Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The table below provides information to forecast the income statement and the cash flows of Easy-T Inc. for the years 2020 to 2024. Use this

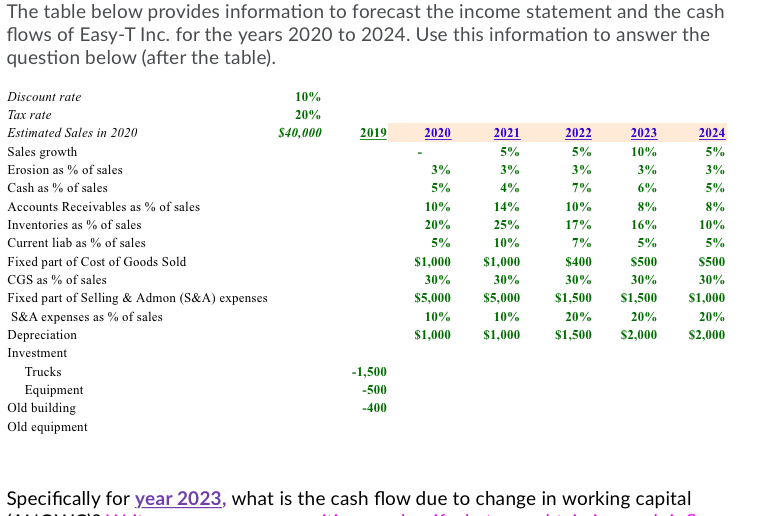

The table below provides information to forecast the income statement and the cash flows of Easy-T Inc. for the years 2020 to 2024. Use this information to answer the question below (after the table).

The table below provides information to forecast the income statement and the cash flows of Easy-T Inc. for the years 2020 to 2024. Use this information to answer the question below (after the table).

| Discount rate | 10% | ||||||

| Tax rate | 20% | ||||||

| Estimated Sales in 2020 | $40,000 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 |

| Sales growth | - | 5% | 5% | 10% | 5% | ||

| Erosion as % of sales | 3% | 3% | 3% | 3% | 3% | ||

| Cash as % of sales | 5% | 4% | 7% | 6% | 5% | ||

| Accounts Receivables as % of sales | 10% | 14% | 10% | 8% | 8% | ||

| Inventories as % of sales | 20% | 25% | 17% | 16% | 10% | ||

| Current liab as % of sales | 5% | 10% | 7% | 5% | 5% | ||

| Fixed part of Cost of Goods Sold | $1,000 | $1,000 | $400 | $500 | $500 | ||

| CGS as % of sales | 30% | 30% | 30% | 30% | 30% | ||

| Fixed part of Selling & Admon (S&A) expenses | $5,000 | $5,000 | $1,500 | $1,500 | $1,000 | ||

| S&A expenses as % of sales | 10% | 10% | 20% | 20% | 20% | ||

| Depreciation | $1,000 | $1,000 | $1,500 | $2,000 | $2,000 | ||

| Investment | |||||||

| Trucks | -1,500 | ||||||

| Equipment | -500 | ||||||

| Old building | -400 | ||||||

| Old equipment | |||||||

Specifically for year 2023, what is the cash flow due to change in working capital (NOWC)?

The table below provides information to forecast the income statement and the cash flows of Easy-T Inc. for the years 2020 to 2024. Use this information to answer the question below (after the table). 10% 20% $40,000 2019 2020 2022 2024 5% 5% 3% 3% 3% 2023 10% 3% 6% 8% 16% 5% 5% 10% 8% 10% 20% 5% Discount rate Tax rate Estimated Sales in 2020 Sales growth Erosion as % of sales Cash as % of sales Accounts Receivables as % of sales Inventories as % of sales Current liab as % of sales Fixed part of Cost of Goods Sold CGS as % of sales Fixed part of Selling & Admon (S&A) expenses S&A expenses as % of sales Depreciation Investment Trucks Equipment Old building Old equipment 2021 5% 3% 4% 14% 25% 10% $1,000 30% $5,000 10% $1,000 5% 5% $1,000 30% $5,000 10% $1,000 7% 10% 17% 7% $400 30% $1,500 20% $1,500 $500 30% $1,500 20% $500 30% $1,000 20% $2,000 -1,500 -500 -400 Specifically for year 2023, what is the cash flow due to change in working capitalStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started