Question

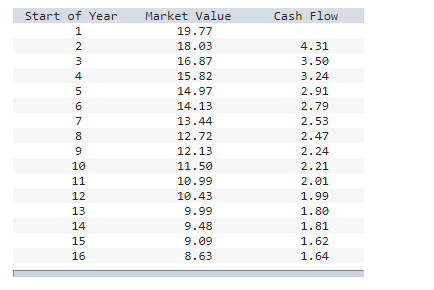

The table given below shows how, on average, the market value of a Boeing 737 has varied with its age and the cash flow needed

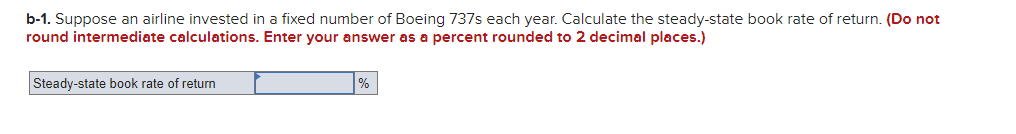

The table given below shows how, on average, the market value of a Boeing 737 has varied with its age and the cash flow needed in each year to provide a 13% return. (For example, if you bought a 737 for $19.77 million at the start of year 1 and sold it a year later, your total profit would be 18.03 + 4.31 19.77 = $2.57 million, 13% of the purchase cost.) Assume airlines write off their aircraft straight-line over 15 years to a salvage value equal to 10% of the original cost.

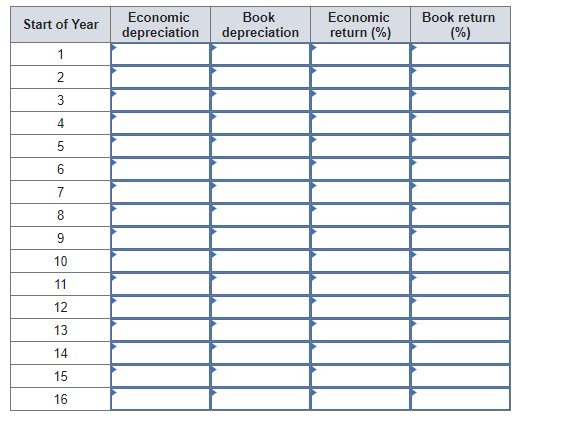

Calculate economic depreciation, book depreciation, economic return, and book return for each year of the planes life. (Leave no cells blank - be certain to enter "0" wherever required. Do not round intermediate calculations. Enter your answers in millions except for percentage values. Round your percentage answers to 1 decimal place and other answers to 2 decimal places.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started