Answered step by step

Verified Expert Solution

Question

1 Approved Answer

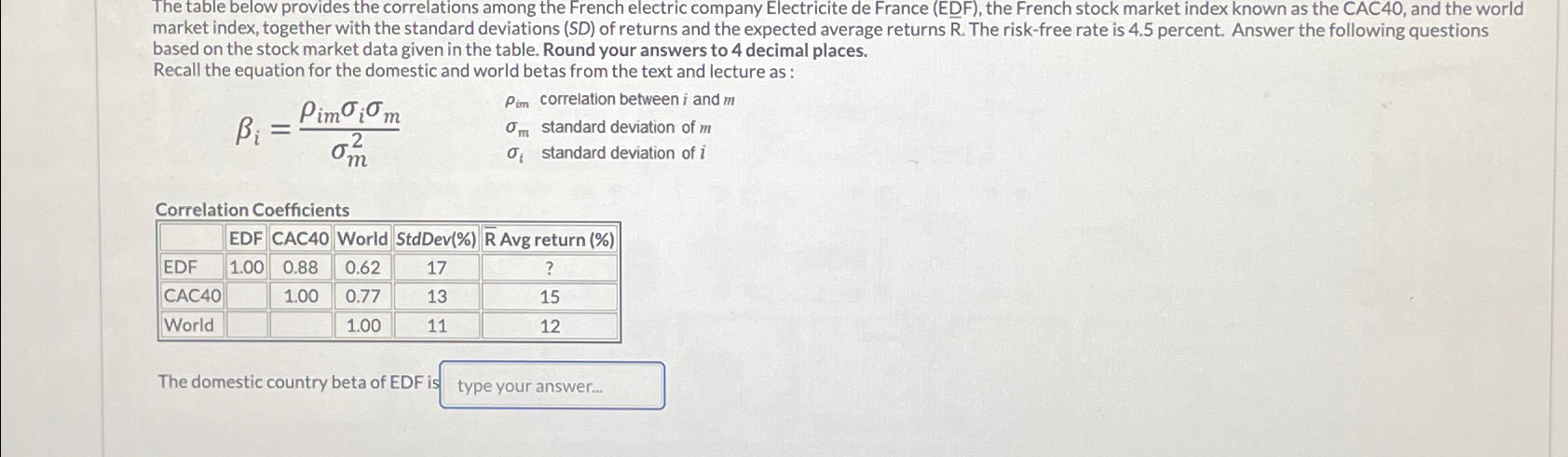

The table below provides the correlations among the French electric company Electricite de France ( EDF ) , the French stock market index known as

The table below provides the correlations among the French electric company Electricite de France EDF the French stock market index known as the CAC and the world market index, together with the standard deviations SD of returns and the expected average returns The riskfree rate is percent. Answer the following questions based on the stock market data given in the table. Round your answers to decimal places. Recall the equation for the domestic and world betas from the text and lecture as: Correlation Coefficients tableEDF,CACWorld,StdDevR Avg return EDF

The table below provides the correlations among the French electric company Electricite de France EDF the French stock market index known as the CAC and the world market index, together with the standard deviations SD of returns and the expected average returns The riskfree rate is percent. Answer the following questions based on the stock market data given in the table. Round your answers to decimal places.

Recall the equation for the domestic and world betas from the text and lecture as:

Correlation Coefficients

tableEDF,CACWorld,StdDevR Avg return EDF

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access with AI-Powered Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started