Answered step by step

Verified Expert Solution

Question

1 Approved Answer

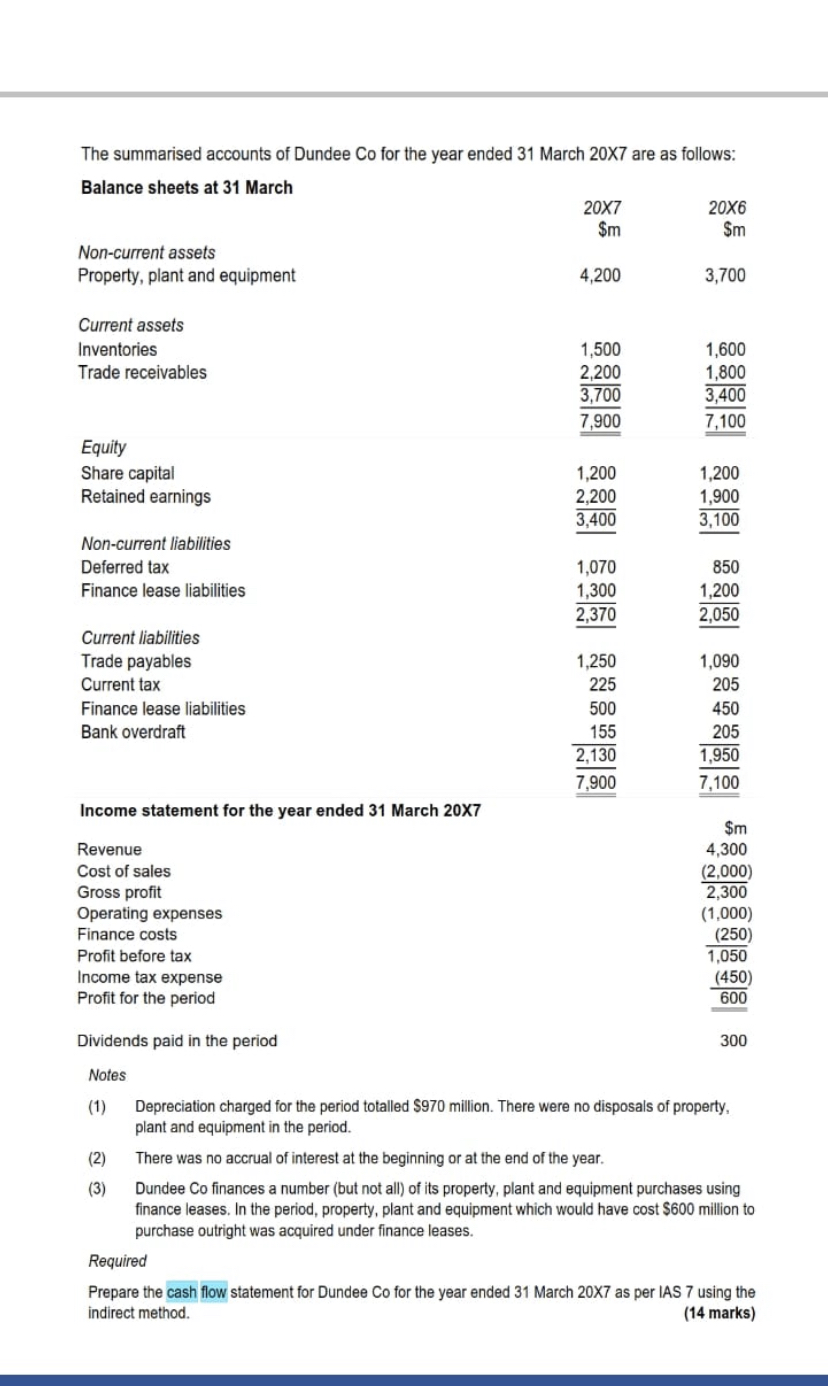

The summarised accounts of Dundee Co for the year ended 31 March 20X7 are as follows: Balance sheets at 31 March Non-current assets Property,

The summarised accounts of Dundee Co for the year ended 31 March 20X7 are as follows: Balance sheets at 31 March Non-current assets Property, plant and equipment 20X7 20X6 $m Sm 4,200 3.700 Current assets Inventories Trade receivables 1,500 1,600 2,200 1,800 3.700 3,400 7,900 7,100 Equity Share capital 1,200 1,200 Retained earnings 2,200 1,900 3,400 3,100 Non-current liabilities Deferred tax 1,070 850 Finance lease liabilities 1,300 1,200 2,370 2,050 Current liabilities Trade payables 1,250 1,090 Current tax 225 205 Finance lease liabilities 500 450 Bank overdraft 155 205 2,130 1,950 7,900 7,100 Income statement for the year ended 31 March 20X7 $m 4,300 Revenue Cost of sales Gross profit Operating expenses Finance costs Profit before tax Income tax expense Profit for the period Dividends paid in the period Notes (2,000) 2,300 (1,000) (250) 1,050 (450) 600 300 (1) Depreciation charged for the period totalled $970 million. There were no disposals of property, plant and equipment in the period. (2) There was no accrual of interest at the beginning or at the end of the year. (3) Dundee Co finances a number (but not all) of its property, plant and equipment purchases using finance leases. In the period, property, plant and equipment which would have cost $600 million to purchase outright was acquired under finance leases. Required Prepare the cash flow statement for Dundee Co for the year ended 31 March 20X7 as per IAS 7 using the indirect method. (14 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To prepare the cash flow statement for Dundee Co for the year ended 31 March 20X7 using the indirect ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started