Question

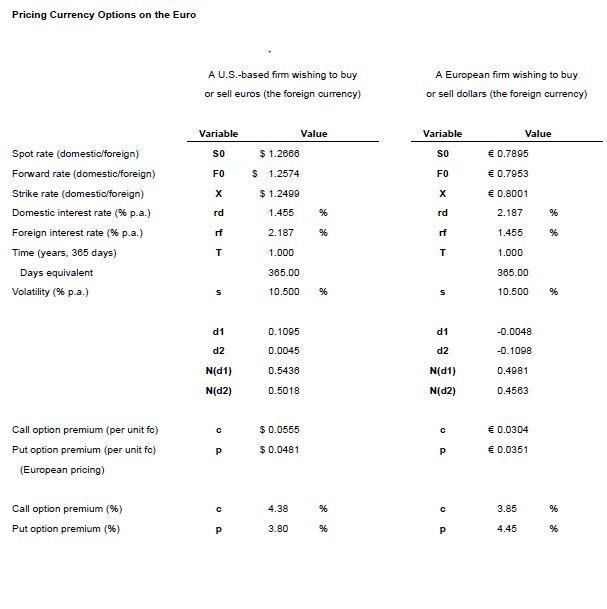

The table, indicates that a 1-year call option on euros at a strike rate of $1.2499/ will cost the buyer $0.0555/, or 4.38%. But that

The table, indicates that a 1-year call option on euros at a strike rate of $1.2499/ will cost the buyer $0.0555/, or 4.38%. But that assumed a volatility of 10.500% when the spot rate was $1.2666/. What would the same call option cost if the volatility was reduced to 10.500% when the spot rate fell to $1.2484/?

The decimal equivalent for 365.00 days is ??? (Round to three decimal places.)

The new forward rate is $1.23931.2393/. ??? (Round to four decimal places.)

The same call option cost if the volatility was reduced to 10.500% when the spot rate fell to $1.2484/ would be $0.04640.0464/. ??? (Round to four decimal places.)

Pricing Currency Options on the Euro A II S -haced firm wishinn to hur A Fumnean firm wiahinn to huv Pricing Currency Options on the Euro A II S -haced firm wishinn to hur A Fumnean firm wiahinn to huvStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started