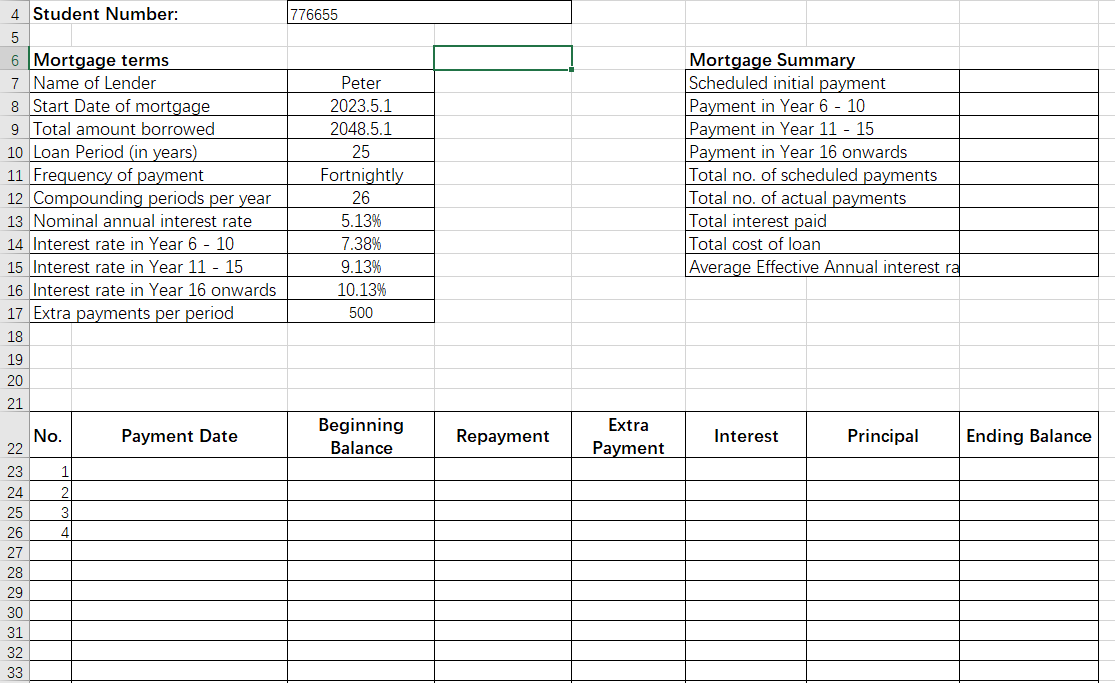

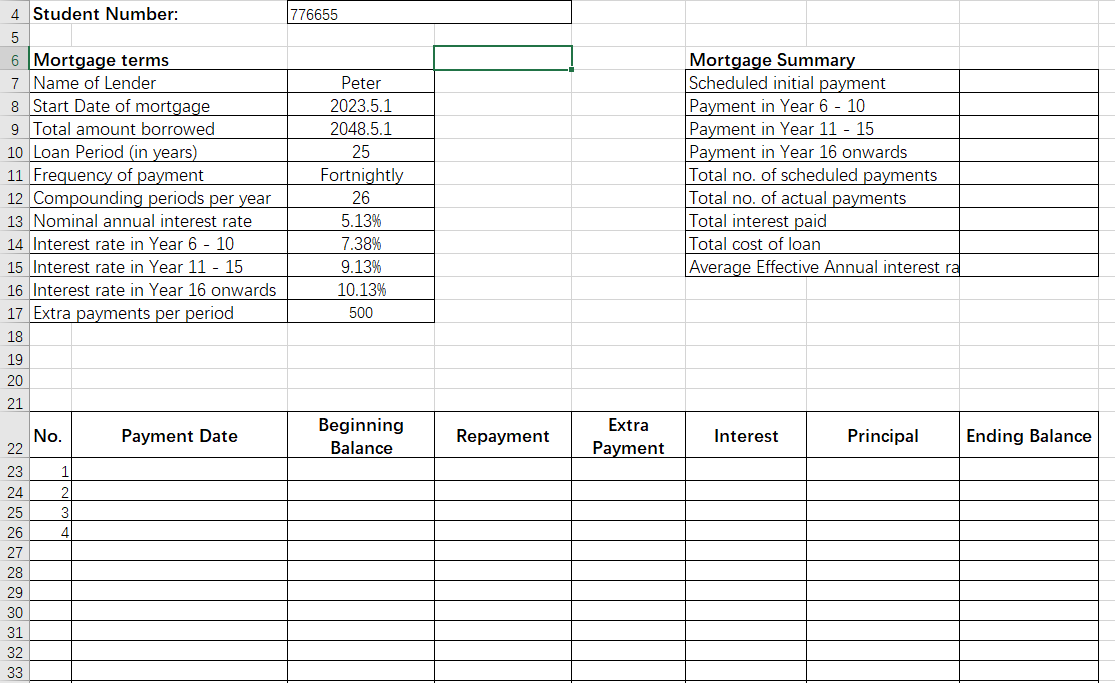

The student number is same as the amount borrowed is $776655,Use Excel fomular to fill up the empty space and show the steps that how to use excel fomular to calculate:

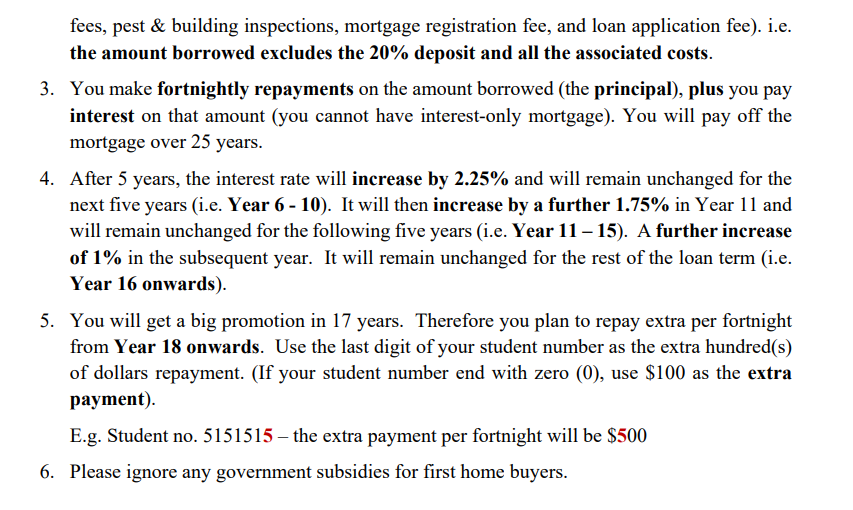

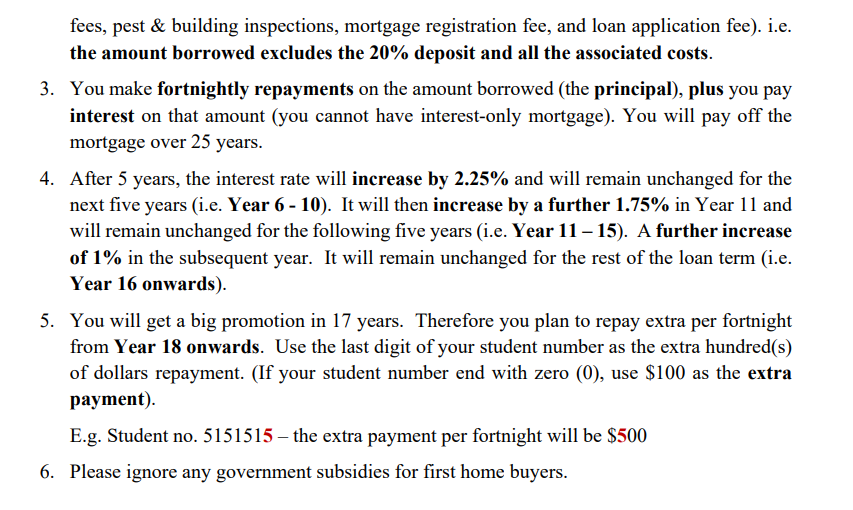

Assumptions: 1. You have a full time job and are going to buy your first home (owner occupier). 2. You are eligible to apply for a mortgage. You have already saved 20% for the deposit and all other related costs associated with buying the house and applying for the mortgage (e.g. stamp duty, conveyancing \& legal fees, pest \& building inspections, mortgage registration fee, and loan application fee). i.e. the amount borrowed excludes the 20% deposit and all the associated costs. 3. You make fortnightly repayments on the amount borrowed (the principal), plus you pay interest on that amount (you cannot have interest-only mortgage). You will pay off the mortgage over 25 years. 4. After 5 years, the interest rate will increase by 2.25% and will remain unchanged for the next five years (i.e. Year 6 - 10). It will then increase by a further 1.75% in Year 11 and will remain unchanged for the following five years (i.e. Year 11-15). A further increase of 1% in the subsequent year. It will remain unchanged for the rest of the loan term (i.e. Year 16 onwards). 5. You will get a big promotion in 17 years. Therefore you plan to repay extra per fortnight from Year 18 onwards. Use the last digit of your student number as the extra hundred(s) of dollars repayment. (If your student number end with zero (0), use $100 as the extra payment). E.g. Student no. 5151515 - the extra payment per fortnight will be $500 6. Please ignore any government subsidies for first home buyers. \begin{tabular}{|r|l|c|} \hline 4 & Student Number: & 776655 \\ \hline 5 & & \\ 6 & Mortgage terms & \\ 7 & Name of Lender & Peter \\ 8 & Start Date of mortgage & 2023.5 .1 \\ \hline 9 & Total amount borrowed & 2048.5 .1 \\ \hline 1 & Loan Period (in years) & 25 \\ 11 & Frequency of payment & Fortnightly \\ 12 & Compounding periods per year & 26 \\ \hline 13 & Nominal annual interest rate & 5.13% \\ \hline 1 & Interest rate in Year 6 - 10 & 7.38% \\ \hline 15 & Interest rate in Year 11 - 15 & 9.13% \\ \hline 1 & Interest rate in Year 16 onwards & 10.13% \\ \hline 17 & Extra payments per period & 500 \\ \hline \end{tabular} \begin{tabular}{|l|l|} \hline Mortgage Summary & \\ \hline Scheduled initial payment & \\ \hline Payment in Year 610 & \\ \hline Payment in Year 1115 & \\ \hline Payment in Year 16 onwards & \\ \hline Total no. of scheduled payments & \\ \hline Total no. of actual payments & \\ \hline Total interest paid & \\ \hline Total cost of loan & \\ \hline Average Effective Annual interest ra \\ \hline \end{tabular}