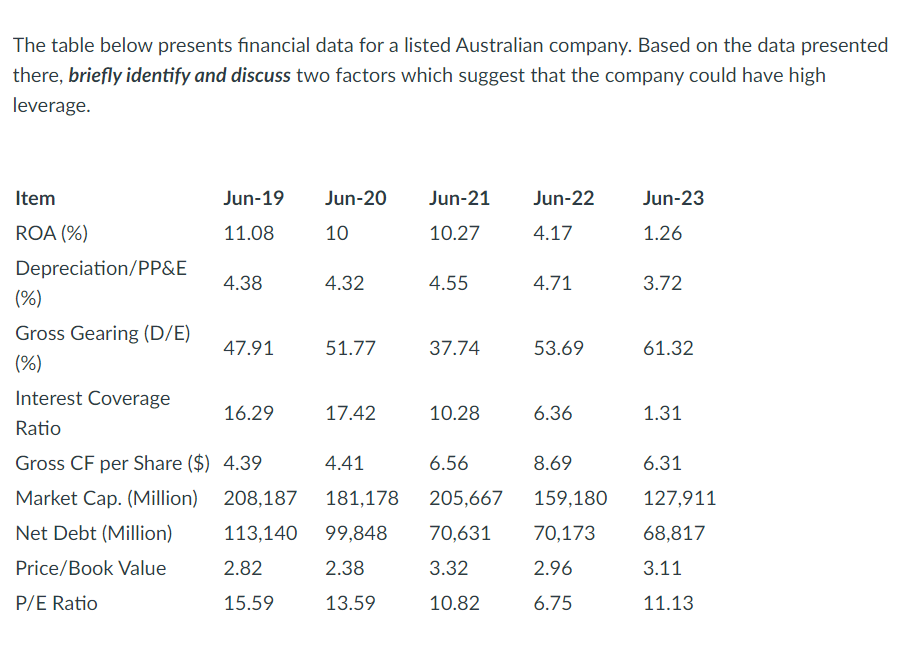

The table below presents financial data for a listed Australian company. Based on the data presented there, briefly identify and discuss two factors which

The table below presents financial data for a listed Australian company. Based on the data presented there, briefly identify and discuss two factors which suggest that the company could have high leverage. Item ROA (%) Depreciation/PP&E (%) Gross Gearing (D/E) (%) Interest Coverage Ratio Jun-19 11.08 4.38 47.91 16.29 Gross CF per Share ($) 4.39 Market Cap. (Million) Net Debt (Million) Price/Book Value P/E Ratio Jun-20 Jun-21 10 10.27 2.82 15.59 4.32 51.77 17.42 4.55 37.74 10.28 4.41 6.56 208,187 181,178 205,667 113,140 99,848 70,631 2.38 3.32 13.59 10.82 Jun-22 4.17 4.71 53.69 6.36 8.69 159,180 70,173 2.96 6.75 Jun-23 1.26 3.72 61.32 1.31 6.31 127,911 68,817 3.11 11.13

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Based on the provided financial data two factors that suggest the company could have high leverage a...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started