Question

The table below shows the minimum lease payment contractual maturities pertaining to Lassonde's operating leases: Suppose that the company's shareholders require a 9% rate of

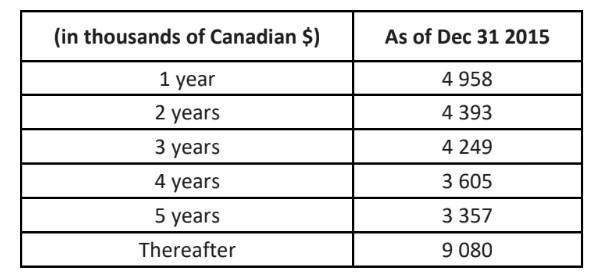

The table below shows the minimum lease payment contractual maturities pertaining to Lassonde's operating leases:

Suppose that the company's shareholders require a 9% rate of return, while the company's bondholders require a 6% rate of return. If you convert Lassonde's operating leases into capital leases:

a) What would be the amount of the additional total debt added to the balance sheet at the end of 2015? Show your calculations. b) What would be the additional amount of current portion of long term debt(CPLTD) added to the balance sheet at the end of 2015? Show yourcalculations. c) What would be Lassonde's current ratio following the conversion of the contracts? Show your calculations.

\begin{tabular}{|c|c|} \hline (in thousands of Canadian \$) & As of Dec 312015 \\ \hline 1 year & 4958 \\ \hline 2 years & 4393 \\ \hline 3 years & 4249 \\ \hline 4 years & 3605 \\ \hline 5 years & 3357 \\ \hline Thereafter & 9080 \\ \hline \end{tabular} \begin{tabular}{|c|c|} \hline (in thousands of Canadian \$) & As of Dec 312015 \\ \hline 1 year & 4958 \\ \hline 2 years & 4393 \\ \hline 3 years & 4249 \\ \hline 4 years & 3605 \\ \hline 5 years & 3357 \\ \hline Thereafter & 9080 \\ \hline \end{tabular}Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started