Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The table below shows the projected cash flow statements for ABC Corporation, which is being considered as a target for Willowtech, a large conglomerate. The

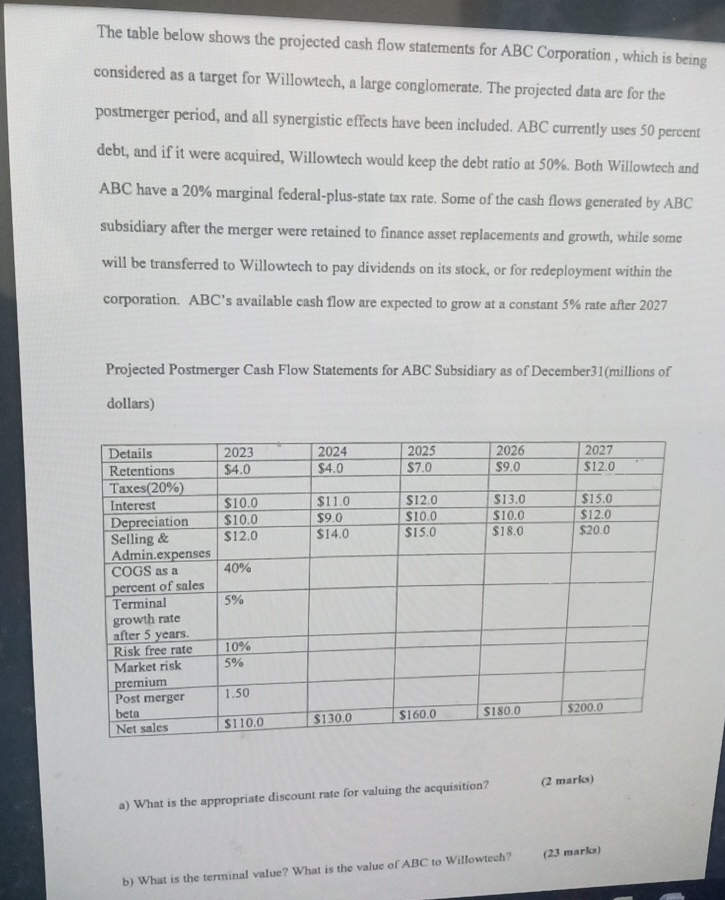

The table below shows the projected cash flow statements for ABC Corporation, which is being considered as a target for Willowtech, a large conglomerate. The projected data are for the postmerger period, and all synergistic effects have been included. ABC currently uses percent debt, and if it were acquired, Willowtech would keep the debt ratio at Both Willowtech and ABC have a marginal federalplusstate tax rate. Some of the cash flows generated by ABC subsidiary after the merger were retained to finance asset replacements and growth, while some will be transferred to Willowtech to pay dividends on its stock, or for redeployment within the corporation. ABC's available cash flow are expected to grow at a constant rate after

Projected Postmerger Cash Flow Statements for ABC Subsidiary as of Decembermillions of dollars

tableDetailsRetentions$$$$$

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started