the table links above are disconnected. just ignored;

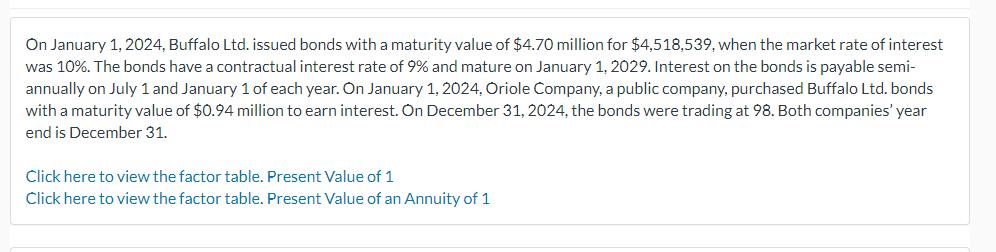

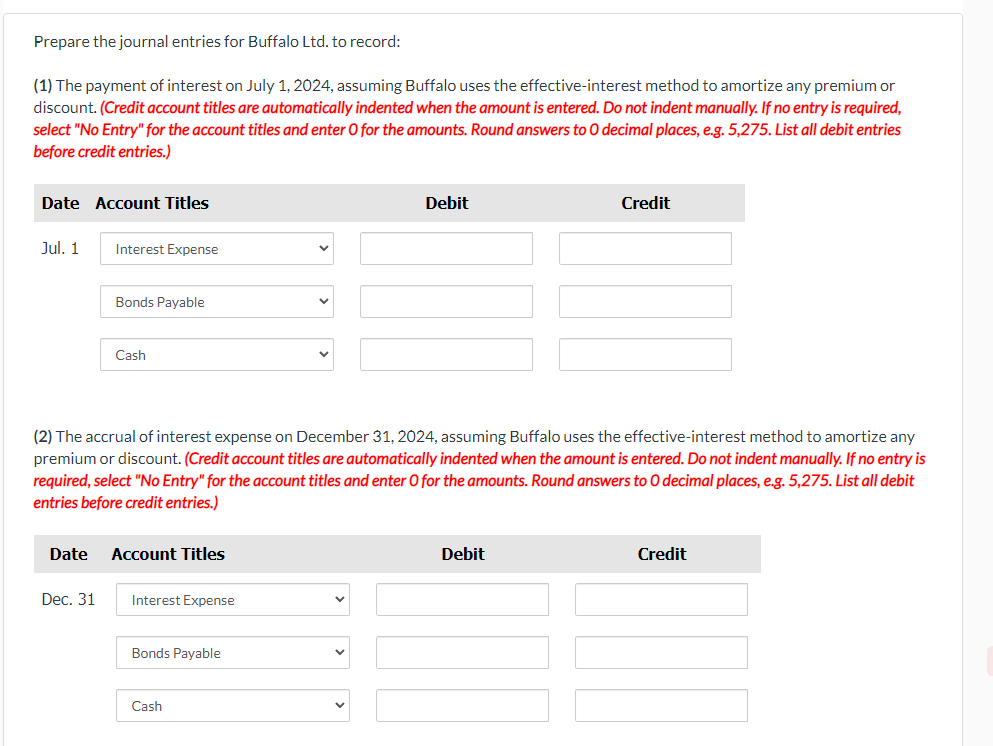

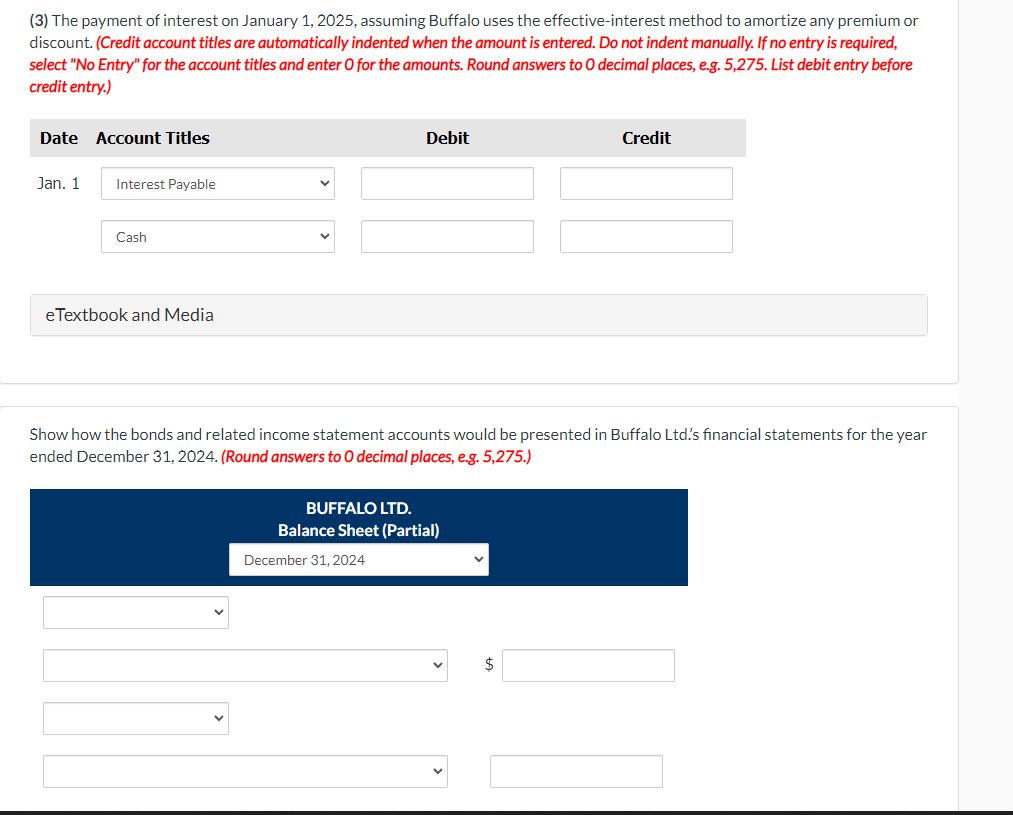

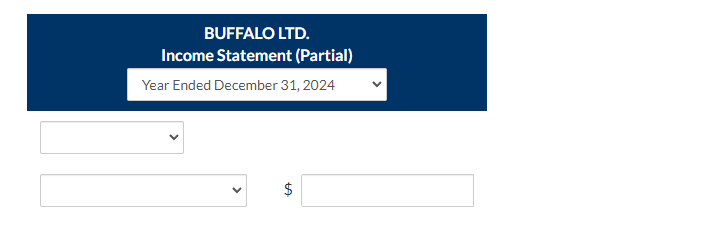

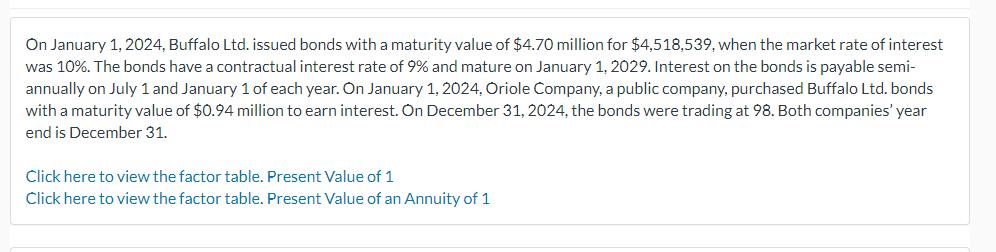

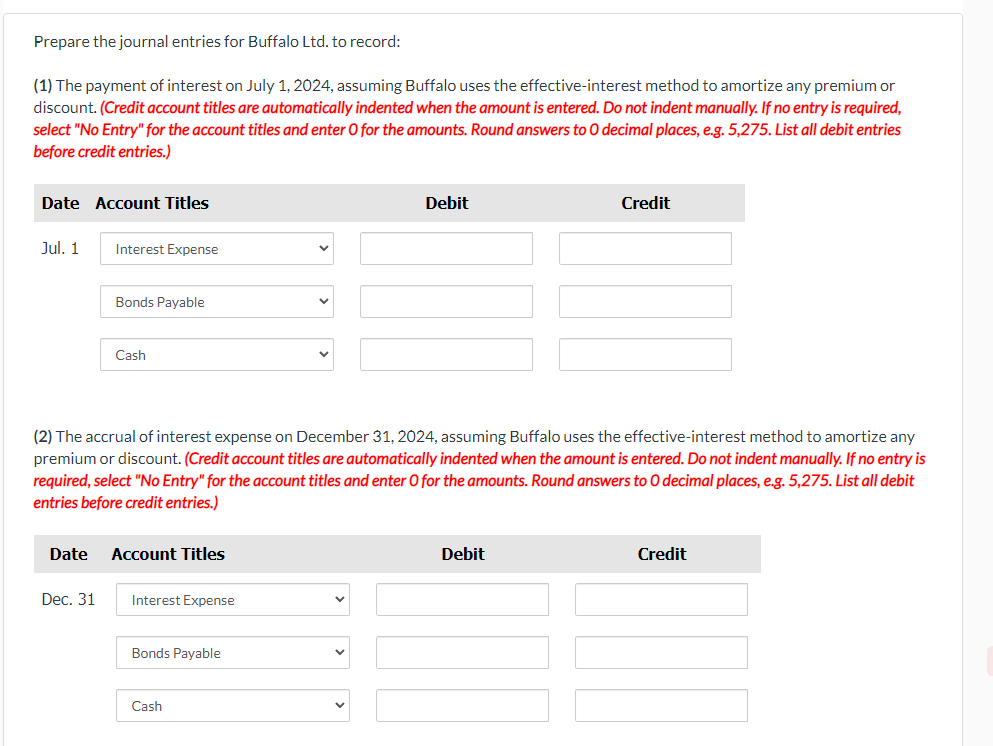

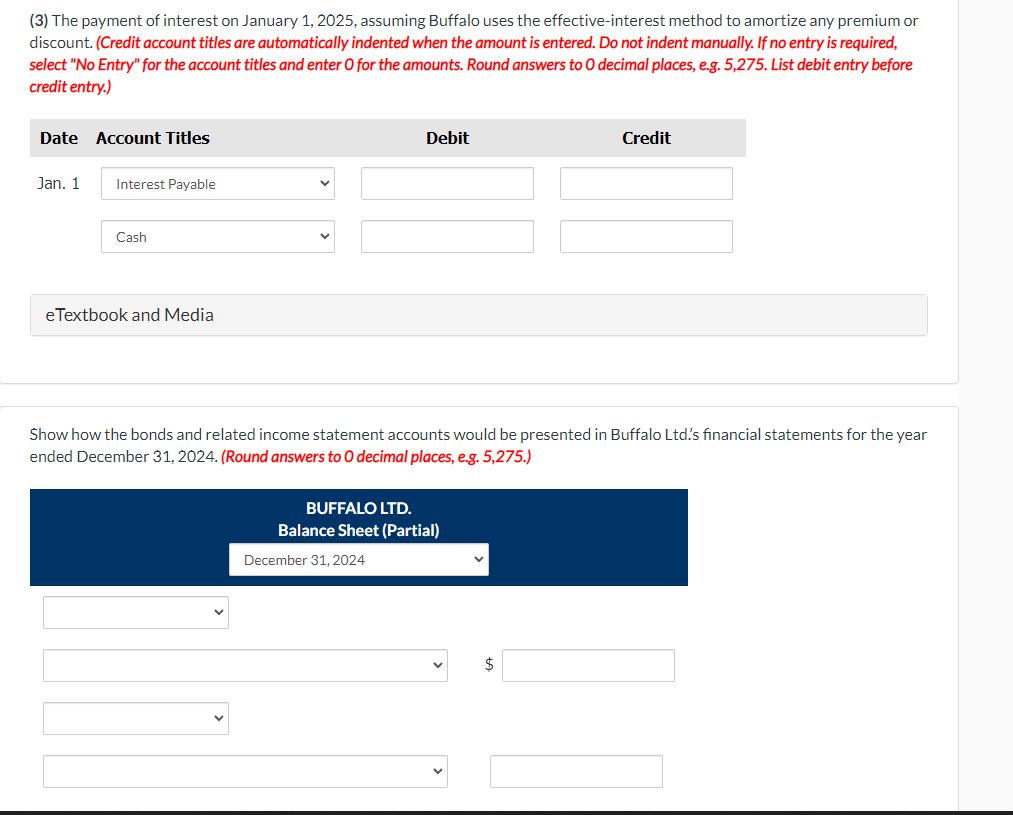

On January 1, 2024, Buffalo Ltd. issued bonds with a maturity value of $4.70 million for $4,518,539, when the market rate of interest was 10%. The bonds have a contractual interest rate of 9% and mature on January 1,2029 . Interest on the bonds is payable semiannually on July 1 and January 1 of each year. On January 1, 2024, Oriole Company, a public company, purchased Buffalo Ltd. bonds with a maturity value of $0.94 million to earn interest. On December 31,2024 , the bonds were trading at 98 . Both companies' year end is December 31. Click here to view the factor table. Present Value of 1 Click here to view the factor table. Present Value of an Annuity of 1 Prepare the journal entries for Buffalo Ltd. to record: (1) The payment of interest on July 1, 2024, assuming Buffalo uses the effective-interest method to amortize any premium or discount. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. Round answers to 0 decimal places, e.g. 5,275. List all debit entries before credit entries.) (2) The accrual of interest expense on December 31, 2024, assuming Buffalo uses the effective-interest method to amortize any premium or discount. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. Round answers to 0 decimal places, e.g. 5,275. List all debit entries before credit entries.) (3) The payment of interest on January 1, 2025, assuming Buffalo uses the effective-interest method to amortize any premium or discount. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. Round answers to 0 decimal places, e.g. 5,275. List debit entry before credit entry.) eTextbook and Media Show how the bonds and related income statement accounts would be presented in Buffalo Ltd's financial statements for the year ended December 31, 2024. (Round answers to 0 decimal places, e.g. 5,275.) BUFFALO LTD. Income Statement (Partial) Year Ended December 31, 2024 $