Answered step by step

Verified Expert Solution

Question

1 Approved Answer

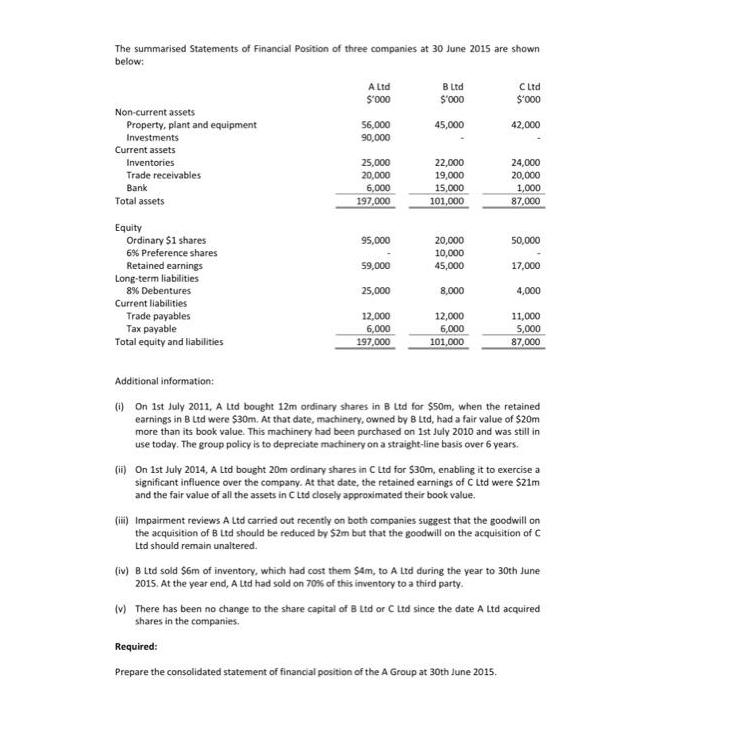

The summarised Statements of Financial Position of three companies at 30 June 2015 are shown below: Non-current assets Property, plant and equipment Investments Current

The summarised Statements of Financial Position of three companies at 30 June 2015 are shown below: Non-current assets Property, plant and equipment Investments Current assets Inventories Trade receivables Bank Total assets Equity Ordinary $1 shares 6% Preference shares Retained earnings Long-term liabilities 8% Debentures Current liabilities Trade payables Tax payable Total equity and liabilities A Ltd $'000 56,000 90,000 25,000 20,000 6,000 197,000 95,000 59,000 25,000 12,000 6,000 197,000 B Ltd $'000 45,000 22,000 19,000 15,000 101,000 20,000 10,000 45,000 8,000 12,000 6,000 101,000 C Ltd $'000 42,000 24,000 20,000 1,000 87,000 50,000 17,000 4,000 Required: Prepare the consolidated statement of financial position of the A Group at 30th June 2015. 11,000 5,000 87,000 Additional information: (i) On 1st July 2011, A Ltd bought 12m ordinary shares in B Ltd for $50m, when the retained earnings in B Ltd were $30m. At that date, machinery, owned by 8 Ltd, had a fair value of $20m more than its book value. This machinery had been purchased on 1st July 2010 and was still in use today. The group policy is to depreciate machinery on a straight-line basis over 6 years. (ii) On 1st July 2014, A Ltd bought 20m ordinary shares in C Ltd for $30m, enabling it to exercise a significant influence over the company. At that date, the retained earnings of C Ltd were $21m and the fair value of all the assets in C Ltd closely approximated their book value. (iii) Impairment reviews A Ltd carried out recently on both companies suggest that the goodwill on the acquisition of B Ltd should be reduced by $2m but that the goodwill on the acquisition of C Ltd should remain unaltered. (iv) B Ltd sold $6m of inventory, which had cost them 54m, to A Ltd during the year to 30th June 2015. At the year end, A Ltd had sold on 70% of this inventory to a third party. (v) There has been no change to the share capital of 8 Ltd or C Ltd since the date A Ltd acquired shares in the companies.

Step by Step Solution

★★★★★

3.44 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

A Group Consolidated Statement of Financial Position as at 30 June 2015 000 Noncurren...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started