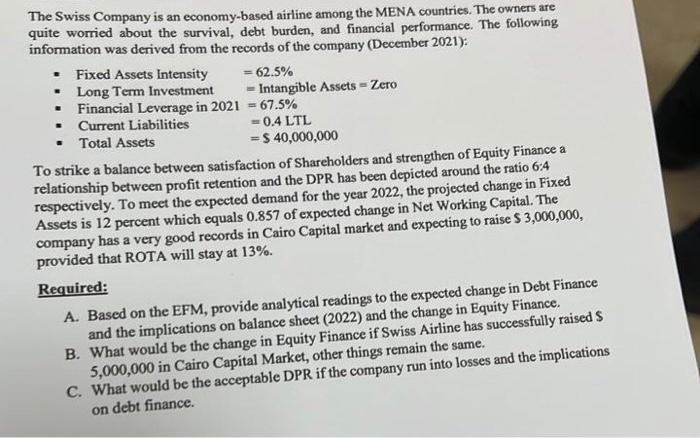

. . . The Swiss Company is an economy-based airline among the MENA countries. The owners are quite worried about the survival, debt burden, and financial performance. The following information was derived from the records of the company (December 2021): Fixed Assets Intensity 62.5% Long Term Investment - Intangible Assets - Zero Financial Leverage in 2021 = 67.5% Current Liabilities -0.4 LTL Total Assets = $ 40,000,000 To strike a balance between satisfaction of Shareholders and strengthen of Equity Finance a relationship between profit retention and the DPR has been depicted around the ratio 6:4 respectively. To meet the expected demand for the year 2022, the projected change in Fixed Assets is 12 percent which equals 0.857 of expected change in Net Working Capital. The company has a very good records in Cairo Capital market and expecting to raise $ 3,000,000, provided that ROTA will stay at 13%. Required: A. Based on the EFM, provide analytical readings to the expected change in Debt Finance and the implications on balance sheet (2022) and the change in Equity Finance. B. What would be the change in Equity Finance if Swiss Airline has successfully raised $ 5,000,000 in Cairo Capital Market, other things remain the same. C. What would be the acceptable DPR if the company run into losses and the implications on debt finance. . . . The Swiss Company is an economy-based airline among the MENA countries. The owners are quite worried about the survival, debt burden, and financial performance. The following information was derived from the records of the company (December 2021): Fixed Assets Intensity 62.5% Long Term Investment - Intangible Assets - Zero Financial Leverage in 2021 = 67.5% Current Liabilities -0.4 LTL Total Assets = $ 40,000,000 To strike a balance between satisfaction of Shareholders and strengthen of Equity Finance a relationship between profit retention and the DPR has been depicted around the ratio 6:4 respectively. To meet the expected demand for the year 2022, the projected change in Fixed Assets is 12 percent which equals 0.857 of expected change in Net Working Capital. The company has a very good records in Cairo Capital market and expecting to raise $ 3,000,000, provided that ROTA will stay at 13%. Required: A. Based on the EFM, provide analytical readings to the expected change in Debt Finance and the implications on balance sheet (2022) and the change in Equity Finance. B. What would be the change in Equity Finance if Swiss Airline has successfully raised $ 5,000,000 in Cairo Capital Market, other things remain the same. C. What would be the acceptable DPR if the company run into losses and the implications on debt finance