Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The Supreme Court in 1 8 9 5 ruled that the income tax was unconstitutional because the tax needed to be apportioned among the states

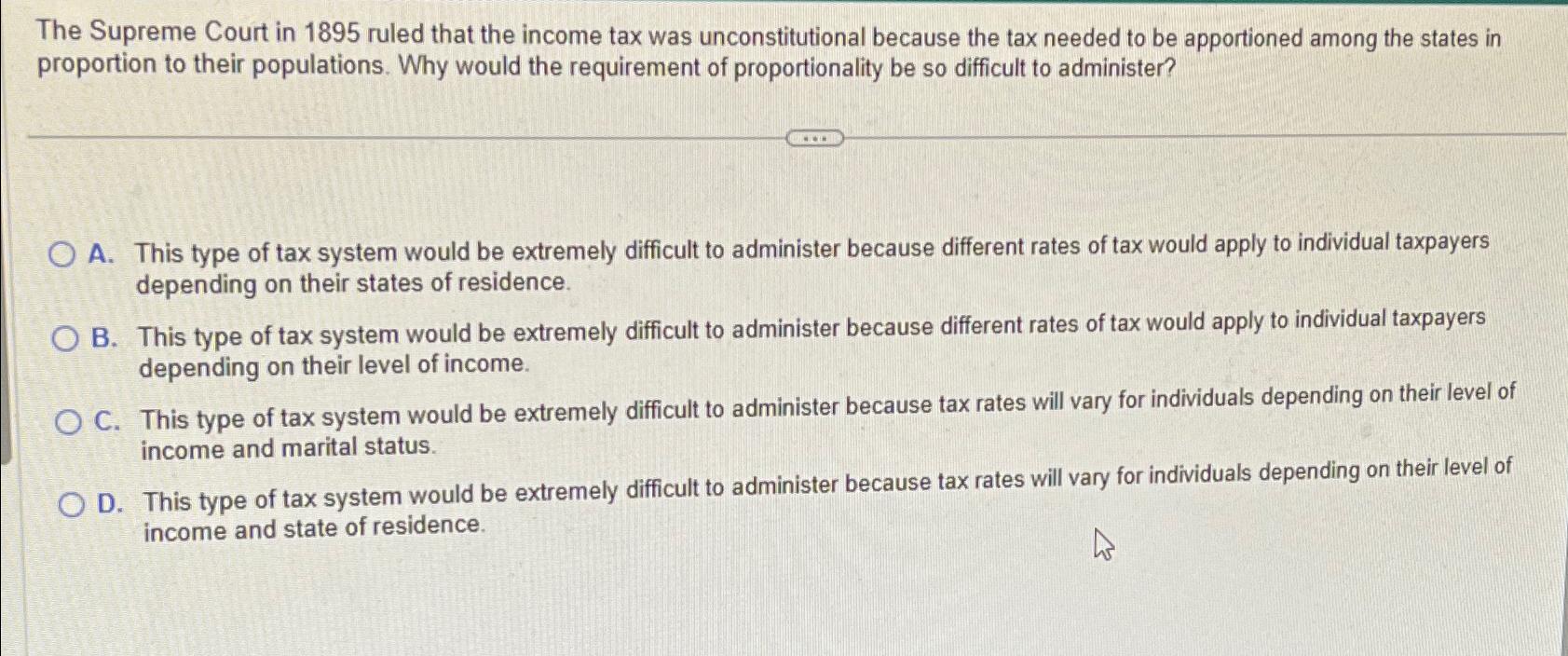

The Supreme Court in ruled that the income tax was unconstitutional because the tax needed to be apportioned among the states in proportion to their populations. Why would the requirement of proportionality be so difficult to administer?

A This type of tax system would be extremely difficult to administer because different rates of tax would apply to individual taxpayers depending on their states of residence.

B This type of tax system would be extremely difficult to administer because different rates of tax would apply to individual taxpayers depending on their level of income.

C This type of tax system would be extremely difficult to administer because tax rates will vary for individuals depending on their level of income and marital status.

D This type of tax system would be extremely difficult to administer because tax rates will vary for individuals depending on their level of income and state of residence.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started