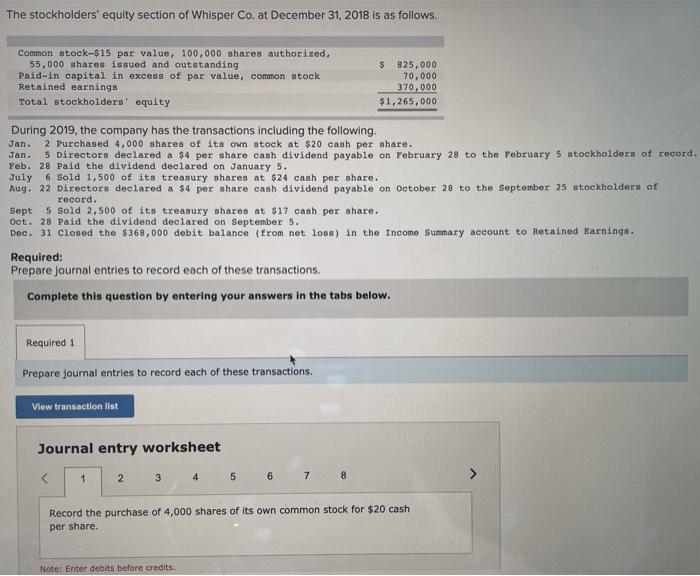

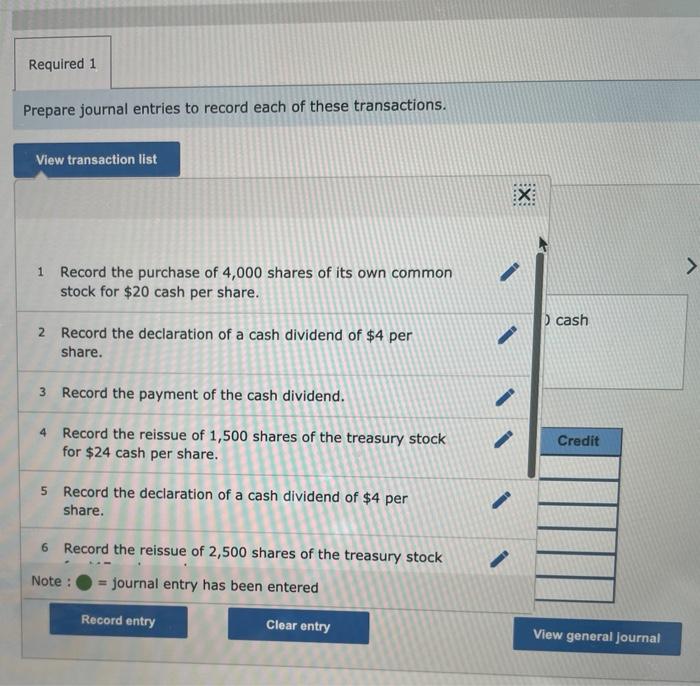

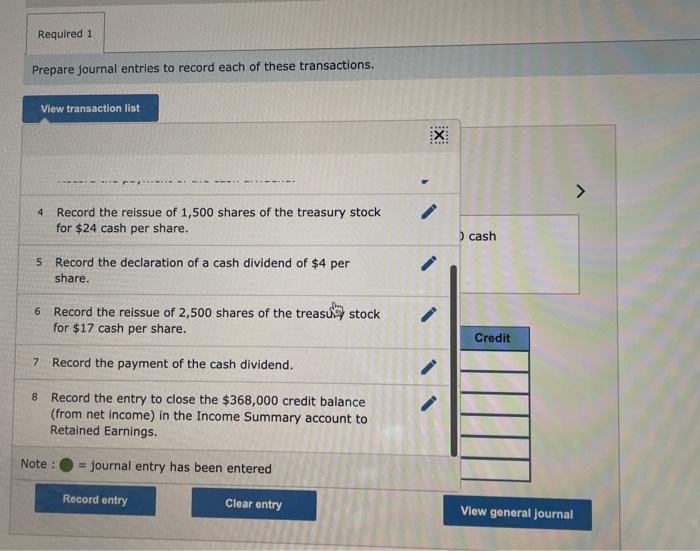

The stockholders' equity section of Whisper Co. at December 31, 2018 is as follows. Common stock-$15 par value, 100,000 shares authorized, 55,000 shares issued and outstanding Paid-in capital in excess of par value, common stock Retained earnings Total stockholders' equity $ 825,000 70,000 370,000 $1,265,000 During 2019, the company has the transactions including the following. Jan. 2 Purchased 4,000 shares of its own stock at $20 cash per share. Jan. 5 Directors declared a $4 per share cash dividend payable on February 28 to the February 5 stockholders of record. Feb. 28 Paid the dividend declared on January 5. July 6 Sold 1,500 of its treasury shares at $24 cash per share. Aug. 22 Directors declared a $4 per share cash dividend payable on October 28 to the September 25 stockholders of record. Sept 5 Sold 2,500 of its treasury shares at $17 cash per share. Oct. 28 Paid the dividend declared on September 5. Dec. 31 Closed the $368,000 debit balance (from net loss) in the Income Summary account to Retained Earnings Required: Prepare journal entries to record each of these transactions. Complete this question by entering your answers in the tabs below. Required 1 Prepare journal entries to record each of these transactions. View transaction list Journal entry worksheet 2 1 3 5 6 7 8 Record the purchase of 4,000 shares of its own common stock for $20 cash per share. Note: Enter debits before credits. Required 1 Prepare journal entries to record each of these transactions. View transaction list X: > 1 Record the purchase of 4,000 shares of its own common stock for $20 cash per share. D cash 2 Record the declaration of a cash dividend of $4 per share. 3 Record the payment of the cash dividend. 4 Record the reissue of 1,500 shares of the treasury stock for $24 cash per share. Credit 5 Record the declaration of a cash dividend of $4 per share. 6 Record the reissue of 2,500 shares of the treasury stock Note : = journal entry has been entered Record entry Clear entry View general Journal Required 1 Prepare journal entries to record each of these transactions. View transaction list :X --------- 4 Record the reissue of 1,500 shares of the treasury stock for $24 cash per share. cash 5 Record the declaration of a cash dividend of $4 per share. 6 Record the reissue of 2,500 shares of the treasu) stock for $17 cash per share. Credit 7 Record the payment of the cash dividend. 8 Record the entry to close the $368,000 credit balance (from net income) in the Income Summary account to Retained Earnings. Note : = journal entry has been entered Record entry Clear entry View general Journal