Answered step by step

Verified Expert Solution

Question

1 Approved Answer

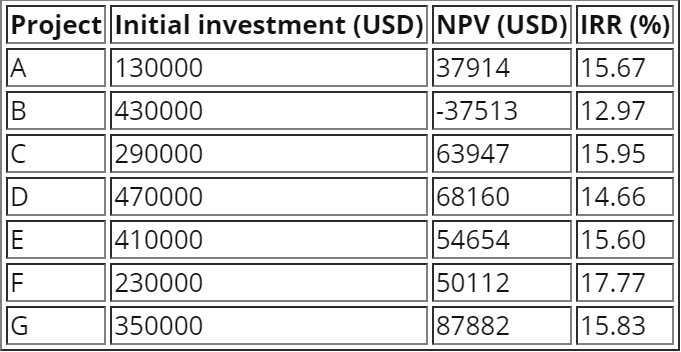

The table below lists the independent projects that your company is considering to invest: The required return is 13.8 percent. If there is an investment

The table below lists the independent projects that your company is considering to invest:

The required return is 13.8 percent. If there is an investment budget ceiling of $1,000,000, what is the total net present value of investment opportunuties missed (the sum of NPVs of the feasible projects that your company couldn't invest) due to budget limit?

Project Initial investment (USD) NPV (USD) IRR (%) 130000 37914 15.67 430000 1-37513 12.97 C 290000 63947 15.95 ID 470000 68160 14.66 E |410000 54654 15.60 IF F 230000 50112 17.77 G 350000 87882 15.83Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started