Answered step by step

Verified Expert Solution

Question

1 Approved Answer

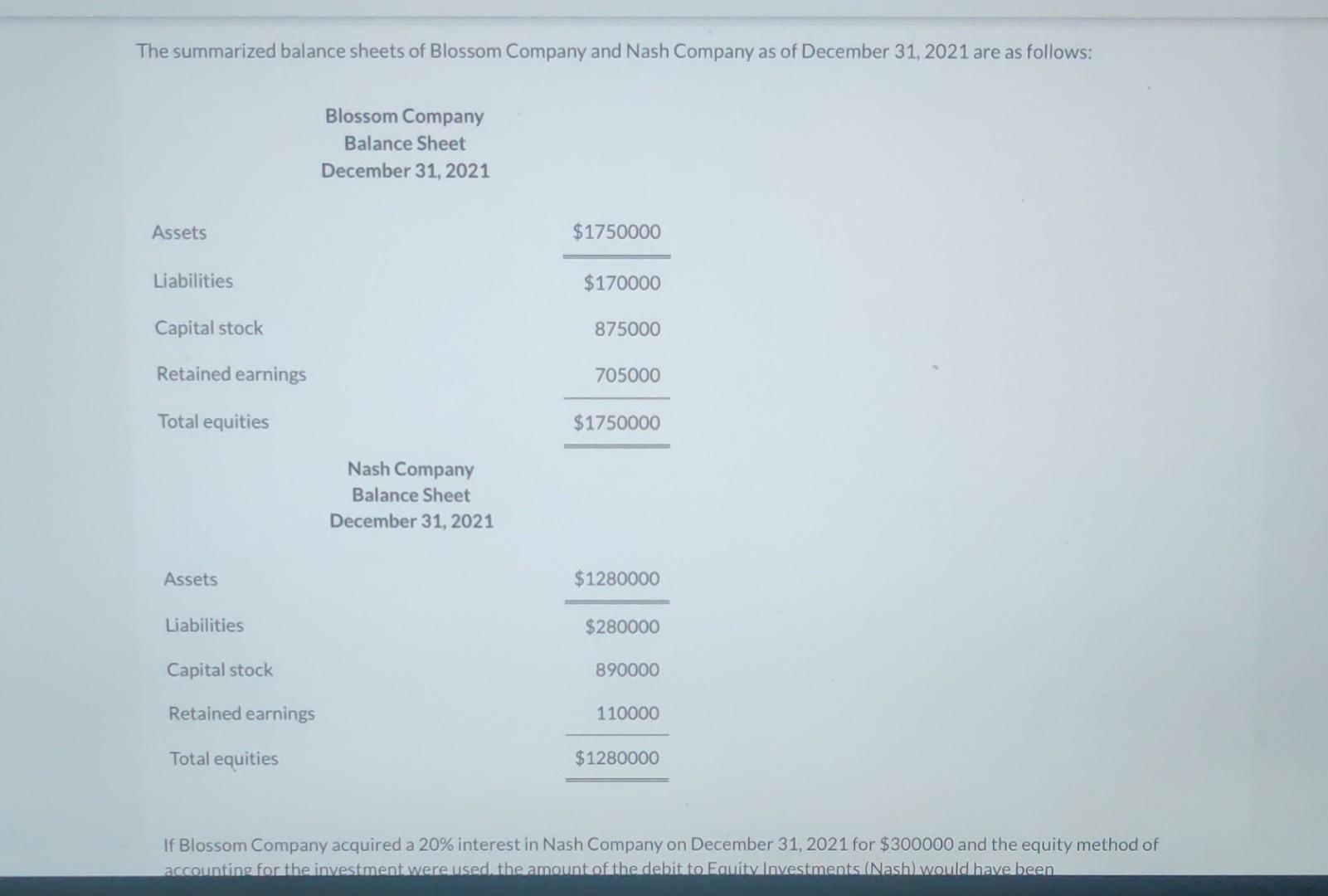

The summarized balance sheets of Blossom Company and Nash Company as of December 31, 2021 are as follows: If Blossom Company acquired a 20% interest

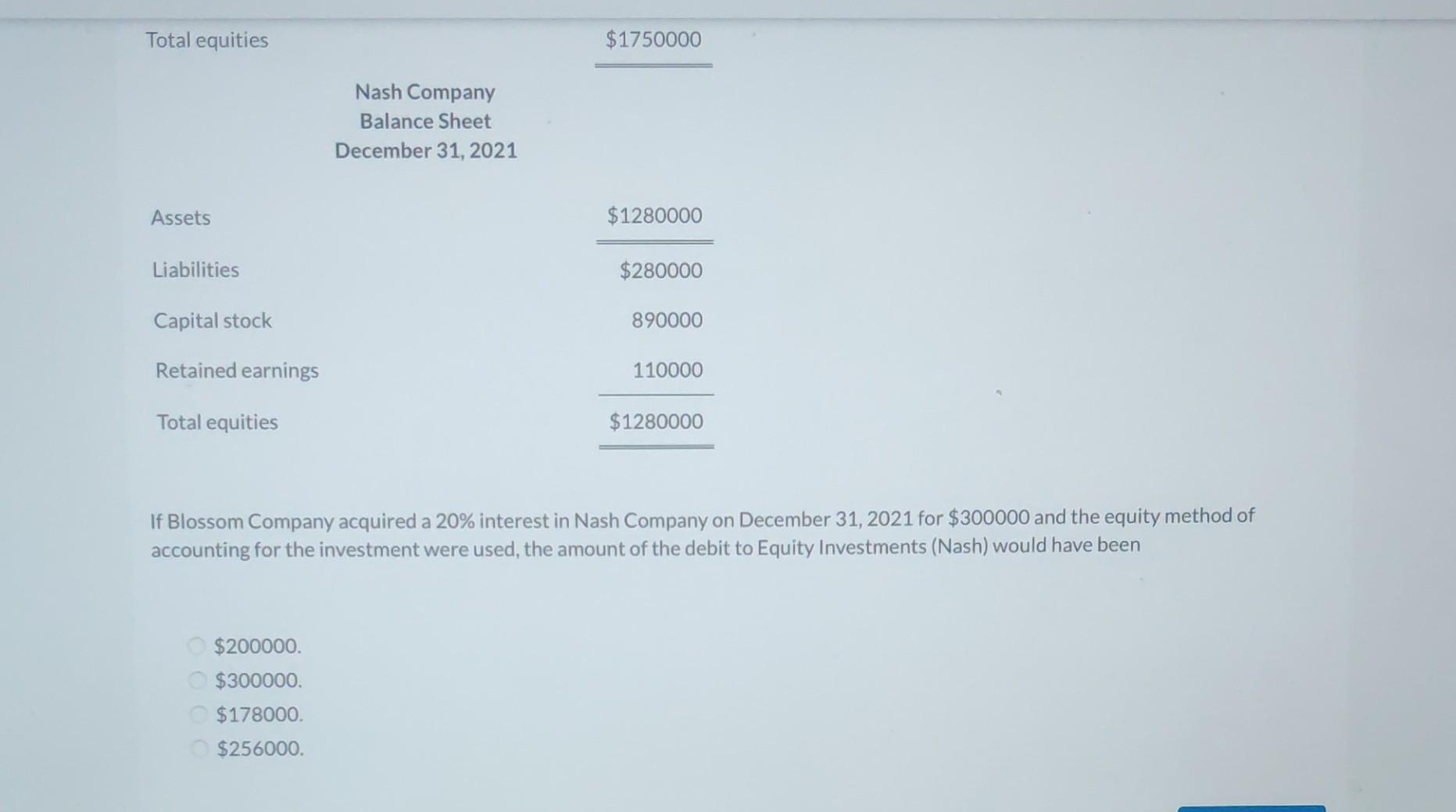

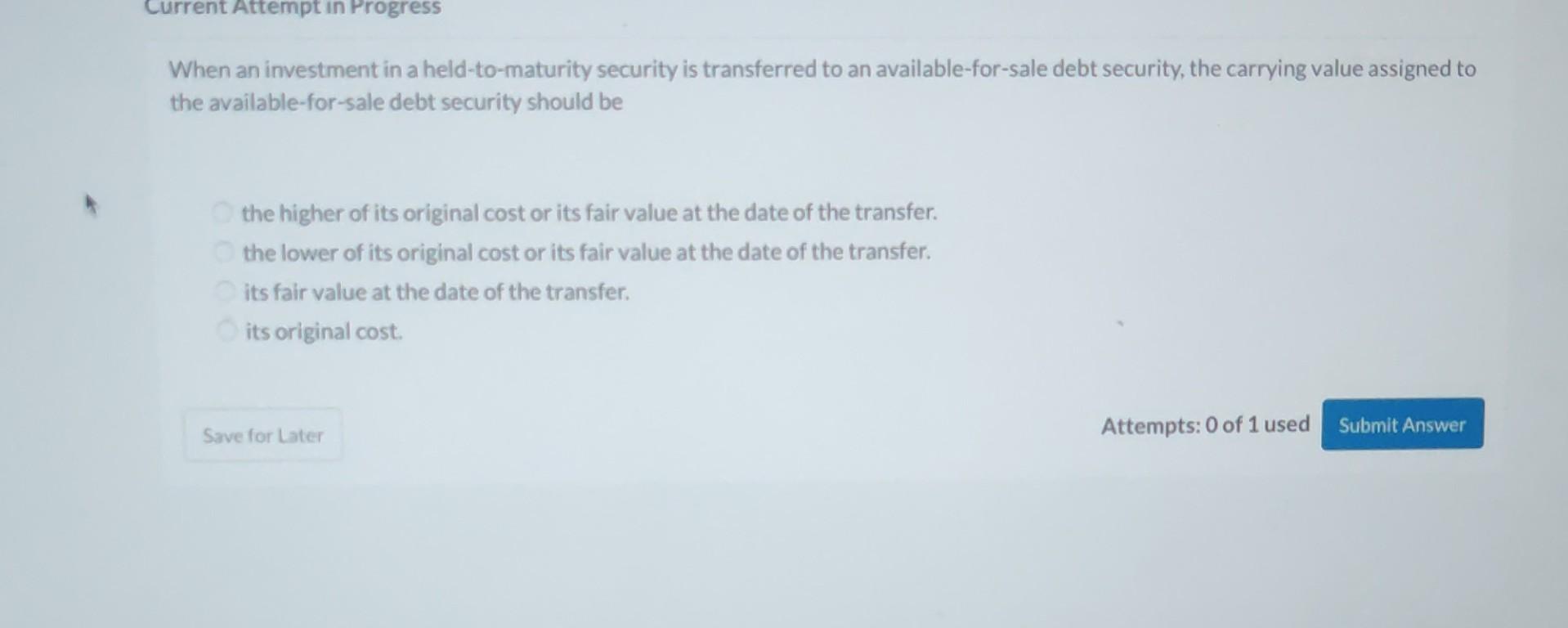

The summarized balance sheets of Blossom Company and Nash Company as of December 31, 2021 are as follows: If Blossom Company acquired a 20\% interest in Nash Company on December 31,2021 for $300000 and the equity method of accounting for the investment were used the amount of the debit to Equitv Investments (Nash) would have been When an investment in a held-to-maturity security is transferred to an available-for-sale debt security, the carrying value assigned to the available-for-sale debt security should be the higher of its original cost or its fair value at the date of the transfer. the lower of its original cost or its fair value at the date of the transfer. its fair value at the date of the transfer. its original cost. If Blossom Company acquired a 20\% interest in Nash Company on December 31, 2021 for $300000 and the equity method of accounting for the investment were used, the amount of the debit to Equity Investments (Nash) would have been $200000. $300000. $178000. $256000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started