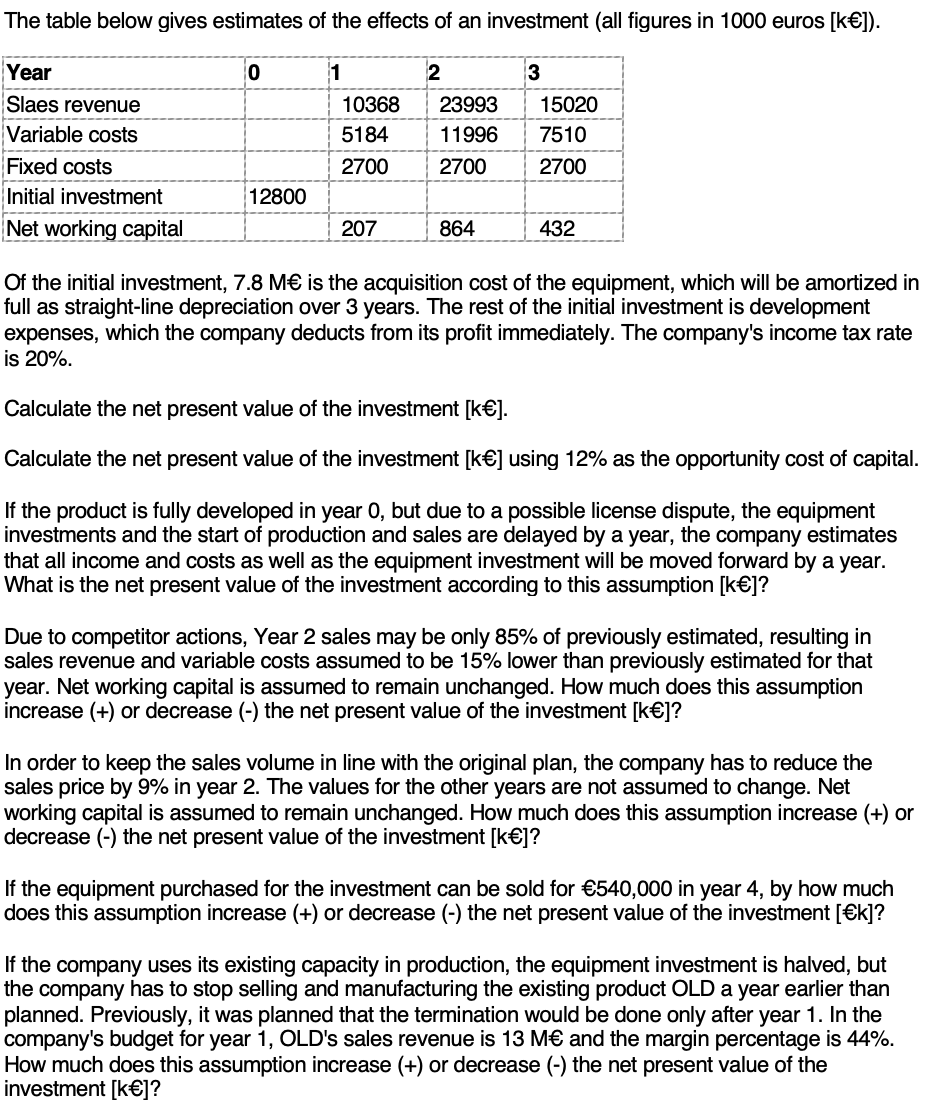

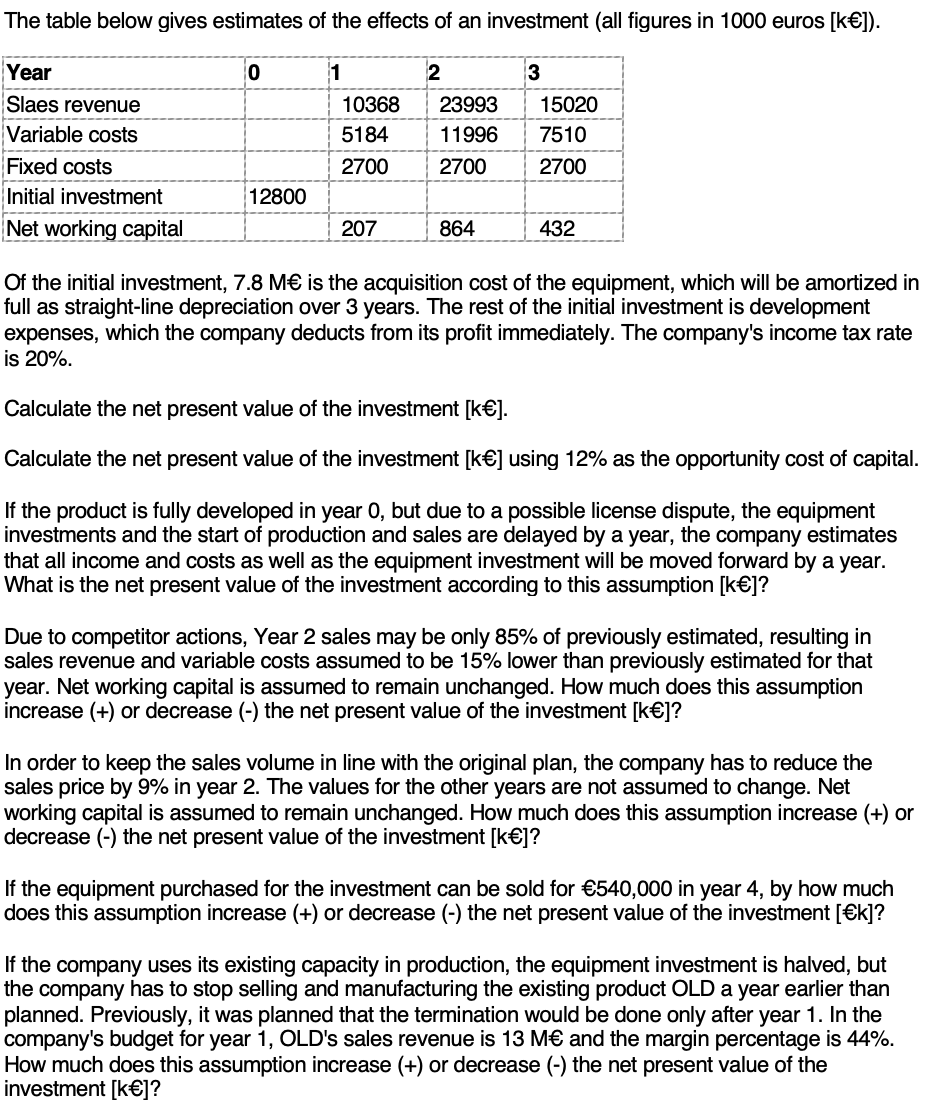

The table below gives estimates of the effects of an investment (all figures in 1000 euros [k]). Of the initial investment, 7.8M is the acquisition cost of the equipment, which will be amortized in full as straight-line depreciation over 3 years. The rest of the initial investment is development expenses, which the company deducts from its profit immediately. The company's income tax rate is 20%. Calculate the net present value of the investment [k]. Calculate the net present value of the investment [ k] using 12% as the opportunity cost of capital. If the product is fully developed in year 0 , but due to a possible license dispute, the equipment investments and the start of production and sales are delayed by a year, the company estimates that all income and costs as well as the equipment investment will be moved forward by a year. What is the net present value of the investment according to this assumption [k]? Due to competitor actions, Year 2 sales may be only 85% of previously estimated, resulting in sales revenue and variable costs assumed to be 15% lower than previously estimated for that year. Net working capital is assumed to remain unchanged. How much does this assumption increase (+) or decrease () the net present value of the investment [k]? In order to keep the sales volume in line with the original plan, the company has to reduce the sales price by 9% in year 2 . The values for the other years are not assumed to change. Net working capital is assumed to remain unchanged. How much does this assumption increase (+) or decrease () the net present value of the investment [k] ? If the equipment purchased for the investment can be sold for 540,000 in year 4, by how much does this assumption increase (+) or decrease () the net present value of the investment [k]? If the company uses its existing capacity in production, the equipment investment is halved, but the company has to stop selling and manufacturing the existing product OLD a year earlier than planned. Previously, it was planned that the termination would be done only after year 1 . In the company's budget for year 1, OLD's sales revenue is 13M and the margin percentage is 44%. How much does this assumption increase (+) or decrease () the net present value of the investment [k]