Answered step by step

Verified Expert Solution

Question

1 Approved Answer

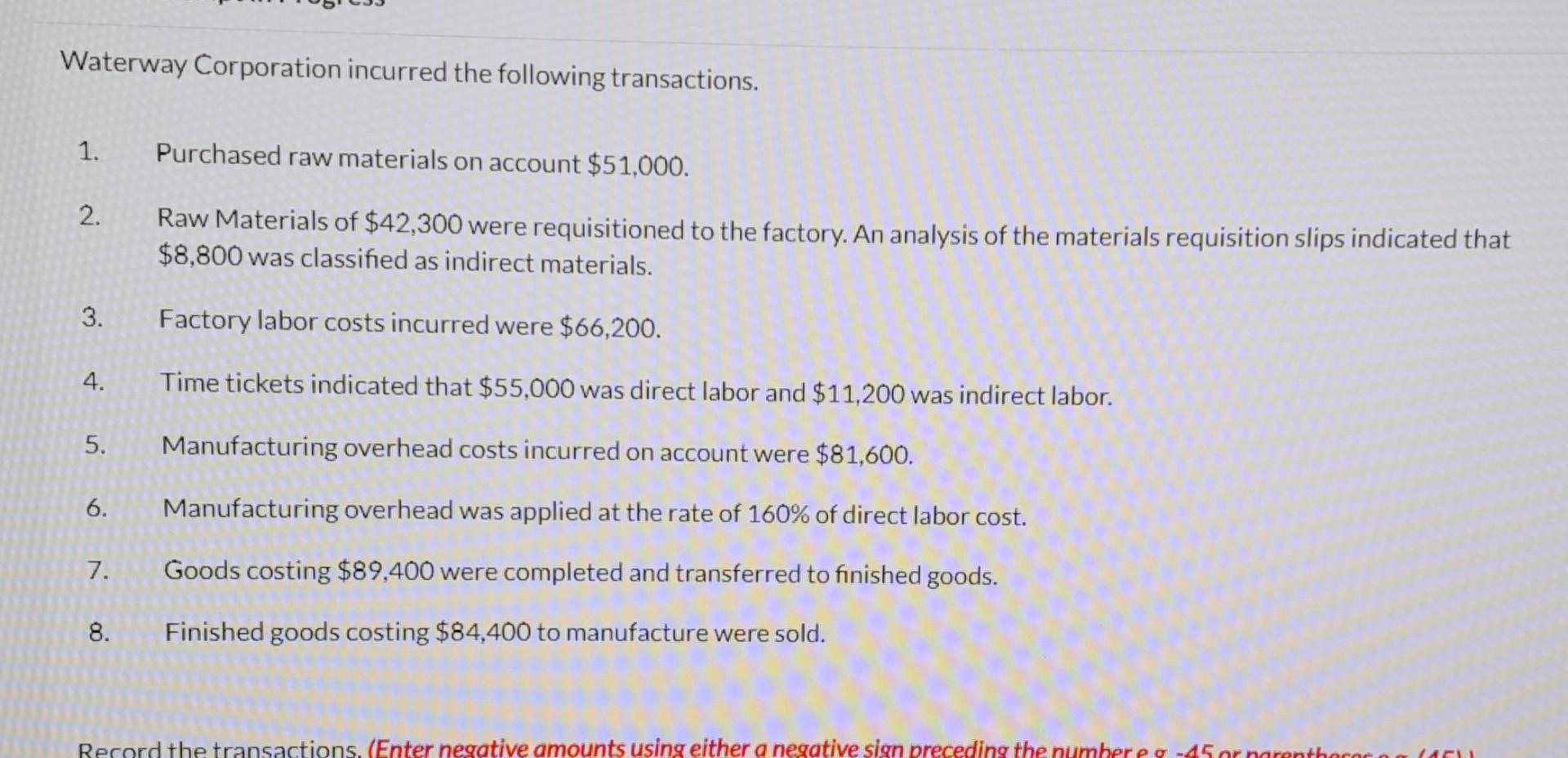

Waterway Corporation incurred the following transactions. 1. 2. 3. 4. 5. 6. 7. 8. Purchased raw materials on account $51,000. Raw Materials of $42,300

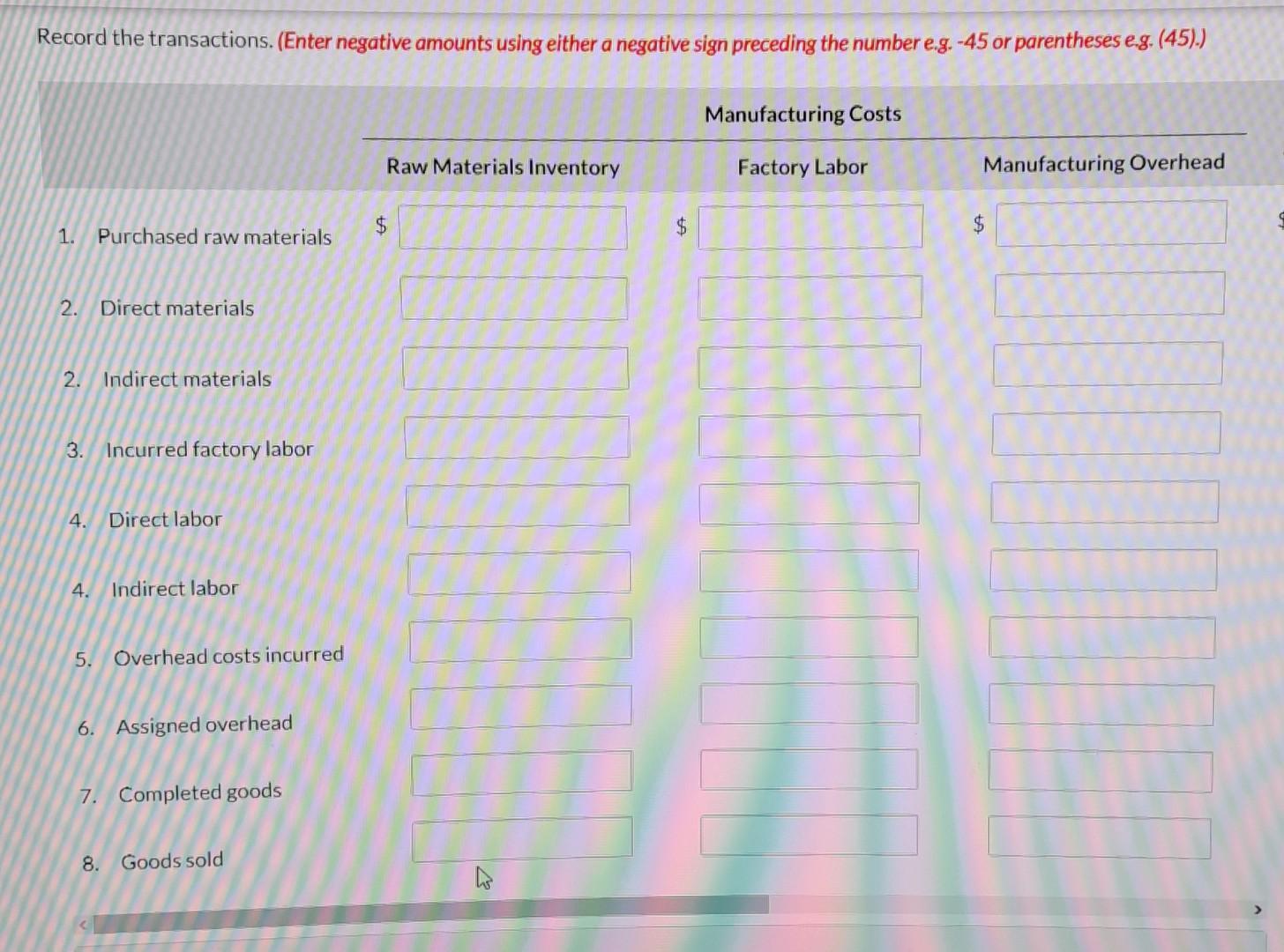

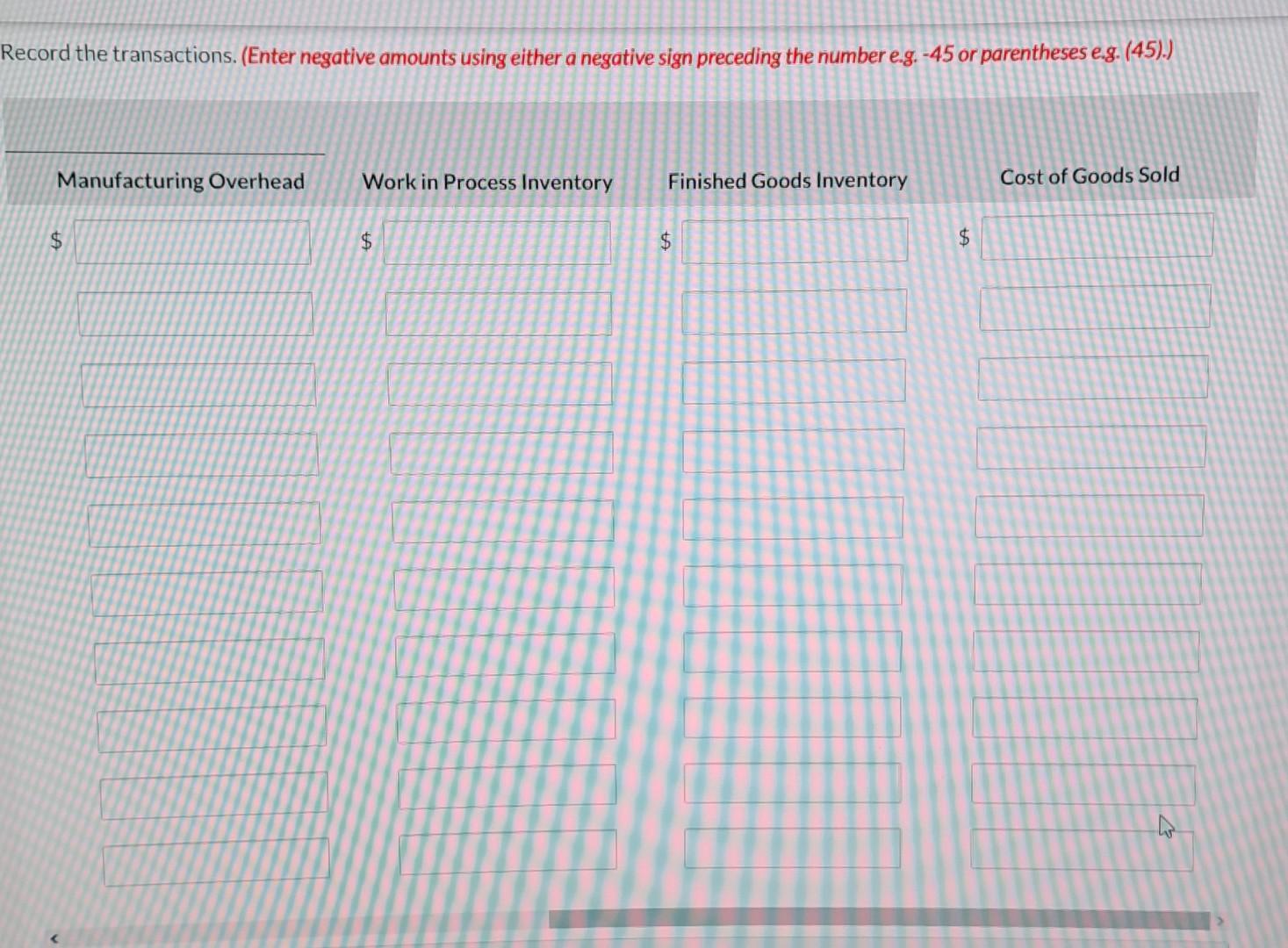

Waterway Corporation incurred the following transactions. 1. 2. 3. 4. 5. 6. 7. 8. Purchased raw materials on account $51,000. Raw Materials of $42,300 were requisitioned to the factory. An analysis of the materials requisition slips indicated that $8,800 was classified as indirect materials. Factory labor costs incurred were $66,200. Time tickets indicated that $55,000 was direct labor and $11,200 was indirect labor. Manufacturing overhead costs incurred on account were $81,600. Manufacturing overhead was applied at the rate of 160% of direct labor cost. Goods costing $89,400 were completed and transferred to finished goods. Finished goods costing $84,400 to manufacture were sold. Record the transactions. (Enter negative amounts using either a negative sign preceding the number -45. or parenthor (451) Record the transactions. (Enter negative amounts using either a negative sign preceding the number e.g. -45 or parentheses e.g. (45).) 1. Purchased raw materials 2. Direct materials 2. Indirect materials 3. Incurred factory labor 4. Direct labor 4. Indirect labor 5. Overhead costs incurred 6. Assigned overhead 7. Completed goods 8. Goods sold Raw Materials Inventory $ CONST $ Manufacturing Costs Factory Labor Manufacturing Overhead $ Record the transactions. (Enter negative amounts using either a negative sign preceding the number e.g. -45 or parentheses e.g. (45).) Manufacturing Overhead $ Work in Process Inventory $ Finished Goods Inventory $ $ Cost of Goods Sold 4

Step by Step Solution

★★★★★

3.42 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

2 indirect materials 3 incurred factory labor 4 Direct labor 1 purchased raw mate...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started