Question

The table below shows the prices of call and puts at different strike prices of options on Alphabet Inc. (GOOG) on 12th February, 2021. The

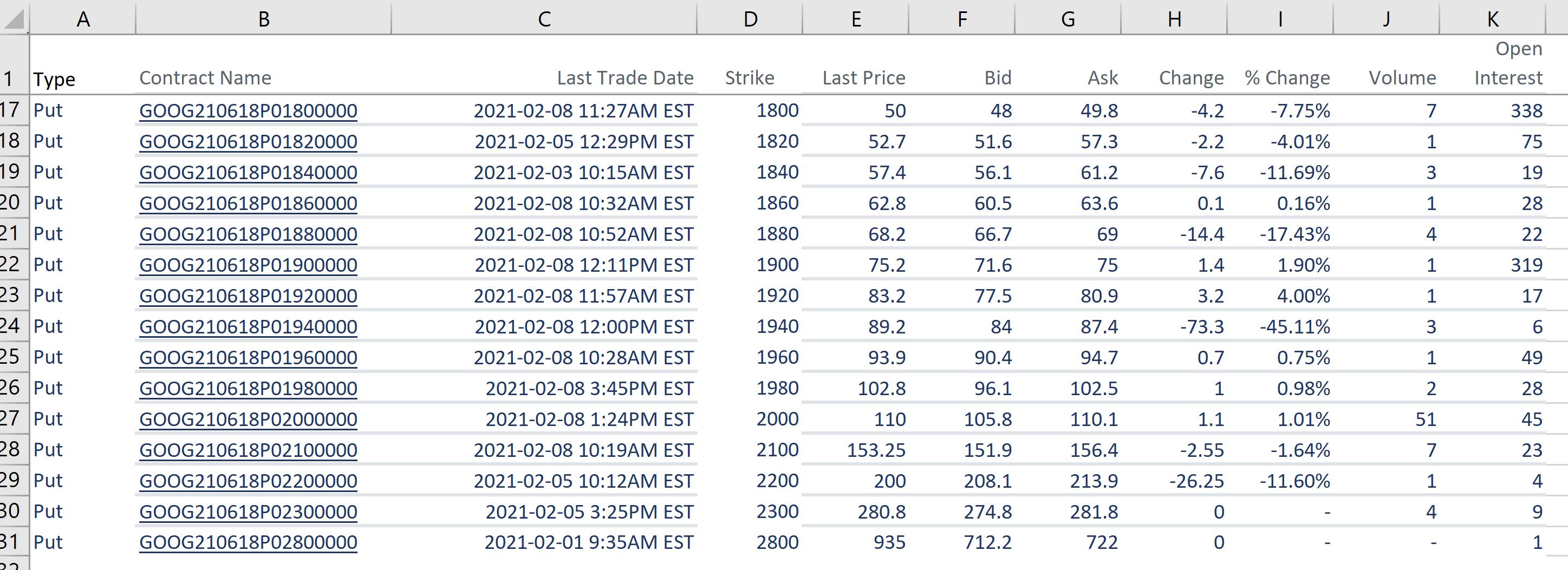

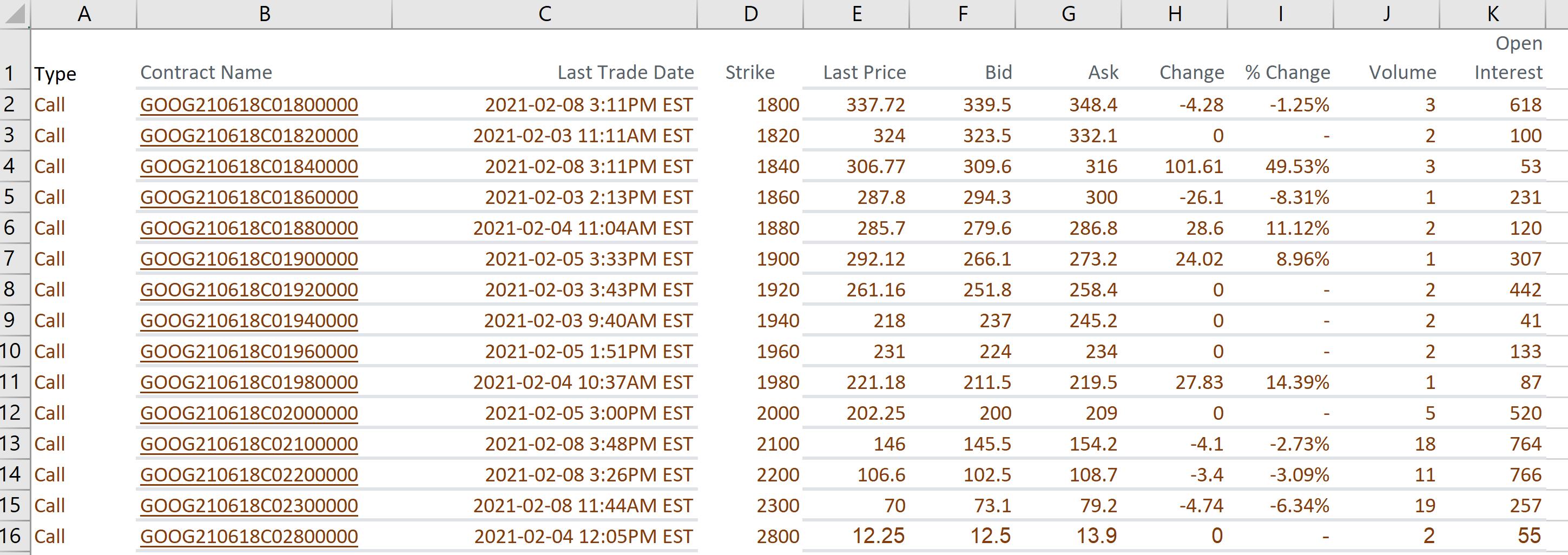

The table below shows the prices of call and puts at different strike prices of options on Alphabet Inc. (GOOG) on 12th February, 2021. The expiration of all options are same - June 18, 2021. The market price of the GOOG stock on 12th February, 2021 is $2,092.91. Remember to make buy /sell decisions of options based on bid/ask prices (not last prices).

If you expect stock price is more likely to go up to $3,000, what strategy ((spread (bull/bear/box/butterfly) or straddle or strangle or strip/strap) would better serve you? Explain. Calculate payoff and profit of the strategy.

A 1 Type 17 Put 18 Put 19 Put 20 Put 21 Put 22 Put 23 Put 24 Put 25 Put 26 Put 27 Put 28 Put 29 Put 30 Put 31 Put 22 B Contract Name GOOG210618P01800000 GOOG210618P01820000 GOOG210618P01840000 GOOG210618P01860000 GOOG210618P01880000 GOOG210618P01900000 GOOG210618P01920000 GOOG210618P01940000 GOOG210618P01960000 GOOG210618P01980000 GOOG210618P02000000 GOOG210618P02100000 GOOG210618P02200000 GOOG210618P02300000 GOOG210618P02800000 Last Trade Date 2021-02-08 11:27AM EST 2021-02-05 12:29PM EST 2021-02-03 10:15AM EST 2021-02-08 10:32AM EST 2021-02-08 10:52AM EST 2021-02-08 12:11PM EST 2021-02-08 11:57AM EST 2021-02-08 12:00PM EST 2021-02-08 10:28AM EST 2021-02-08 3:45PM EST 2021-02-08 1:24PM EST 2021-02-08 10:19AM EST 2021-02-05 10:12AM EST 2021-02-05 3:25PM EST 2021-02-01 9:35AM EST D Strike 1800 1820 1840 1860 1880 1900 1920 1940 1960 1980 2000 2100 2200 2300 2800 E Last Price 50 52.7 57.4 62.8 68.2 75.2 83.2 89.2 93.9 102.8 110 153.25 200 280.8 935 F LL Bid 48 51.6 56.1 60.5 66.7 71.6 77.5 84 90.4 96.1 105.8 151.9 208.1 274.8 712.2 G Ask 49.8 57.3 61.2 63.6 69 75 80.9 87.4 94.7 102.5 110.1 156.4 213.9 281.8 722 H Change % Change -7.75% -4.01% -11.69% 0.16% -17.43% 1.90% 4.00% -45.11% 0.75% 0.98% 1.01% -1.64% -11.60% -4.2 -2.2 -7.6 0.1 -14.4 1.4 3.2 -73.3 0.7 1 1.1 -2.55 -26.25 0 0 Volume 7 1 3 1 4 1 1 3 1 2 51 7 1 4 K Open Interest 338 75 19 28 22 319 17 6 49 28 45 23 4 9 1

Step by Step Solution

3.40 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

Given your expectation that GOOGs stock price is likely to increase to 3000 a bullish strategy would be appropriate One of the simplest bullish strate...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started