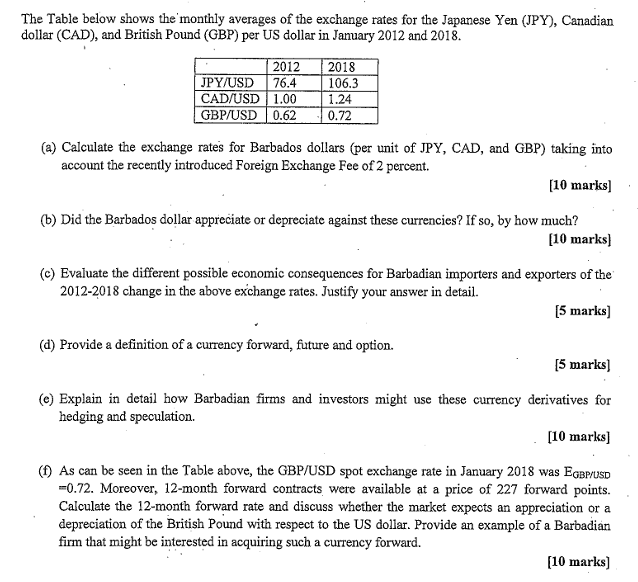

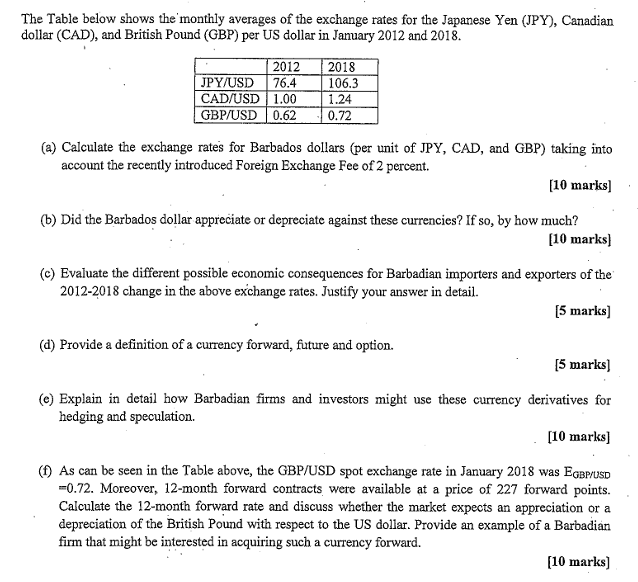

The Table below shows the monthly averages of the exchange rates for the Japanese Yen (JPY), Canadian dollar (CAD), and British Pound (GBP) per US dollar in January 2012 and 2018. 2012 JPY/USD 76.4 CAD/USD 1.00 GBP/USD 0.62 2018 106.3 1.24 0.72 (a) Calculate the exchange rates for Barbados dollars (per unit of JPY, CAD, and GBP) taking into account the recently introduced Foreign Exchange Fee of 2 percent. [10 marks) (6) Did the Barbados dollar appreciate or depreciate against these currencies? If so, by how much? [10 marks) (c) Evaluate the different possible economic consequences for Barbadian importers and exporters of the 2012-2018 change in the above exchange rates. Justify your answer in detail. (5 marks) (d) Provide a definition of a currency forward, future and option. [5 marks) (2) Explain in detail how Barbadian firms and investors might use these currency derivatives for hedging and speculation. [10 marks) (1) As can be seen in the Table above, the GBP/USD spot exchange rate in January 2018 was EGBP/USD =0.72. Moreover, 12-month forward contracts were available at a price of 227 forward points. Calculate the 12-month forward rate and discuss whether the market expects an appreciation or a depreciation of the British Pound with respect to the US dollar. Provide an example of a Barbadian firm that might be interested in acquiring such a currency forward. (10 marks) The Table below shows the monthly averages of the exchange rates for the Japanese Yen (JPY), Canadian dollar (CAD), and British Pound (GBP) per US dollar in January 2012 and 2018. 2012 JPY/USD 76.4 CAD/USD 1.00 GBP/USD 0.62 2018 106.3 1.24 0.72 (a) Calculate the exchange rates for Barbados dollars (per unit of JPY, CAD, and GBP) taking into account the recently introduced Foreign Exchange Fee of 2 percent. [10 marks) (6) Did the Barbados dollar appreciate or depreciate against these currencies? If so, by how much? [10 marks) (c) Evaluate the different possible economic consequences for Barbadian importers and exporters of the 2012-2018 change in the above exchange rates. Justify your answer in detail. (5 marks) (d) Provide a definition of a currency forward, future and option. [5 marks) (2) Explain in detail how Barbadian firms and investors might use these currency derivatives for hedging and speculation. [10 marks) (1) As can be seen in the Table above, the GBP/USD spot exchange rate in January 2018 was EGBP/USD =0.72. Moreover, 12-month forward contracts were available at a price of 227 forward points. Calculate the 12-month forward rate and discuss whether the market expects an appreciation or a depreciation of the British Pound with respect to the US dollar. Provide an example of a Barbadian firm that might be interested in acquiring such a currency forward. (10 marks)