Answered step by step

Verified Expert Solution

Question

1 Approved Answer

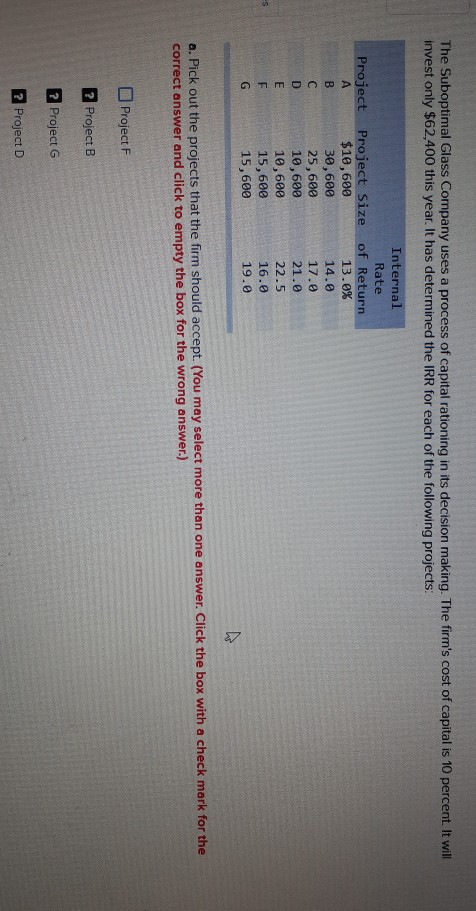

The Suboptimal Glass Company uses a process of capital rationing in its decision making. The firm's cost of capital is 10 percent. It will invest

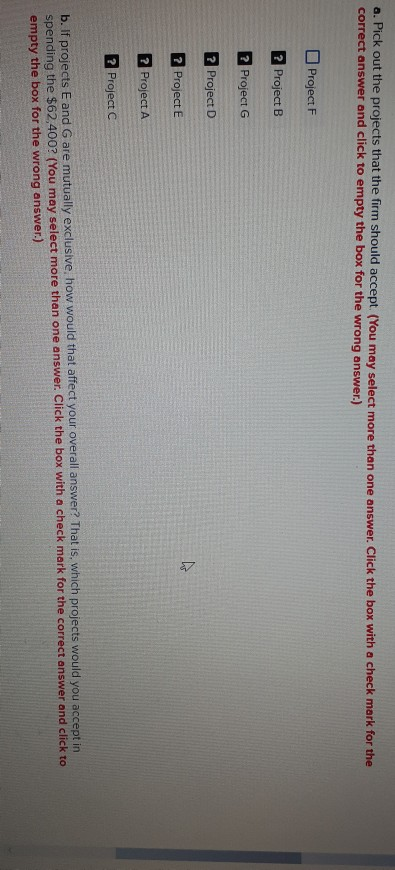

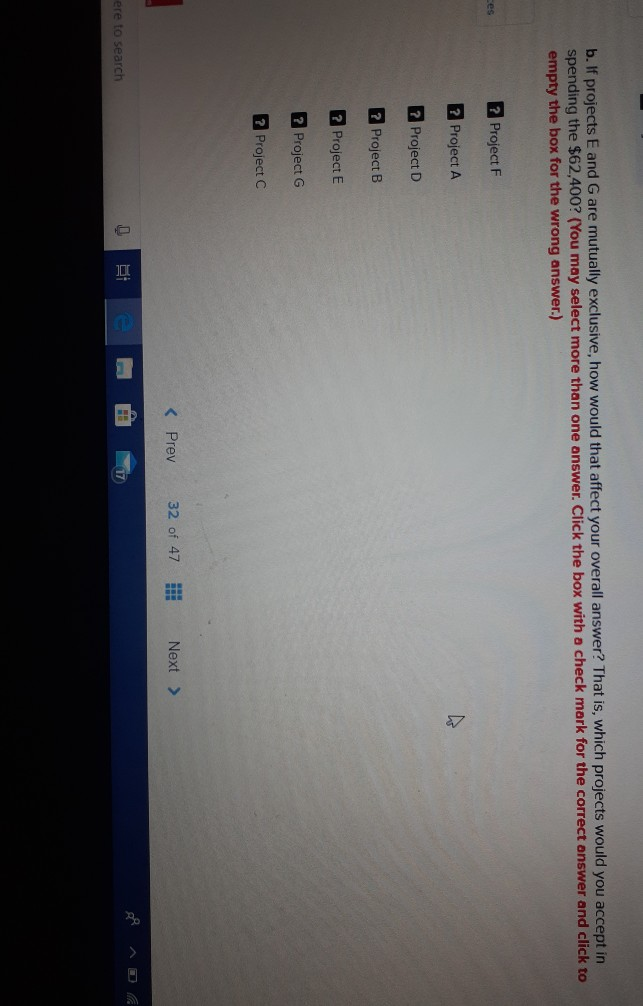

The Suboptimal Glass Company uses a process of capital rationing in its decision making. The firm's cost of capital is 10 percent. It will invest only $62,400 this year. It has determined the IRR for each of the following projects: Internal Rate Project Project Size of Return $10,600 13.0% 30,600 14.0 25,600 17.0 D 19,600 21.0 10,600 22.5 15,600 16.0 15,600 19.0 a. Pick out the projects that the firm should accept. (You may select more than one answer. Click the box with a check mark for the correct answer and click to empty the box for the wrong answer.) Project F 2 Project B 2 Project 2 Project D a. Pick out the projects that the firm should accept (You may select more than one answer. Click the box with a check mark for the correct answer and click to empty the box for the wrong answer.) Project F Project B ? Project G 2 Project D 2 Project E 2 Project A 2 Project C b. If projects E and G are mutually exclusive, how would that affect your overall answer? That is, which projects would you accept in spending the $624002 (You may select more than one answer. Click the box with a check mark for the correct answer and click to empty the box for the wrong answer.) b. If projects E and G are mutually exclusive, how would that affect your overall answer? That is, which projects would you accept in spending the $62,400? (You may select more than one answer. Click the box with a check mark for the correct answer and click to empty the box for the wrong answer.) ces 2 Project F 2 Project A 2 Project D 2 Project B 2 Project E 2 Project G ? Project C ere to search

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started