Answered step by step

Verified Expert Solution

Question

1 Approved Answer

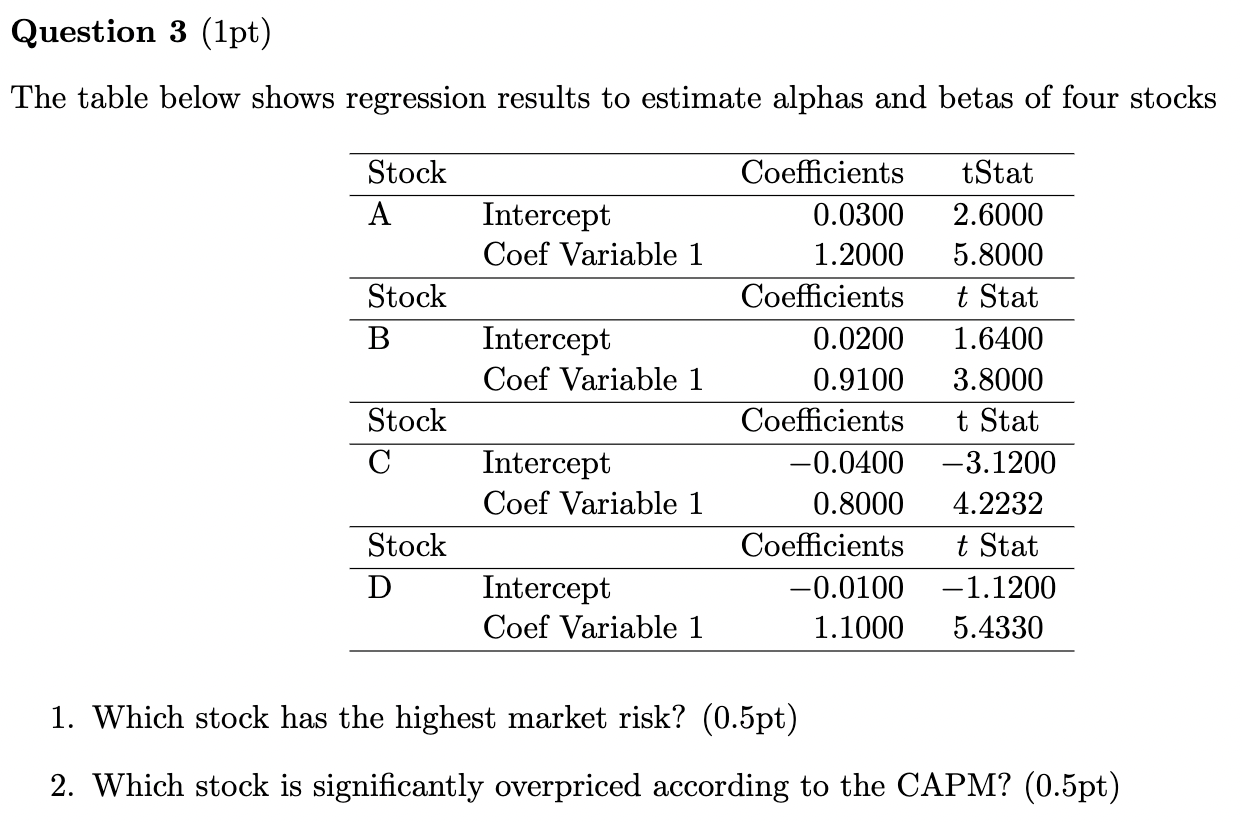

The table below shows regression results to estimate alphas and betas of four stocks 1. Which stock has the highest market risk? (0.5pt) 2. Which

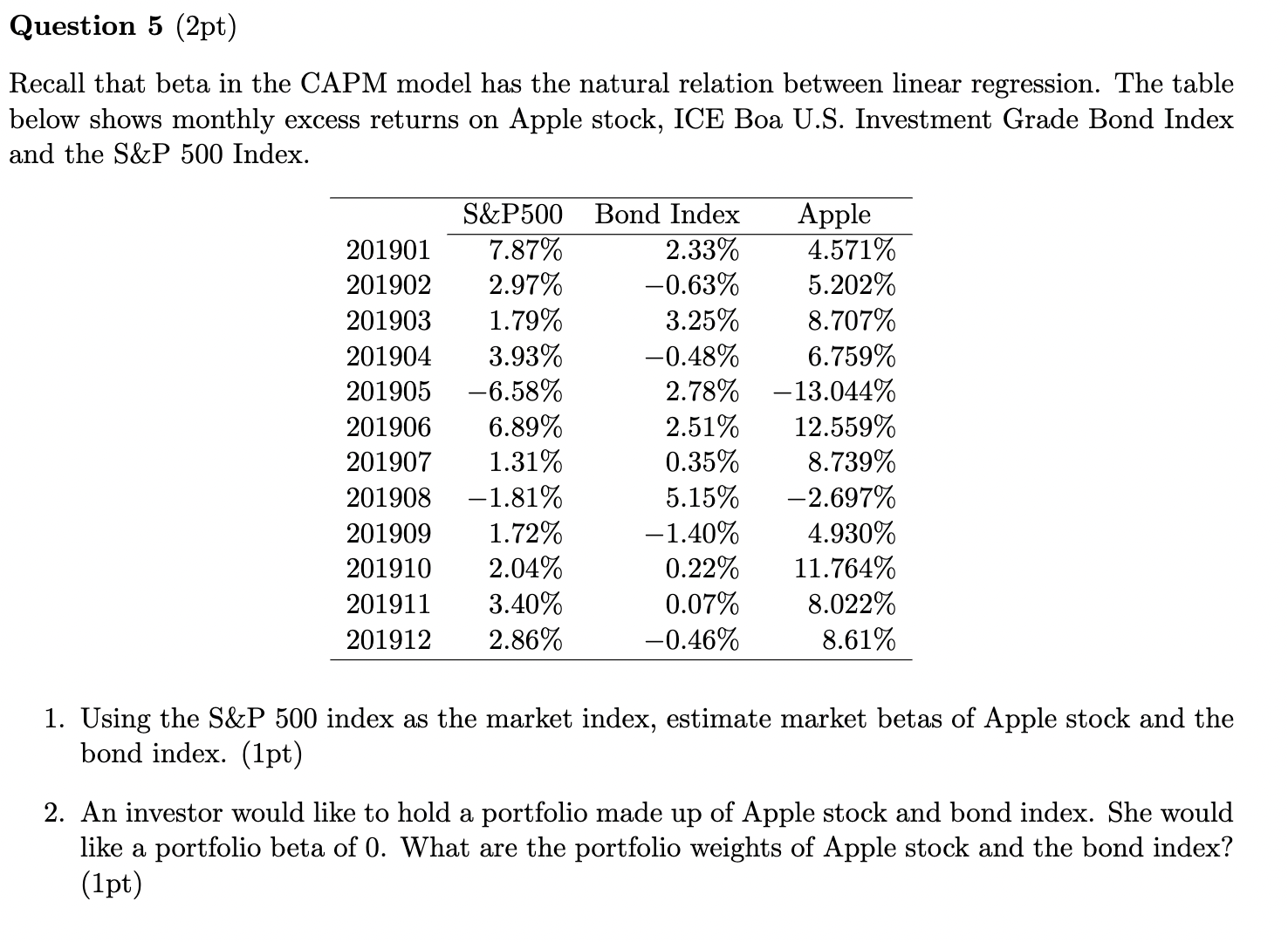

The table below shows regression results to estimate alphas and betas of four stocks 1. Which stock has the highest market risk? (0.5pt) 2. Which stock is significantly overpriced according to the CAPM? (0.5pt) Which of the following is not an assumption of the CAPM? (A) Investors will form the same expectations about the average returns, variances and covariance of financial assets. (B) Returns on financial assets can be described by two parameters, expected value and standard deviation. (C) There are bid-ask spreads when trading financial securities. (D) Capital gains and incomes from investments are not taxable. Recall that beta in the CAPM model has the natural relation between linear regression. The table below shows monthly excess returns on Apple stock, ICE Boa U.S. Investment Grade Bond Index and the S\&P 500 Index. 1. Using the S\&P 500 index as the market index, estimate market betas of Apple stock and the bond index. (1pt) 2. An investor would like to hold a portfolio made up of Apple stock and bond index. She would like a portfolio beta of 0 . What are the portfolio weights of Apple stock and the bond index? (1pt)

The table below shows regression results to estimate alphas and betas of four stocks 1. Which stock has the highest market risk? (0.5pt) 2. Which stock is significantly overpriced according to the CAPM? (0.5pt) Which of the following is not an assumption of the CAPM? (A) Investors will form the same expectations about the average returns, variances and covariance of financial assets. (B) Returns on financial assets can be described by two parameters, expected value and standard deviation. (C) There are bid-ask spreads when trading financial securities. (D) Capital gains and incomes from investments are not taxable. Recall that beta in the CAPM model has the natural relation between linear regression. The table below shows monthly excess returns on Apple stock, ICE Boa U.S. Investment Grade Bond Index and the S\&P 500 Index. 1. Using the S\&P 500 index as the market index, estimate market betas of Apple stock and the bond index. (1pt) 2. An investor would like to hold a portfolio made up of Apple stock and bond index. She would like a portfolio beta of 0 . What are the portfolio weights of Apple stock and the bond index? (1pt) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started