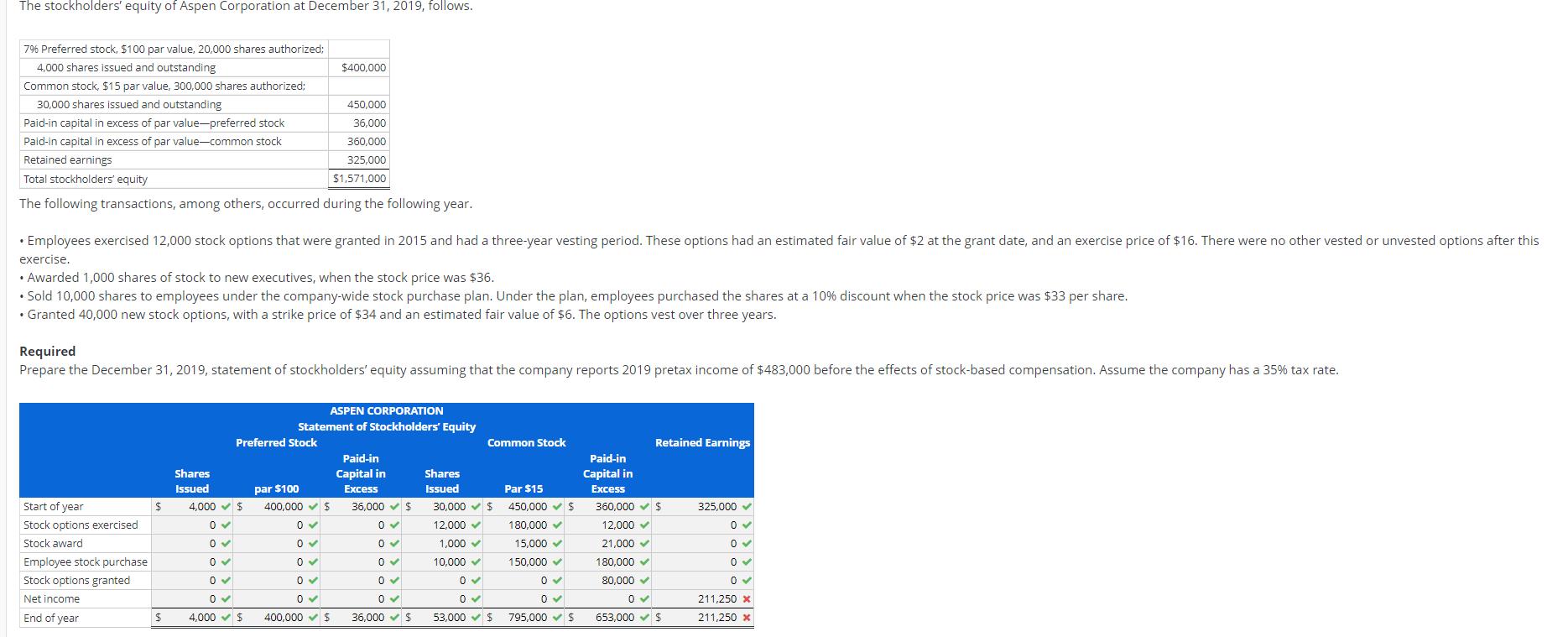

The stockholders' equity of Aspen Corporation at December 31, 2019, follows. 7% Preferred stock, $100 par value, 20,000 shares authorized; 4,000 shares issued and

The stockholders' equity of Aspen Corporation at December 31, 2019, follows. 7% Preferred stock, $100 par value, 20,000 shares authorized; 4,000 shares issued and outstanding Common stock, $15 par value, 300,000 shares authorized; 30,000 shares issued and outstanding Paid-in capital in excess of par value-preferred stock Paid-in capital in excess of par value-common stock Retained earnings Total stockholders' equity The following transactions, among others, occurred during the following year. Employees exercised 12,000 stock options that were granted in 2015 and had a three-year vesting period. These options had an estimated fair value of $2 at the grant date, and an exercise price of $16. There were no other vested or unvested options after this exercise. Awarded 1,000 shares of stock to new executives, when the stock price was $36. Sold 10,000 shares to employees under the company-wide stock purchase plan. Under the plan, employees purchased the shares at a 10% discount when the stock price was $33 per share. Granted 40,000 new stock options, with a strike price of $34 and an estimated fair value of $6. The options vest over three years. Start of year Stock options exercised Stock award Employee stock purchase Stock options granted Net income End of year Required Prepare the December 31, 2019, statement of stockholders' equity assuming that the company reports 2019 pretax income of $483,000 before the effects of stock-based compensation. Assume the company has a 35% tax rate. $ $ Shares Issued 4,000 $ 0 0 0 0 0 4,000 $ Preferred Stock $400,000 ASPEN CORPORATION Statement of Stockholders' Equity par $100 400,000 $ 0 0 450,000 36,000 360,000 325,000 $1,571,000 0 0 0 400,000 $ Paid-in Capital in Excess 36,000 $ 0 0 0 0 0 36,000 $ Shares Issued 30,000 12,000 1,000 10,000 Common Stock Par $15 $450,000 $ 180,000 15,000 150,000 0 0 0 0 53,000 $ 795,000 $ Retained Earnings Paid-in Capital in Excess 360,000 $ 12,000 21,000 180,000 80,000 0 653,000 $ 325,000 0 0 0 0 211,250 x 211,250 x

Step by Step Solution

★★★★★

3.43 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

1 Total Employees compensation expense is 12000 shares fair value of options 12000 2 24000 These exp...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started