Question: The table below shows the different tax-rates that are applied to each level of income. We need to ensure the correct tax-rate is applied based

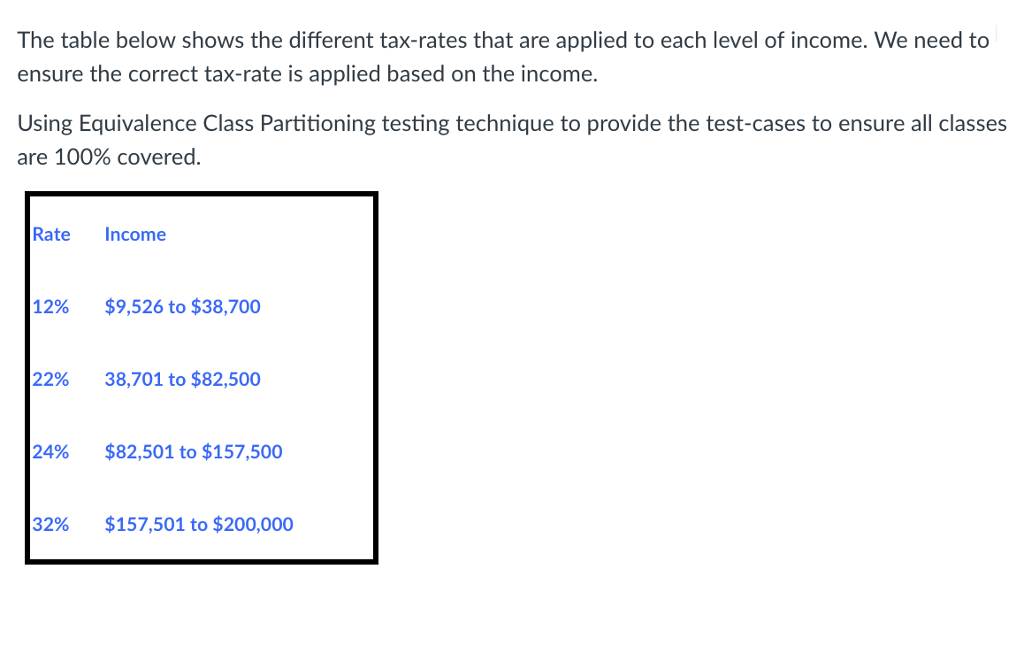

The table below shows the different tax-rates that are applied to each level of income. We need to ensure the correct tax-rate is applied based on the income. Using Equivalence Class Partitioning testing technique to provide the test-cases to ensure all classes are 100% covered. Rate Income 12% $9,526 to $38,700 22% 38,701 to $82,500 24% $82,501 to $157,500 32% $157,501 to $200,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts