Answered step by step

Verified Expert Solution

Question

1 Approved Answer

the table is the correct answer i just want steps on how to do it without trying to find EBC for each combination this is

the table is the correct answer i just want steps on how to do it without trying to find EBC for each combination

this is the whole question. im just trying to figure out how he made the table

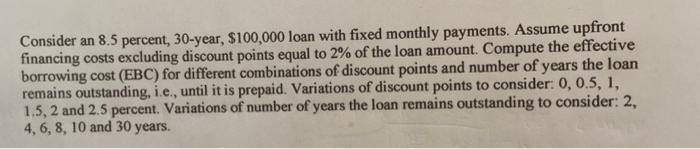

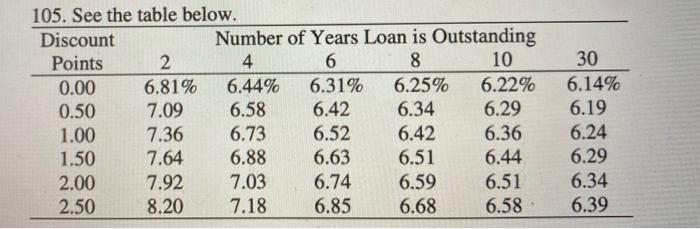

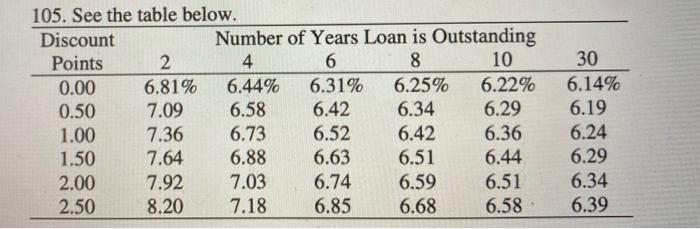

Consider an 8.5 percent, 30-year, $100,000 loan with fixed monthly payments. Assume upfront financing costs excluding discount points equal to 2% of the loan amount. Compute the effective borrowing cost (EBC) for different combinations of discount points and number of years the loan remains outstanding, i.e., until it is prepaid. Variations of discount points to consider: 0, 0.5, 1, 1.5, 2 and 2.5 percent. Variations of number of years the loan remains outstanding to consider: 2, 4,6,8,10 and 30 years. 105. See the table below. Discount Number of Years Loan is Outstanding Points 2 4 6 8 10 0.00 6.81% 6.44% 6.31% 6.25% 6.22% 0.50 7.09 6.58 6.42 6.34 6.29 1.00 7.36 6.73 6.52 6.42 6.36 1.50 7.64 6.88 6.63 6.51 6.44 2.00 7.92 7.03 6.74 6.59 6.51 2.50 8.20 7.18 6.85 6.68 6.58 30 6.14% 6.19 6.24 6.29 6.34 6.39 Consider an 8.5 percent, 30-year, $100,000 loan with fixed monthly payments. Assume upfront financing costs excluding discount points equal to 2% of the loan amount. Compute the effective borrowing cost (EBC) for different combinations of discount points and number of years the loan remains outstanding, i.e., until it is prepaid. Variations of discount points to consider: 0, 0.5, 1, 1.5, 2 and 2.5 percent. Variations of number of years the loan remains outstanding to consider: 2, 4,6,8,10 and 30 years. 105. See the table below. Discount Number of Years Loan is Outstanding Points 2 4 6 8 10 0.00 6.81% 6.44% 6.31% 6.25% 6.22% 0.50 7.09 6.58 6.42 6.34 6.29 1.00 7.36 6.73 6.52 6.42 6.36 1.50 7.64 6.88 6.63 6.51 6.44 2.00 7.92 7.03 6.74 6.59 6.51 2.50 8.20 7.18 6.85 6.68 6.58 30 6.14% 6.19 6.24 6.29 6.34 6.39 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started