Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The capital structure of BlueScope Steel (BSC) is 90% equity and 10% debt. BSC's return on equity and before-tax return on debt are Re

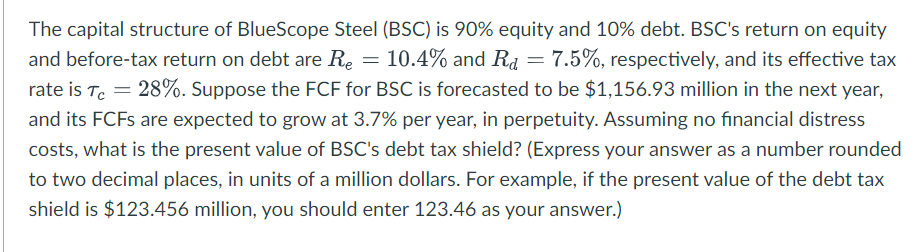

The capital structure of BlueScope Steel (BSC) is 90% equity and 10% debt. BSC's return on equity and before-tax return on debt are Re 10.4% and Rd = 7.5%, respectively, and its effective tax rate is Tc = 28%. Suppose the FCF for BSC is forecasted to be $1,156.93 million in the next year, and its FCFs are expected to grow at 3.7% per year, in perpetuity. Assuming no financial distress costs, what is the present value of BSC's debt tax shield? (Express your answer as a number rounded to two decimal places, in units of a million dollars. For example, if the present value of the debt tax shield is $123.456 million, you should enter 123.46 as your answer.)

Step by Step Solution

★★★★★

3.38 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

The present value of the debt tax shield can be calculated using the formula PVDTS T Rd D Where PVDT...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started