Answered step by step

Verified Expert Solution

Question

1 Approved Answer

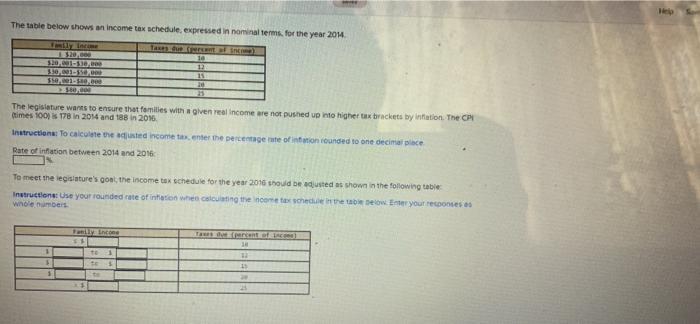

The table below shows an income tax schedule, expressed in nominal terms, for the year 2014 Taxes due (percent of income) 14 12 25

The table below shows an income tax schedule, expressed in nominal terms, for the year 2014 Taxes due (percent of income) 14 12 25 20 Featly Income $20,000 $20,001-536,000 330,001-550,000 $50,001-140,000 $40,000 The legislature wants to ensure that families with a given real income are not pushed up into higher tax brackets by inflation. The CPI (times 100) is 178 in 2014 and 188 in 2016. Instructions: To calculate the adjusted income tax, enter the percentage rate of inflation rounded to one decimal place Rate of inflation between 2014 and 2016 To meet the legislature's goal, the income tax schedule for the year 2016 should be adjusted as shown in the following table Instructions: Use your rounded rate of inflation when calculating the income tax schedule in the table below. Enter your responses es whole numbers. Family Income to 1 to $ Tases due (percent of ince] 18 12 45 W 25 Help

Step by Step Solution

★★★★★

3.45 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

Ansuleri Inflation Inflation between two years can be calculated as follows Inf...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started