Question

The table below sets out the monthly total return, market capitalization, and research spending for ten firms over the four months from January 2020 to

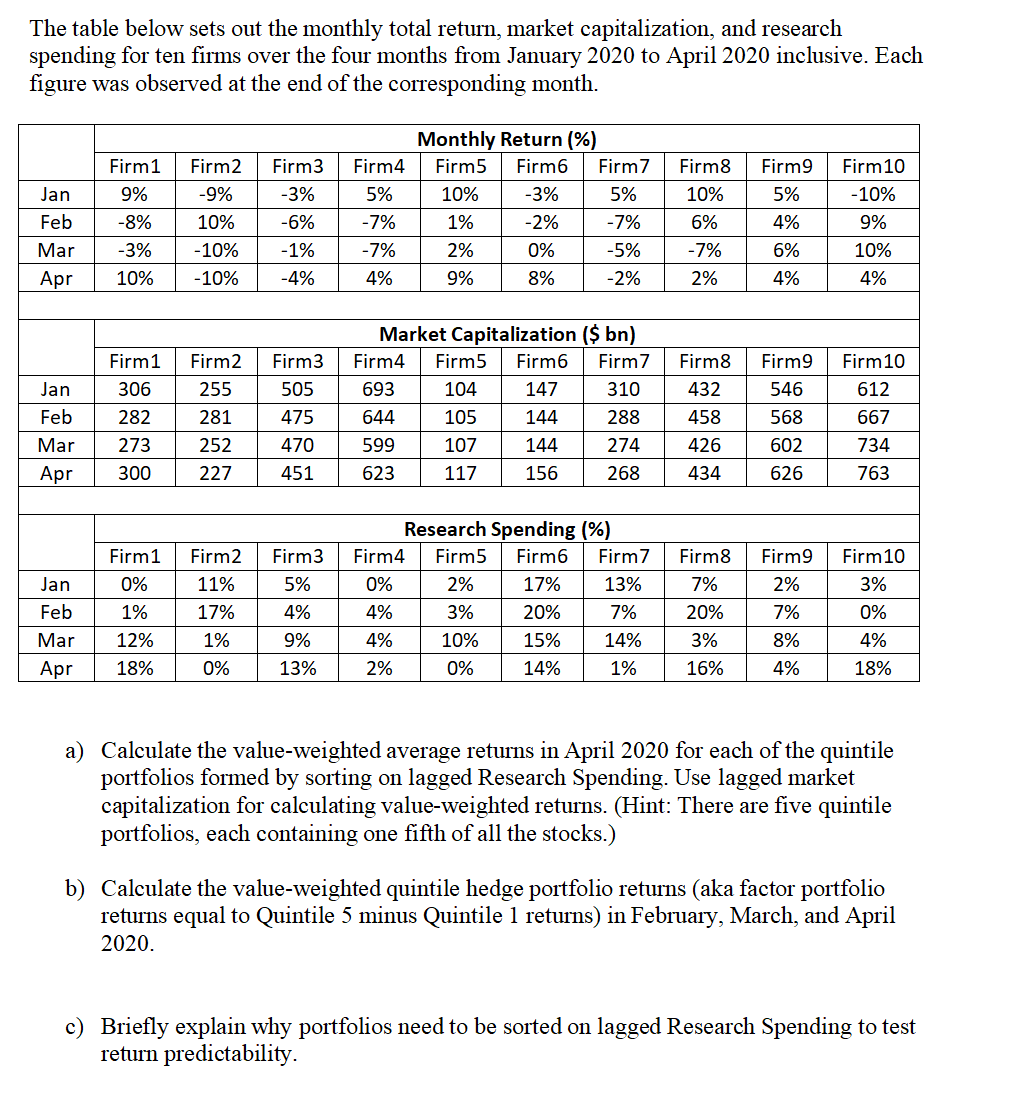

The table below sets out the monthly total return, market capitalization, and research spending for ten firms over the four months from January 2020 to April 2020 inclusive. Each figure was observed at the end of the corresponding month.

| Monthly Return (%) | ||||||||||

| Firm1 | Firm2 | Firm3 | Firm4 | Firm5 | Firm6 | Firm7 | Firm8 | Firm9 | Firm10 | |

| Jan | 9% | -9% | -3% | 5% | 10% | -3% | 5% | 10% | 5% | -10% |

| Feb | -8% | 10% | -6% | -7% | 1% | -2% | -7% | 6% | 4% | 9% |

| Mar | -3% | -10% | -1% | -7% | 2% | 0% | -5% | -7% | 6% | 10% |

| Apr | 10% | -10% | -4% | 4% | 9% | 8% | -2% | 2% | 4% | 4% |

| Market Capitalization ($ bn) | ||||||||||

| Firm1 | Firm2 | Firm3 | Firm4 | Firm5 | Firm6 | Firm7 | Firm8 | Firm9 | Firm10 | |

| Jan | 306 | 255 | 505 | 693 | 104 | 147 | 310 | 432 | 546 | 612 |

| Feb | 282 | 281 | 475 | 644 | 105 | 144 | 288 | 458 | 568 | 667 |

| Mar | 273 | 252 | 470 | 599 | 107 | 144 | 274 | 426 | 602 | 734 |

| Apr | 300 | 227 | 451 | 623 | 117 | 156 | 268 | 434 | 626 | 763 |

| Research Spending (%) | ||||||||||

| Firm1 | Firm2 | Firm3 | Firm4 | Firm5 | Firm6 | Firm7 | Firm8 | Firm9 | Firm10 | |

| Jan | 0% | 11% | 5% | 0% | 2% | 17% | 13% | 7% | 2% | 3% |

| Feb | 1% | 17% | 4% | 4% | 3% | 20% | 7% | 20% | 7% | 0% |

| Mar | 12% | 1% | 9% | 4% | 10% | 15% | 14% | 3% | 8% | 4% |

| Apr | 18% | 0% | 13% | 2% | 0% | 14% | 1% | 16% | 4% | 18% |

- Calculate the value-weighted average returns in April 2020 for each of the quintile portfolios formed by sorting on lagged Research Spending. Use lagged market capitalization for calculating value-weighted returns. (Hint: There are five quintile portfolios, each containing one fifth of all the stocks.)

- Calculate the value-weighted quintile hedge portfolio returns (aka factor portfolio returns equal to Quintile 5 minus Quintile 1 returns) in February, March, and April 2020.

- Briefly explain why portfolios need to be sorted on lagged Research Spending to test return predictability.

(Plz use excel if possible! )

ATTACHMENT:

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started