Question

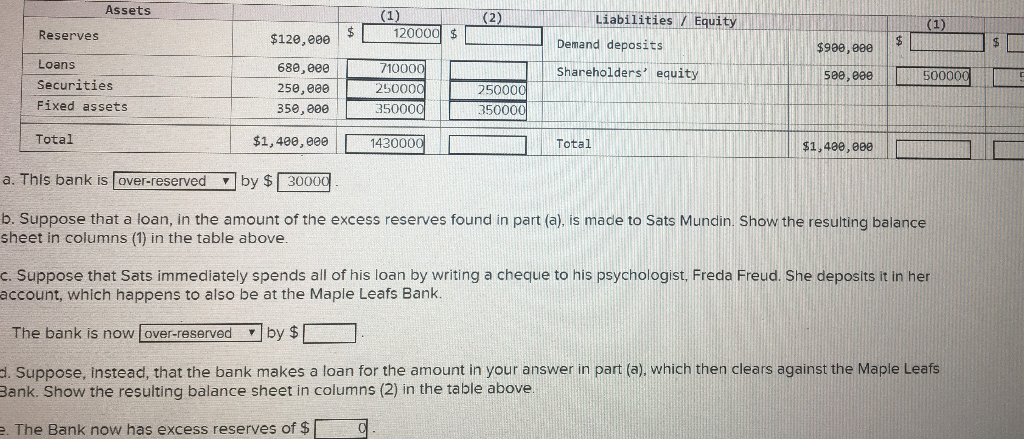

The table below is the current balance sheet for the Maple Leafs Bank. Answer the following questions assuming that the banks target reserve ratio is

The table below is the current balance sheet for the Maple Leafs Bank. Answer the following questions assuming that the banks target reserve ratio is 10%.

C = 27000

Loan (1) (2)= 710000

Reserves(2)= 90000

demand deposits(1)= 930000

For table 1 I need help with , Demand deposits (2)

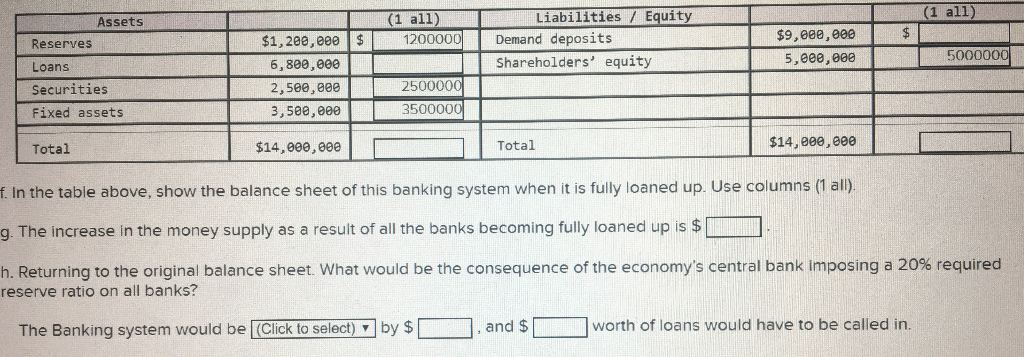

Suppose that there are a total of 9 other banks in the economy and that the balance sheet for the whole banking system is presented in the table below. Assume that each of the other banks also has a target reserve ratio of 10%.

For table 2, I need help with (1 all) ,Loan , demand deposits , f, g ,h.

Thank You.

Assets (1) 120000 $ Liabilities / Equity (2) (1) Reserves $120,e0e Demand deposits $900, 000 Loans 680,0ee 710000 Shareholders' equity s0e, eee 500000 Securities 250000 250,000 25000C Fixed assets 350, 00e 350000 350000 Total $1,400,0ee 1430000 Total $1,400, 00e a. This bank is over-reserved by $ 30000 b. Suppose that a loan, in the amount of the excess reserves found in part (a), sheet in columns (1) in the table above. made to Sats Mundin. Show the resulting balance C. Suppose that Sats immediately spends all of his loan by writing a cheque to his psychologist, Freda Freud. She deposits it in her account, which happens to also be at the Maple Leafs Bank. The bank is now over-reserved by $ d. Suppose, Instead, that the bank makes a loan for the amount in your answer in part (a), which then clears against the Maple Leafs Bank. Show the resulting balance sheet in columns (2) in the table above e. The Bank now has excess reserves of $ (1 all) Liabilities /Equity (1 all) Assets $ $9,ee0,0ee $1,200,eee$ Demand deposits 1200000 Reserves 5000000 5,000,00e Shareholders' equity 6,800,00e Loans 2500000 2,500,eee Securities 3500000 3,500,000 Fixed assets $14,000,eee $14,000,00e Total Total f. In the table above, show the balance sheet of this banking system when it is fully loaned up. Use columns (1 all). g. The increase in the money supply as a result of all the banks becoming fully loaned up is $ h. Returning to the original balance sheet. What would be the consequence of the economy's central bank imposing a 20% required reserve ratio on all banks? worth of loans would have to be called in. and $ by $ The Banking system would be (Click to select) Assets (1) 120000 $ Liabilities / Equity (2) (1) Reserves $120,e0e Demand deposits $900, 000 Loans 680,0ee 710000 Shareholders' equity s0e, eee 500000 Securities 250000 250,000 25000C Fixed assets 350, 00e 350000 350000 Total $1,400,0ee 1430000 Total $1,400, 00e a. This bank is over-reserved by $ 30000 b. Suppose that a loan, in the amount of the excess reserves found in part (a), sheet in columns (1) in the table above. made to Sats Mundin. Show the resulting balance C. Suppose that Sats immediately spends all of his loan by writing a cheque to his psychologist, Freda Freud. She deposits it in her account, which happens to also be at the Maple Leafs Bank. The bank is now over-reserved by $ d. Suppose, Instead, that the bank makes a loan for the amount in your answer in part (a), which then clears against the Maple Leafs Bank. Show the resulting balance sheet in columns (2) in the table above e. The Bank now has excess reserves of $ (1 all) Liabilities /Equity (1 all) Assets $ $9,ee0,0ee $1,200,eee$ Demand deposits 1200000 Reserves 5000000 5,000,00e Shareholders' equity 6,800,00e Loans 2500000 2,500,eee Securities 3500000 3,500,000 Fixed assets $14,000,eee $14,000,00e Total Total f. In the table above, show the balance sheet of this banking system when it is fully loaned up. Use columns (1 all). g. The increase in the money supply as a result of all the banks becoming fully loaned up is $ h. Returning to the original balance sheet. What would be the consequence of the economy's central bank imposing a 20% required reserve ratio on all banks? worth of loans would have to be called in. and $ by $ The Banking system would be (Click to select)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started