Answered step by step

Verified Expert Solution

Question

1 Approved Answer

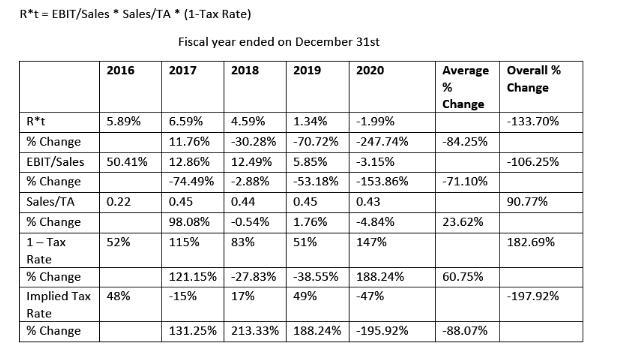

The table contains the After-tax Operating Return on Assets Analysis of Molson Coors. Use the values and its changes to explain R*t and its

The table contains the After-tax Operating Return on Assets Analysis of Molson Coors.

Use the values and its changes to explain R*t and its changes from 2016 to 2020. Then discuss any trends, major causes or general conclusions.

R*t = EBIT/Sales* Sales/TA* (1-Tax Rate) R*t % Change EBIT/Sales % Change Sales/TA % Change 1- Tax Rate % Change Implied Tax Rate % Change 2016 5.89% 50.41% 0.22 52% 48% Fiscal year ended on December 31st 2020 2017 2018 6.59% 4.59% 11.76% -30.28% 12.86% 12.49% -74.49% -2.88% 0.45 0.44 98.08% -0.54% 115% 83% 121.15% -15% -27.83% 17% 2019 1.34% -1.99% -70.72% -247.74% -3.15% -153.86% 5.85% -53.18% 0.45 1.76% 51% -38.55% 49% 131.25% 213.33% 188.24% 0.43 -4.84% 147% 188.24% -47% -195.92% Average % Change -84.25% -71.10 % 23.62% 60.75% -88.07% Overall % Change -133.70% -106.25% 90.77% 182.69% -197.92%

Step by Step Solution

★★★★★

3.56 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

Solution To understand the changes in Rt Aftertax Operating Return on Assets from 2016 to 2020 for Molson Coors we will break down the provided data and analyze the trends and major causes R t is calc...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started